Bitcoin’s Make-or-Break Moment: Crash Below $100K or Shatter ATH Records?

BTC teeters on a knife’s edge—bulls and bears locked in a trillion-dollar staredown. The next candle could trigger a cascade of liquidations or send institutional FOMO into overdrive.

Technical indicators scream ’overbought’ while on-chain data whispers ’accumulation.’ Meanwhile, Wall Street’s latest ’crypto expert’ just discovered moving averages.

Will macro headwinds drown the rally? Or does the halving cycle’s math still trump all? One thing’s certain: someone’s about to get rekt.

BTC Price Might Be Preparing For A Sell-Off

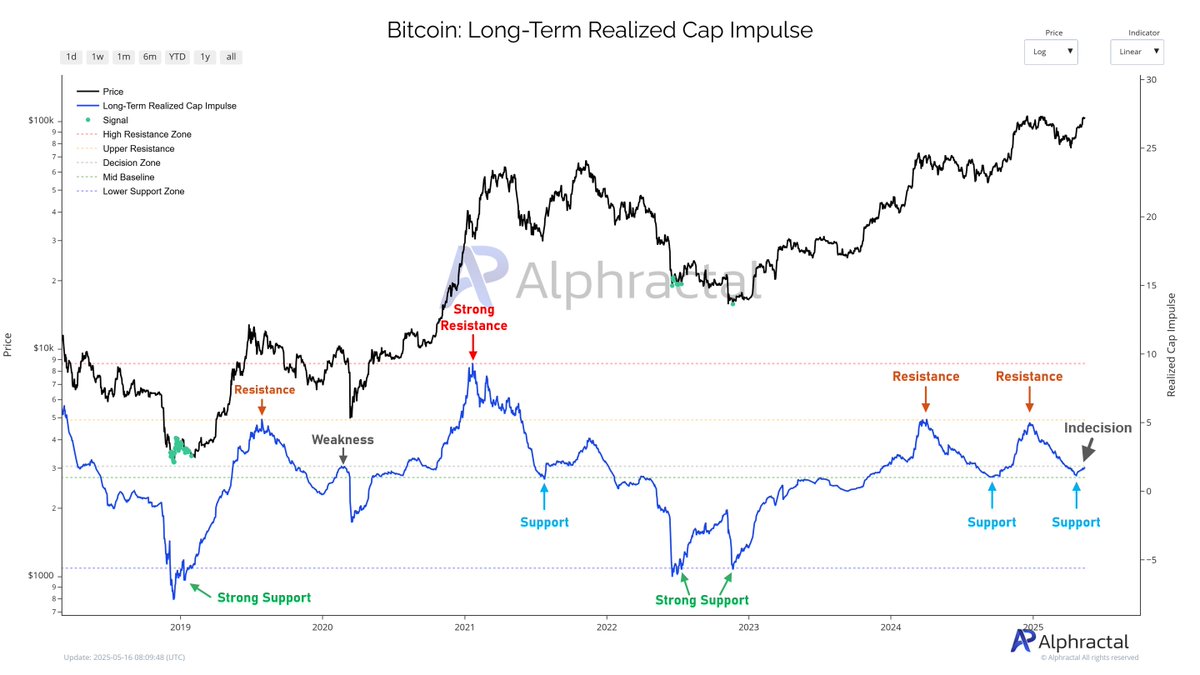

In a May 16 post on the social media platform X, on-chain analytics firm Alphractal explained that the Bitcoin price is at a juncture, which could be critical to its future trajectory. This on-chain evaluation is based on the Long-Term Realized Cap Impulse, a metric that measures the growth rate of the realized capitalization of long-term holders.

For clarity, a positive value for the Long-Term Realized Cap Impulse signals that long-term investors are purchasing more BTC at a higher value. This trend is typically indicative of a bullish period or the start of a bull market when long-term holders are in accumulation mode.

On the other hand, when the Long-Term Realized Cap Impulse metric is negative, it implies that long-term holders are offloading their coins at prices lower than their cost bases. This is usually seen in late bull cycles and early bear markets, where long-term investors are distributing their assets.

Furthermore, the Long-Term Realized Cap Impulse indicator offers insights into Bitcoin’s supply and demand dynamics, highlighting major support and resistance zones. As shown in the chart provided by Alphractal, the bitcoin price is at a critical point marked by a horizontal line known as the indecision level.

The market intelligence firm noted that a breakout of the Long-Term Realized Cap Impulse metric from this level could prove pivotal to Bitcoin’s long-term health, signaling continued strong demand and potential price appreciation.

However, Alphractal attached a historical relevance to this level, noting that the Long-Term Realized Cap Impulse metric was rejected at the indecision zone just before the COVID-19 dump in March 2020. If historical precedent is anything to go by, investors might want to watch out for any rejection around this level, which may trigger a significant sell-off.

Bitcoin Price At A Glance

As of this writing, the price of BTC sits around $103,713, reflecting a mere 0.6% increase in the past 24 hours.