Bitcoin-Gold Correlation Craters – Safe Haven Narrative Unraveling?

Bitcoin’s 30-day price sync with gold just hit its lowest level since 2021 – either a seismic macro shift or another blip in crypto’s volatile dance with traditional assets.

Decoupling or distraction? While gold bugs cling to inflation hedges, Bitcoin’s recent price action looks more like a tech stock on Red Bull. Traders are betting the Fed’s next move matters more than ancient store-of-value debates.

Wall Street analysts (the same ones who called Bitcoin ’digital gold’ in 2020) are now quietly recalculating their models. Meanwhile, crypto natives shrug – when your asset swings 5% before breakfast, who needs correlation coefficients?

Bitcoin Support Faces Pressure As Correlation With Gold Hits Low

Bitcoin is currently navigating a critical zone, with bulls urgently defending the $100,000 mark to maintain bullish momentum. After briefly touching $107,000 over the weekend, BTC experienced a sharp 4% retrace, signaling growing indecision and sparking a wave of concern among investors. The price now hovers NEAR key short-term support, and while the long-term structure remains bullish, failure to hold $100K could trigger further downside into lower demand zones.

Despite the sell-off, many traders believe the path forward still holds upside potential. Liquidity clusters remain just above the $105,000 level, and a breakout above this region could ignite a rally into new all-time highs near $109,000. However, the lack of follow-through following Sunday’s breakout attempt has shaken market sentiment, with some participants anticipating a broader correction before any sustained MOVE higher.

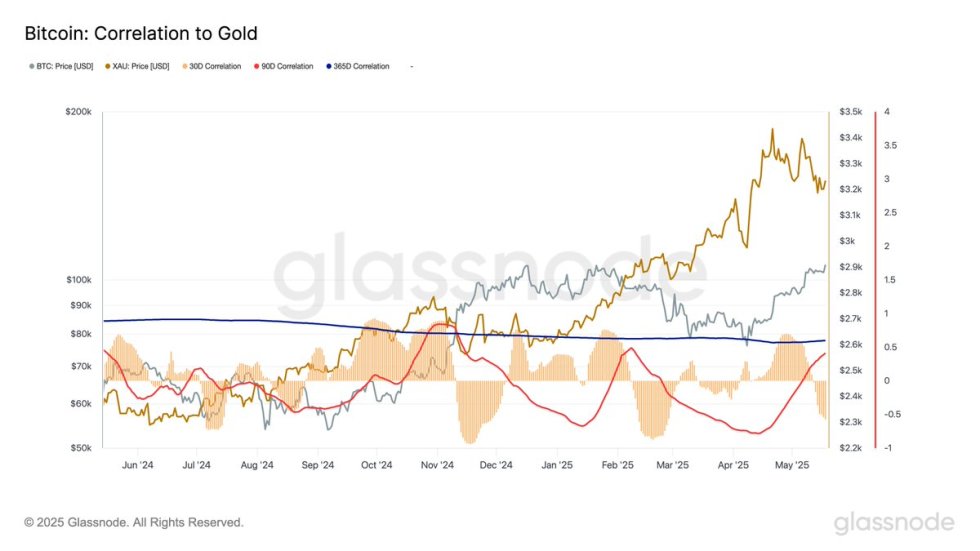

Glassnode data adds another layer to the analysis. Over the past 30 days, Bitcoin’s short-term correlation to gold has dropped to -0.54, the lowest since February, suggesting BTC is diverging from traditional safe havens in the current macro environment. Meanwhile, its 90-day and 365-day correlations to gold remain positive at 0.39 and 0.60, respectively. This indicates that although bitcoin still shares medium- to long-term behavioral patterns with gold, its short-term performance is increasingly driven by crypto-native market forces and speculation.

As Bitcoin consolidates and prepares for its next move, all eyes are on the $100K support level and the $105K-$109K resistance zone. If bulls can defend this key structure and reclaim momentum, the stage will be set for price discovery. But if support fails, a deeper retracement could follow — possibly resetting bullish expectations in the short term.

Bitcoin Pulls Back After Rejection – Key Support In Focus

Bitcoin’s price action on the daily chart reveals a sharp rejection near the $107,000 level, followed by a swift retracement to the $103,000 zone. The recent wick to the upside marked a potential fakeout above previous resistance, indicating heavy selling pressure at the highs. This has triggered a 3.36% pullback on the day, with BTC currently trading around $102,943.

Despite the drop, the broader structure remains bullish as long as Bitcoin stays above the critical $100,000 support level. The 200-day SMA at $92,801 and the EMA at $88,469 offer deeper structural support, but bulls will aim to defend the psychological $100K mark to maintain momentum. A daily close below $100K could invite further selling and shake confidence in the current rally.

Volume on the retracement is notable but not extreme, hinting that the selloff may still be part of a broader consolidation rather than a full trend reversal. For upside confirmation, BTC must reclaim and hold the $105,000–$107,000 area to challenge its all-time high near $109K. Until then, traders should watch for price stability above $100K or risk a deeper correction as volatility remains elevated.

Featured image from Dall-E, chart from TradingView