War Jitters Rock Bitcoin—But This Bold $26M Buy Signals Unshakable Conviction

Geopolitical tremors send BTC into volatility—just as a major player doubles down.

Who's buying when everyone's panicking?

The smart money. While retail traders flinch at headlines, one institutional strategy just dropped $26 million on Bitcoin like it was a Black Friday deal. War moves markets, but diamonds hands move faster.

Here's the kicker: this isn't some reckless gamble. It's a calculated bet on crypto's role as the ultimate hedge—when traditional systems wobble, decentralized assets stand firm. Gold 2.0? Try 'chaos insurance' with 10x upside.

Meanwhile, Wall Street still can't decide if Bitcoin's a risk asset or a safe haven. Maybe it's both—and that's why it keeps winning. *Cue hedge fund managers scrambling to update their PowerPoints.*

Strategy Has Added Another 245 BTC To Its Stack

In a new post on X, Strategy co-founder and chairman Michael Saylor has shared a filing made with the US Securities and Exchange Commission (SEC) for a new Bitcoin purchase.

With this $26 million acquisition, Strategy has added another 245 BTC to its holdings. This is the fourth buy that the company has made this month, although it’s the smallest of the bunch. The last purchase, announced on June 16th, was a particularly big one involving a sum surpassing $1 billion.

Following the buying spree in June so far, the total reserve of Strategy now sits at 592,345 BTC. The firm put together this stack for $41.87 billion, but today it’s worth a whopping $61 billion, implying a significant profit of almost 46%.

According to the SEC filing, the company made the latest purchase between June 16th and 22nd. Thus, it seems the company decided to buy more, despite tensions rising between Israel and Iran during the period.

Bitcoin Market Has Been Struck With Volatility After War Fears

The past day or so has been a wild time for the cryptocurrency market, induced by escalating tensions in the middle east following US strikes on three Iranian nuclear facilities.

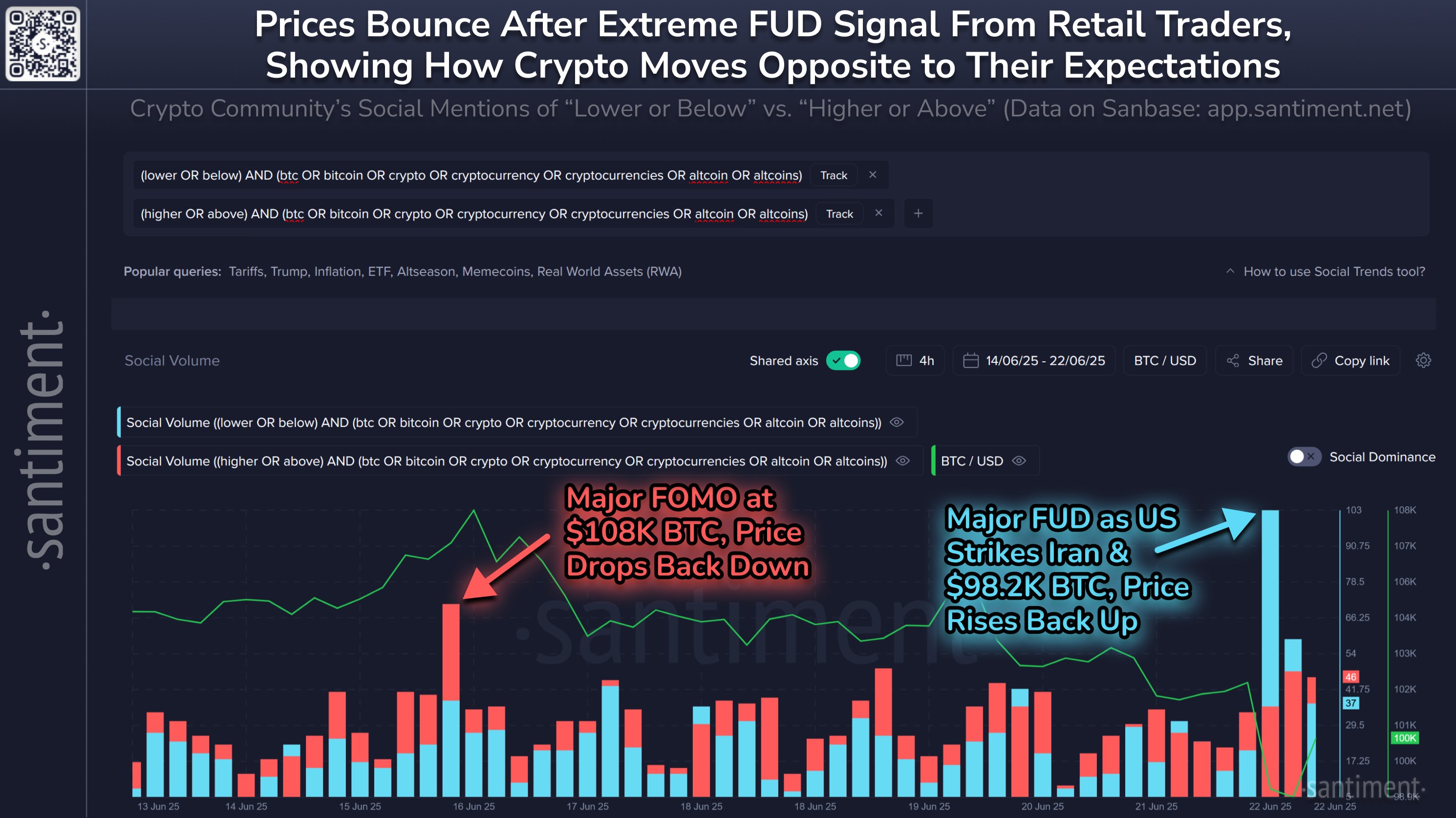

Below is a chart that shows how Bitcoin’s recent performance has looked.

As is visible in the graph, the Bitcoin price plummeted hard all the way down toward the $98,000 level as panic selling ensued, but before long, the coin found a rebound. Now, the asset’s back at $102,800, which is about the same level as before the crash.

According to data from the analytics firm Santiment, the price bounce has followed the same usual pattern of retail investor sentiment acting as a contrarian signal.

In the chart, Santiment has attached the data of the Social Volume, a metric that measures the unique number of posts making mentions of a given term or topic on the major social media platforms. The analytics firm has applied keywords related to cryptocurrency and bitcoin to the metric.

Additionally, it has also applied two separate filters: one corresponding to bearish calls (‘lower’ or ‘below’) and another to bullish calls (‘higher’ or ‘above’). From the graph, it’s apparent that the former type of posts blew up following the US strikes, indicating FUD exploded among the retail investors.

Generally, Bitcoin and other digital assets tend to MOVE in a direction that goes against the expectations of the crowd and that’s indeed what seems to have occurred this time as well.