Bitcoin’s Short-Term Holders Are Sitting on 21% Unrealized Profits—Will the Rally Hold?

Bitcoin’s latest price surge has short-term holders (STHs) grinning—their unrealized profits just hit 21%. But with the market looking frothy, traders are asking: how much higher can this go?

STH unrealized profit margins haven’t been this juicy since the last bull run. The question now is whether this is the start of a sustained rally or just another pump before the inevitable correction. After all, Wall Street still can’t decide if crypto is an asset class or a meme.

History suggests Bitcoin could still have room to run—but don’t bet your Tesla on it.

Traders Back In Profit As Bitcoin Eyes Price Discovery

Bitcoin is showing signs of strength as it hovers just below its all-time high NEAR $109,000. Despite recent upward momentum, the $105,000 resistance level has proven difficult to break, keeping BTC locked in a tight range between $100,000 and $105,000. This consolidation has created a sense of market indecision, with bulls attempting to maintain control while bears test their resolve. Still, the broader trend remains bullish, and many investors believe a breakout into price discovery is imminent if current support holds.

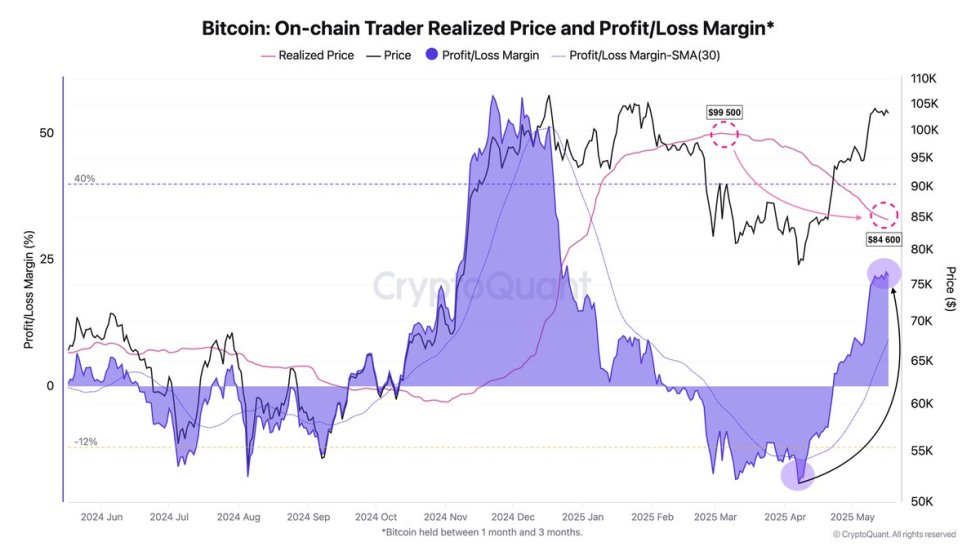

Top analyst Darkfost shared insights into on-chain activity, highlighting that traders—defined as wallets holding Bitcoin for 1 to 3 months—have returned to profit. Their profit/loss margin has shifted dramatically from -19% to +21% over the past month, a sign of renewed market confidence. The 30-day moving average for this cohort’s profitability now sits at +9%, indicating a healthy but not excessive gain.

Interestingly, since the last correction, the realized price for these traders has dropped to $84,600 and appears to be stabilizing. This suggests increased buying activity during the dip, reinforcing the bullish structure. While current levels are far from the overheated zone of +40%, rising unrealized profits may soon tempt some investors to take partial gains.

The coming days are likely to be decisive. A breakout above $105K could open the doors to price discovery, while failure to hold support may trigger short-term selling. For now, Bitcoin remains at a pivotal point.

Technical Details: Calm Before The Big Move

Bitcoin is currently trading around $103,300 after failing to break through the $103,600 resistance level. This area has become a key short-term barrier for bulls as price consolidates tightly beneath it. The chart shows a clear structure of strong bullish momentum from early May, pushing BTC from the $87,000 area into the $100K–$105K zone. However, recent candles reflect indecision, with several wicks above $103,600 being rejected and the price closing below.

Despite the rejection, bulls continue to defend the $100,000 support level effectively. The 200-day EMA and SMA are far below current prices—sitting around $88,000 and $92,600—highlighting the strength of the recent uptrend. Volume is decreasing slightly, suggesting that traders are waiting for a clear breakout or breakdown before committing to a new direction.

If Bitcoin can reclaim and hold above $103,600, a retest of the all-time high near $109K becomes increasingly likely. On the other hand, a loss of $100K could open the door to a deeper retrace toward the $96K–$94K range.

Featured image from Dall-E, chart from TradingView