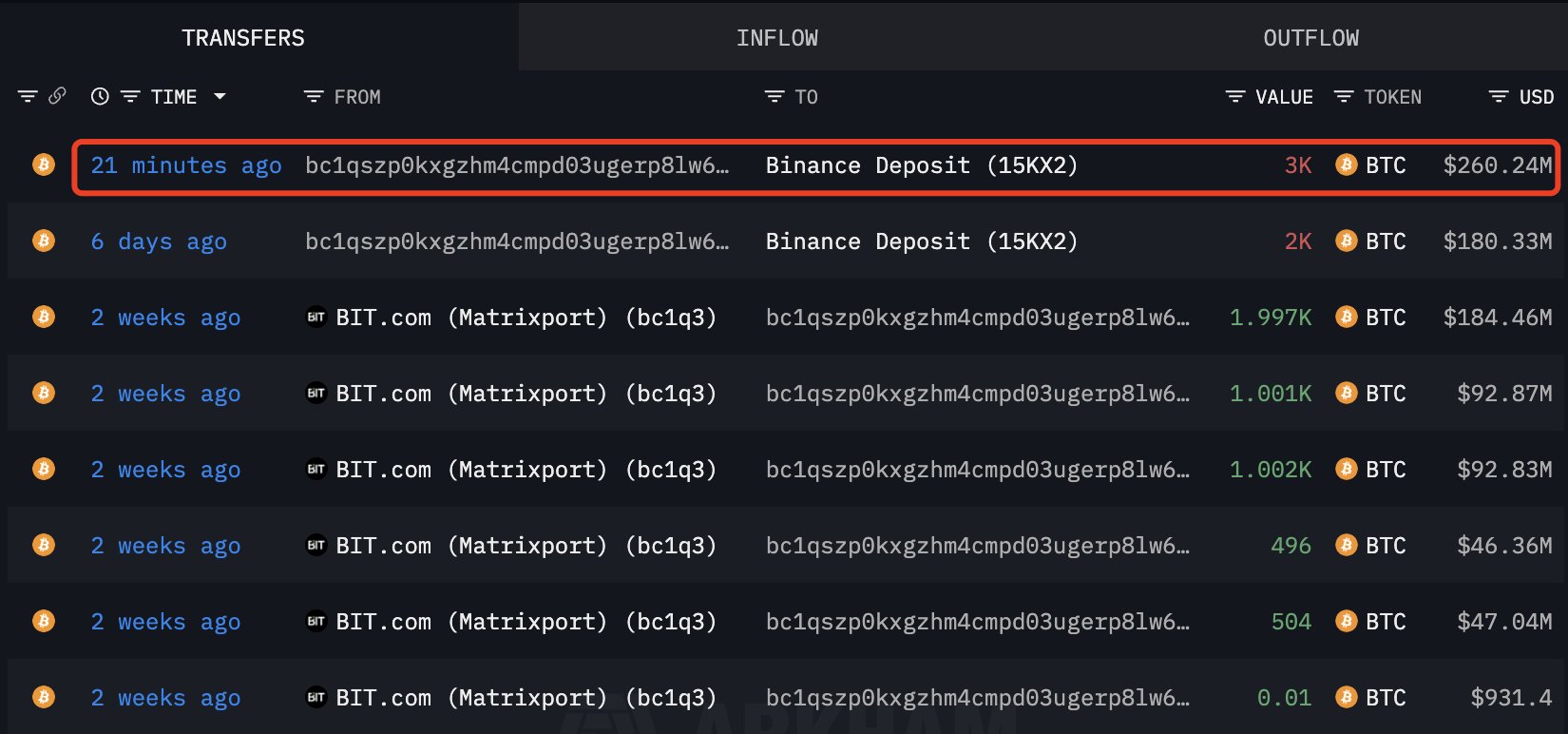

Matrixport Exodus: $347 Million Bitcoin Floods Binance as Major Wallets Unload

Whale-sized wallets linked to crypto giant Matrixport just made a splash—dumping a tidal wave of Bitcoin onto Binance.

The Big Move

On-chain sleuths spotted the massive transfer. We're talking hundreds of millions in value hitting the world's largest exchange in one go. It's the kind of move that makes charts twitch and traders reach for their coffee.

Reading the Tea Leaves

Is this a strategic rebalance? A loss of confidence? Or just some old-fashioned profit-taking? The crypto streets are buzzing with theories. One thing's clear: when wallets this size move, the market feels it.

The Binance Factor

Binance becoming the landing pad is no accident. It's the liquidity hub of choice for major players—the go-to venue when you need to move serious volume without sinking the ship. A backhanded compliment to their market depth, really.

So, what's the real play here? A calculated portfolio shift or a subtle vote of no confidence? In crypto, a nine-figure transaction isn't just a trade—it's a statement. Sometimes that statement is 'I need liquidity,' and other times it's the financial equivalent of quietly gathering your things before the fire alarm goes off. Either way, the rest of us are left to decipher the smoke signals.

Matrixport is a large digital-asset financial services platform founded by former Bitmain executives, offering products including crypto lending, structured products, asset management, and custody solutions.

Such large inflows to exchanges are closely watched by the market, as they often precede distribution or hedging activity, particularly during periods of heightened uncertainty. While not every deposit translates directly into spot selling, the timing of these transfers adds to the growing sense of caution.

Whether current demand can absorb this supply and stabilize price will likely determine if this phase becomes a deeper correction—or the start of a more prolonged bearish regime.

Exchange Inflows And What They Mean For Bitcoin

Large Bitcoin deposits to exchanges are almost always interpreted by the market as a bearish signal, since they increase the immediate supply available for sale. In most historical cases, sharp spikes in exchange inflows have preceded periods of downside volatility, reinforcing the perception that whales are preparing to distribute into liquidity. However, some investors urge caution when reading this data in isolation, as not every exchange transfer results in spot selling.

In certain scenarios, large inflows can be linked to internal treasury management, collateral rotation, or the opening of hedged derivatives positions rather than outright liquidation. Institutions may move bitcoin to centralized venues to post margin for futures or options, allowing them to hedge downside risk without selling their underlying holdings.

In other cases, funds prepare liquidity for over-the-counter settlements or cross-exchange arbitrage, activities that do not necessarily translate into sustained selling pressure on the spot market.

Looking ahead, Bitcoin’s price action over the coming months will likely depend on whether these inflows are followed by a clear increase in realized selling volume. If demand continues to absorb supply NEAR the $85K–$86K zone, the market could transition into a prolonged consolidation phase, allowing sentiment to reset.

However, if exchange balances continue to rise alongside weakening spot demand, downside risks remain elevated. In that scenario, Bitcoin may revisit lower support levels before any durable recovery can begin.

Price Tests Critical Long-Term Support

Bitcoin’s higher-timeframe structure shows a clear loss of momentum after failing to hold above prior highs. On the weekly chart, BTC is now consolidating around the $86,000–$87,000 zone after a sharp rejection from the $110,000–$120,000 region. This area has become a critical demand zone, as price is currently hovering near the rising 200-day moving average, which historically acts as a key trend filter during cycle transitions.

The short-term structure remains fragile. Bitcoin is trading below the 50-week moving average, which has started to roll over, signaling weakening upside momentum. Meanwhile, the 100-week moving average is still trending higher and sits below the current price, suggesting that the broader macro trend has not fully broken but is clearly under stress.

From a price-action perspective, BTC is forming a lower high relative to the previous cycle peak, while volatility remains compressed. This often precedes a larger directional move. If bulls fail to defend the $85,000 support decisively, the next downside targets sit near the $78,000–$80,000 region, where previous consolidation occurred.

Conversely, any structural recovery WOULD require a reclaim and weekly close above $90,000, followed by sustained acceptance above the 50-week average.

Featured image from ChatGPT, chart from TradingView.com