Bitcoin Options Signal Bullish Reversal: Traders Double Down on Rally Despite Market Slump

Wall Street''s crypto gamblers are back at it—loading up on Bitcoin calls like there''s no tomorrow. Even after a 15% pullback from last month''s highs, derivatives traders are pricing in a violent rebound. Someone’s either seeing alpha… or hallucinating it.

Options open interest spikes as whales place asymmetric bets

The smart money move? Stacking September $80K calls while spot prices languish below $65K. Either these degens know something we don’t, or they’ve got risk appetite stronger than a VC’s martini habit.

Market makers scrambling to hedge as skew flips positive

Suddenly every OTC desk is long gamma—just in time for what could become the mother of all squeezes. Cue the ‘institutional adoption’ narrative (and obligatory warnings about implied volatility being juicier than a seed round valuation).

One thing’s clear: When crypto traders smell blood, they don’t buy bandages—they leverage up and hunt. Whether that ends in lambos or liquidations? That’s why we watch the tape.

Bitcoin Options 25 Delta Skew Suggests Traders Are Positioning For Upside

As pointed out by the analytics firm Glassnode in a new post on X, the Options 25 Delta Skew has recently observed a reversal to positive levels for Bitcoin. The “25 Delta Skew” is an indicator related to the BTC Options market that basically tells us about the sentiment present among the traders.

The metric does so by comparing the Implied Volatility (IV) of bearish positions (puts) and bullish positions (calls). Here, the IV is a measure of how volatile the traders expect the asset to be in the future.

The 25 Delta Skew specifically compares this expectation for the puts and calls with a delta of 25. That is, the Options contracts whose price changes by $0.25 for every $1 change in the BTC spot value.

Naturally, for puts, the change is in the opposite direction to the price, as these positions are betting on a bearish outcome. This means their price rises by $0.25 whenever BTC goes down $1. On the other hand, the $0.25 increase/decrease happens alongside a $1 price increase/decrease in the asset’s spot value for the calls.

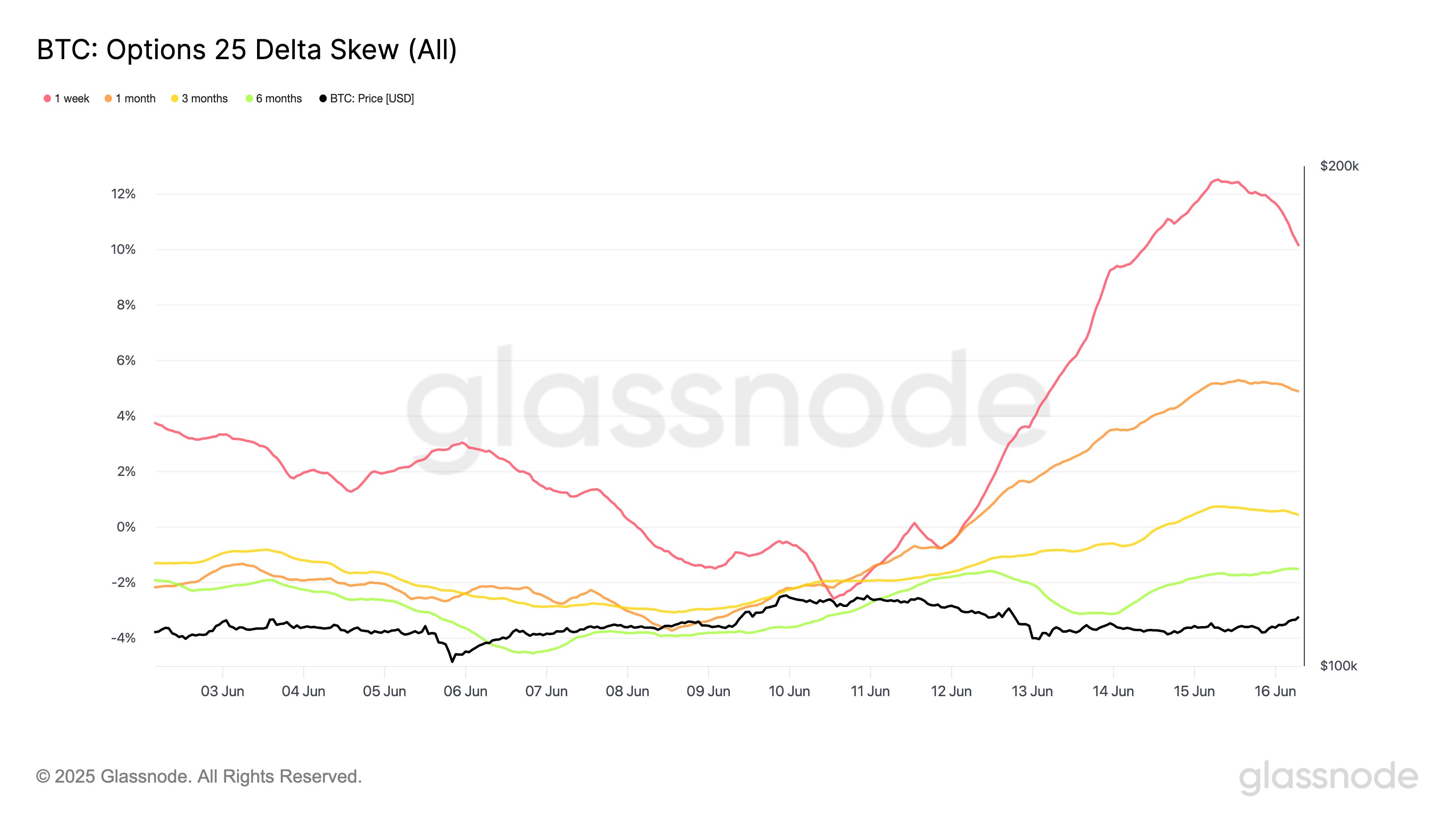

Now, here is a chart that shows the trend in the bitcoin Options 25 Skew Delta for a few different expiration periods over the last couple of weeks:

As displayed in the above graph, the Bitcoin Options 25 Delta Skew was below the 0% mark for all of these expiries earlier in the month. During the past week, however, a flip appears to have occurred in the market, with the metric climbing to a positive value for all of them.

The trend is especially prominent in short-dated contracts. The positions expiring in one week have seen the indicator go from -2.6% to +10.1%. Similarly, those expiring in one month have observed a reversal from -2.2% to +4.9%.

Based on the trend, the analytics firm notes, “traders are aggressively positioning for near-term upside or volatility.” This bullish flip in the Options market has interestingly come while Bitcoin has faced some bearish price action. It now remains to be seen whether the bullish confidence from the market will pay off or not.

In some other news, Strategy has completed yet another Bitcoin purchase, as Chairman Michael Saylor has shared in an X post. The acquisition, involving 10,100 tokens, has cost the company around $1.05 billion. The firm now holds a total of 592,100 BTC, with a cost basis of $41.84 billion.

BTC Price

Bitcoin has made a slight recovery during the past day as its price has returned to $106,600.