Bitcoin’s 2026 Outlook: Why It Could Stay Calmer Than Nvidia, According to Bitwise

Forget the chip frenzy—Bitcoin might just be the steady hand in your portfolio through 2026.

Bitwise, the crypto asset manager, just dropped a prediction that flips the script on volatility expectations. While tech stocks like Nvidia ride the AI rollercoaster, Bitcoin could be entering a phase of surprising stability. It's the kind of forecast that makes traditional portfolio managers clutch their pearls—or at least their spreadsheets.

The Calm After the Storm?

The narrative isn't about explosive, overnight gains. Bitwise points to a maturation story. Think less 'meme-stock mania' and more 'digital gold finding its footing.' As institutional frameworks solidify and adoption becomes less about speculation and more about utility, the wild price swings that defined Bitcoin's adolescence may start to temper.

A Different Kind of Growth Engine

This isn't a prediction of stagnation. It's a bet on a different growth trajectory. The drivers are shifting: think network upgrades, scaling solutions finally hitting mainstream use, and yes, the relentless ticking of the halving clock that continues to tighten new supply. It's fundamental, grinding growth versus hype-driven spikes.

One cynical finance jab? Wall Street might finally understand it once the chart looks less like a heart attack and more like a boring, upward-trending line they can charge a 2% management fee for.

The takeaway? For the next two years, the most disruptive action in Bitcoin might not be on the price chart, but under the hood. Buckle up for boring—it could be the most profitable ride yet.

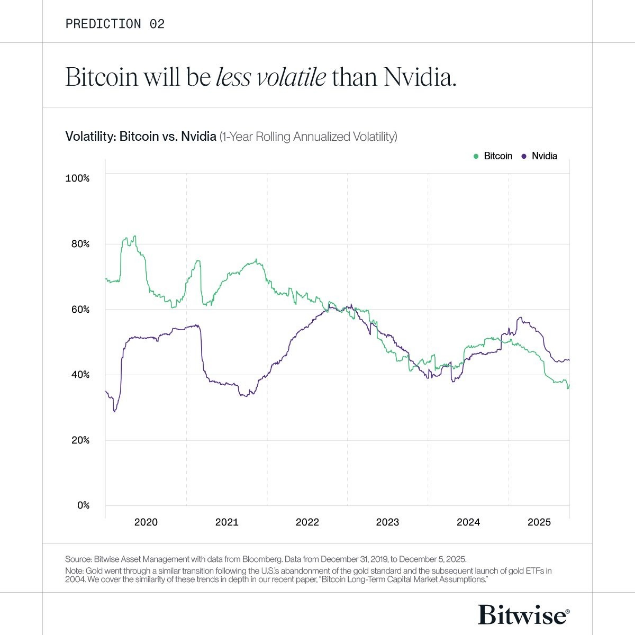

Volatility Comparison Shows Shift

Based on reports from Bitwise, bitcoin will likely be calmer than Nvidia in 2026. “BTC already less volatile than Nvidia in 2025 … thanks to institutional inflows & ETFs,” Bitwise said in an X post.

That change is linked to more traditional money coming in through products such as spot ETFs and other institutional channels. In short: more big, steady investors are in the mix now, and that tends to smooth out wild swings.

![]() Bitcoin maturing fast!

Bitcoin maturing fast!

Bitwise : BTC already less volatile than Nvidia in 2025 (68% vs 120% price swing) thanks to institutional inflows & ETFs.

Volatility to stay lower in 2026 + new all-time high ahead as crypto stocks outperform tech!![]() #Bitcoin #BTC #Crypto… pic.twitter.com/TEyzoZQrYv

#Bitcoin #BTC #Crypto… pic.twitter.com/TEyzoZQrYv

— ChartSage (@CryptoChartSage) December 18, 2025

Institutional Entry And The Bull Case

Bitwise also put forward a bullish view for next year. It expects a new all-time high and a break from the old four-year cycle. The firm listed several reasons: the halving, shifts in interest-rate cycles, and weaker boom-and-bust forces than in past runs.

The company named big institutions — Citigroup, Morgan Stanley, Wells Fargo and Merrill Lynch — as potential new entrants, and it said allocations to spot crypto ETFs should rise. Bitwise added that onchain work could speed up too, and that crypto equities might beat tech stocks in returns.

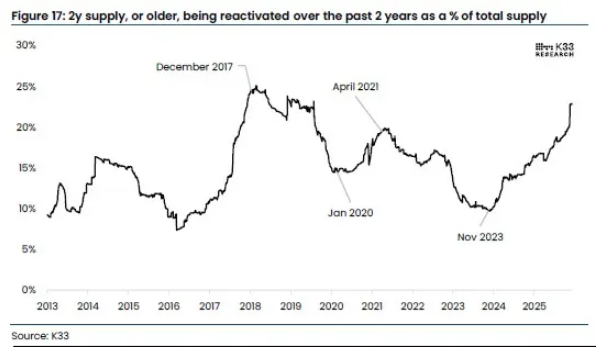

Long-Time Holders Are SellingReports have disclosed heavy selling from long-term holders, a trend that complicates the bullish story. K33 Research found about 1.6 million coins that had been idle for at least two years moved since early 2023.

That amount is worth roughly $140 billion. In 2025 alone, nearly $300 billion of coins that had been dormant for over one year returned to the market, according to K33 and CryptoQuant data.

CryptoQuant also flagged one of the heaviest long-term holder distributions seen in more than five years in the past 30 days.

Chris Newhouse, director of research at Ergonia, described the FLOW as a “slow bleed” caused by steady selling into thin bids, which can create a long, grinding fall that is not easy to reverse.

Market Divergence And Near-Term PressureThe split with equities is clear. Nvidia shares are up about 27% year-to-date. Bitcoin, on the other hand, is down roughly 8% so far this year and has dropped nearly 30% from its record above $126,000.

That gap shows crypto is not always moving with big tech. Selling by long-term holders is one reason prices are under pressure even while some investors push for fresh gains.

Featured image from Unsplash, chart from TradingView