Ethereum Exit Queue Hits Zero: Staking Frenzy Defies Market Volatility

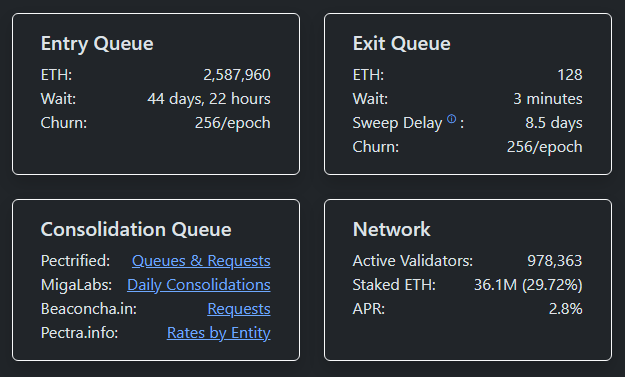

The line to leave Ethereum's staking system just vanished. Not a single validator waiting to withdraw—while the queue to lock up fresh ETH stretches longer than a Wall Street bonus justification.

Staking Hits Escape Velocity

Forget cold feet. The data screams conviction. The exit queue—once a nervous gauge of staker sentiment—emptied completely. Meanwhile, the deposit queue balloons, signaling a capital influx that treats short-term price swings like background noise. This isn't passive holding; it's active, capital-intensive commitment.

The Lock-In Effect

This dynamic creates a powerful flywheel. More staked ETH means more security for the network and more illiquid supply off the exchanges. It tightens the available float, potentially amplifying price moves when demand returns. The mechanics themselves become a bullish catalyst, independent of daily crypto headlines.

Beyond the Hype Cycle

The real story isn't just rising numbers—it's changing behavior. Emptying the exit queue during uncertain times suggests a maturity shift. Participants are playing a longer game, prioritizing protocol rewards and network participation over quick, speculative exits. It's a structural bet on Ethereum's utility, not just its token price.

The takeaway? While traders watch charts, builders are locking down the foundation. This staking surge reveals a hardening core of Ethereum's economy—one that's betting on code over sentiment, even if the traditional finance crowd still thinks 'staking' is something you do to a vampire.

Ethereum Exit Queue Clears

The queue once held millions of ETH. Now it is empty, data from ethereum Validator Queue shows. This means validators who choose to exit can be processed almost immediately, rather than being forced to wait. The backlog that worried traders in late 2025 has gone.

A change this clear removes an obvious supply overhang and it shifts the balance between how much ETH stays locked versus how much can be spent.

Supply Tightening And Market Noise

Based on reports, staking inflows have been strong enough to pull a big share of circulating ETH out of active markets. With fewer validators lined up to leave, sudden large dumps tied to emergency exits become less likely.

That does not make prices certain, but it lowers one kind of downside risk. Traders tracking on-chain flows now weigh staking behavior alongside spot and derivatives activity when forming short-term views.

Staking Demand GrowsEntry requests to stake ETH are rising fast. Reports note that the entry queue — ETH waiting to become active validators — has climbed to high levels once seen only in big onboarding periods.

Wait times for new activations have stretched into many weeks in places. Institutions and staking services are part of this push, according to market observers, and their moves tend to lock up larger sums for longer.

More ETH locked for staking helps the network’s security because more validators are actively participating. It also creates yield opportunities for holders who prefer steady returns over trading.

That said, the presence of large staking pools and services means some risks are concentrated. If one big provider faces trouble, the effects will be felt widely. Reports say regulators and product issuers are watching closely as staking becomes easier to access through mainstream channels.

What Traders Are WatchingPrice action will depend on many things beyond exit queues. Derivatives positions, ETF flows, and macro headlines still matter. Still, analysts point out that when a visible outlet for mass withdrawals disappears, the narrative around “forced selling” weakens.

Liquidity conditions can shift quietly — and then rapidly — if any of those other levers move. Market participants are therefore watching withdrawal metrics alongside exchange balances and futures open interest.

Featured image from Gemini, chart from TradingView