Bitcoin vs Ethereum vs Dogecoin: The Raw Address Count Showdown Reveals Who’s Really Building

Forget market cap hype for a second. The real story of crypto adoption isn't told in price charts—it's etched into the blockchain itself, in the cold, hard count of active addresses. Let's cut through the noise and see where the users actually are.

The Network Effect, By The Numbers

Bitcoin's ledger isn't just a record of transactions; it's a monument to first-mover advantage and hardened security. Its address count reflects a global settlement layer that's been stress-tested for over a decade. Every new wallet added is another brick in a fortress that traditional finance still struggles to comprehend.

Ethereum's address book tells a different tale—one of explosive, application-driven growth. It's not just about storing value; it's about interacting with a sprawling digital economy. From DeFi to NFTs, each new address often represents a user diving into a specific protocol, making its growth metrics a proxy for developer mindshare and real-world utility.

Then there's Dogecoin. Its address growth curve is a masterclass in meme-powered virality, a social phenomenon that somehow bypassed the need for a complex whitepaper or a detailed roadmap. It proves that in crypto, community sentiment can be just as powerful a driver as technological innovation—a fact that still gives traditional asset managers night sweats.

The Bottom Line

Address counts are the footprints in the sand, showing where the traffic is really flowing. One network builds a gold-standard vault, another engineers a global computer, and a third rides a wave of pure, unadulterated vibe. In the end, the numbers don't lie about who's playing the long game versus who's just enjoying the ride—and maybe that's the most cynical finance jab of all: in this market, sometimes the joke's on the fundamentals.

Ethereum Beats Bitcoin, Dogecoin, & Others In Total Amount Of Holders

In a new post on X, Santiment has talked about where the Total Amount of Holders indicator stands for Bitcoin, Dogecoin, and other coins in the cryptocurrency sector today. This metric measures, as its name suggests, the total number of addresses carrying a non-empty balance on a given network.

When the value of this indicator rises, it can be a sign that new investors are joining the blockchain and/or old investors who sold earlier are making a return. The trend can also arise from existing holders creating multiple wallets for accounting or privacy purposes.

In general, all of these factors can be assumed to simultaneously be in action whenever the Total Amount of Holders registers an increase. As such, some net adoption of the cryptocurrency can be considered to have occurred.

On the other hand, the metric going down implies some investors have cleaned out their wallet balances, potentially because they have decided to exit the blockchain.

Now, here is the chart shared by Santiment that shows the trend in the Total Amount of Holders for eight different cryptocurrencies:

As displayed in the above graph, ethereum is the most dominant cryptocurrency in terms of the Total Amount of Holders, with the metric sitting at 167.96 million. Bitcoin, the next largest network, only hosts a userbase that’s a third of ETH’s (about 57.62 million addresses).

Ethereum’s dominance could be down to the fact that the blockchain hosts a vibrant ecosystem of LAYER two blockchains and decentralized finance (DeFi) applications, made possible by its smart-contracts system.

The gulf between Bitcoin and third place is again massive, with the stablecoin USDT having 9.63 million non-empty wallets. From USDT on, however, the altcoins are much closer to each other.

Dogecoin and XRP are the cryptocurrencies with the fourth and fifth largest holder counts on the list with the indicator having a value of 8.13 million and 7.41 million, respectively.

From the chart, it’s visible that while Bitcoin has seen a more or less flat trajectory in the Total Amount of Holders during the last year, Ethereum has only been witnessing growth, extending its lead.

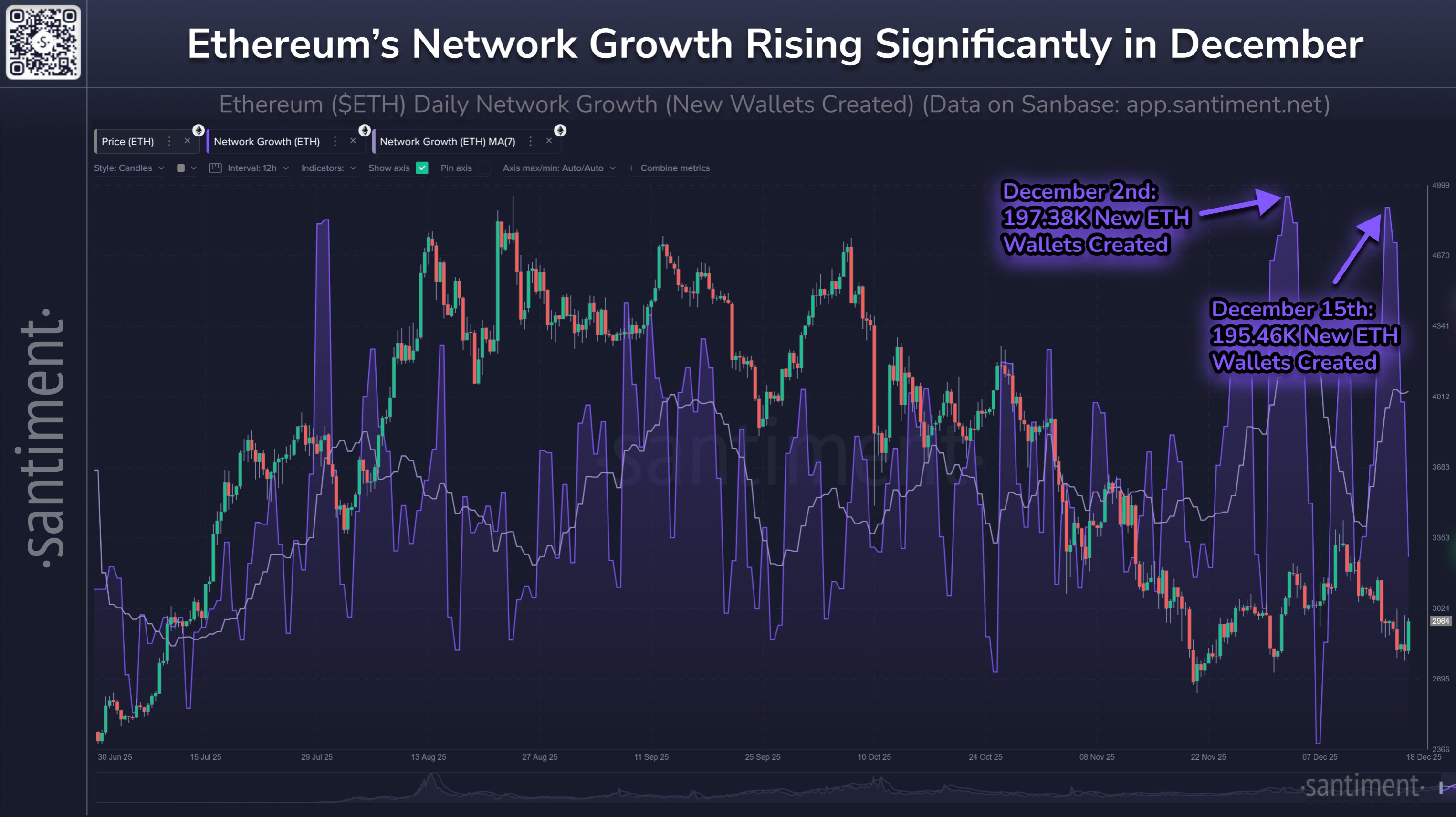

The adoption trend for ETH is also visible from another indicator shared by the analytics firm, known as the Network Growth. This metric keeps track of the new addresses appearing on the blockchain.

As is apparent from the chart, the Ethereum Network Growth has spiked recently. “The #2 market cap is seeing an average of 163K new addresses per day, compared to 124K in July,” noted Santiment.

BTC Price

At the time of writing, bitcoin is trading around $87,500, down 2% over the last week.