Bitcoin Targets $124K as Golden Ratio Fractal Hints at Parabolic Rally – Wall Street Skeptics Grind Teeth

Bitcoin’s price action mirrors historical golden ratio patterns that previously preceded massive bull runs—this time pointing toward a potential $124,000 target. Traders are stacking sats while traditional finance pundits dismiss it as ’math for degenerates.’

The 1.618 Fibonacci extension level, which marked cycle tops in 2017 and 2021, now aligns with whale accumulation zones. On-chain data shows addresses holding 1,000+ BTC grew 11% since January.

Short squeezes could accelerate the move. Over $2.8 billion in BTC shorts remain vulnerable above $72,000—a level that’s now acting as support rather than resistance.

Regulators are already drafting warning memos. Meanwhile, Goldman Sachs quietly allocates 3% of its alt-fund to ’digital gold.’ The irony burns brighter than a proof-of-work validator.

Can Bitcoin Return To 1.6x Accumulation Peak Target?

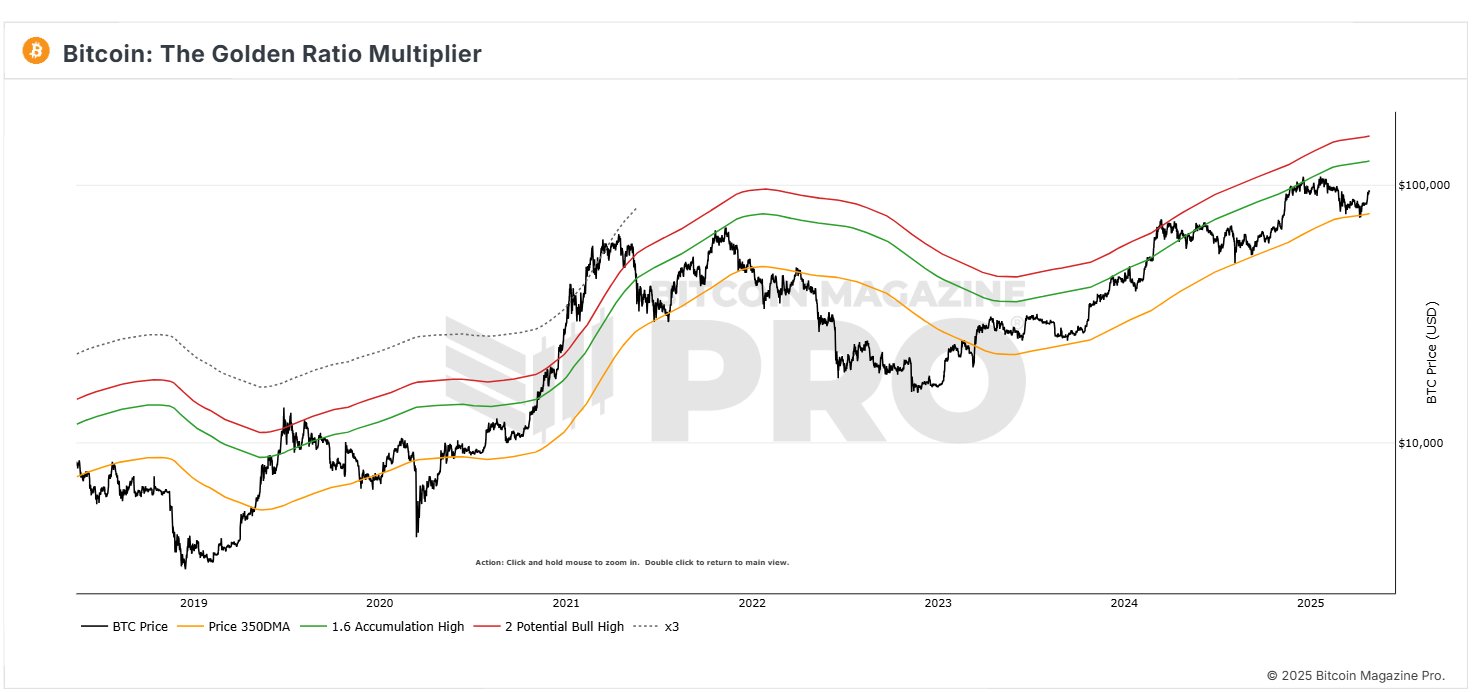

In an X post on April 26, Burak Kesmeci shared the latest updates on the Bitcoin Golden Ratio Multiplier price model, referencing data from Bitcoin Magazine Pro. For context, the Golden Ratio Multiplier model uses moving averages and Fibonacci ratios to help identify when BTC might be overvalued or undervalued, thereby signaling possible market tops or good accumulation opportunities.

According to the chart below, Bitcoin has recently retested the 350 daily moving average (350DMA) at $77,000. As the name implies, the 350DMA tracks BTC’s average price over the last 350 days and acts as a key support zone. Touching or briefly dipping below this level often signals a potential long-term buying opportunity.

Bitcoin recently rebounded off its 350DMA, after a price dip to $75,000 was followed by two subsequent price rallies to trade as high as $96,000.

In line with the price bands on the Golden Multiplier ratio, BTC is now headed for 1.6x Accumulation High, i.e, 1.6 times the 350 DMA, which is currently at $124,000. Therefore, despite the ongoing price consolidation, BTC is likely to produce another price rally based on the Golden Multiplier ratio price model.

Interestingly, when Bitcoin moves NEAR or above this level, it often signals the end of an accumulation phase and the start of a stronger bullish trend. Therefore, BTC reaching the $124,000 would only pave the way for further price gains in line with the lofty targets of some market analysts.

BTC Miners Gain $18.60 Million In Profit

In other news, another top crypto analyst, Ali Martinez, reports that miners have recently capitalized on Bitcoin’s impressive price rally, realizing nearly $18.60 million in profits as prices surged past $94,000.

This realized profit spike highlights that early miners are strategically taking profits at these high price levels. However, it’s worth noting that Bitcoin retains a strong bullish momentum despite this sell pressure, fueled by multiple factors, including strong inflows into spot ETFs.

At the time of writing, BTC is valued at $94,393, reflecting a price decline of 0.76% in the past day.