Smart Money Exodus: 14,000 Ethereum Floods Market as Two Major Whales Dump Positions

Two crypto whales just made a splash—and it's sending ripples across the entire Ethereum pond.

The Whale-Sized Exit

Forget retail panic. This is smart money on the move. Two major holders—the kind that move markets with a single transaction—have just offloaded a staggering 14,000 ETH. That's not a cautious trim; it's a strategic exit. Their wallets are lighter, and the market is now swimming in a sudden, massive supply of the second-largest crypto asset.

Reading the Ripples

What does a move this size signal? It's the ultimate sentiment check. These players aren't reacting to daily headlines; they're executing pre-planned strategies. Their exit could foreshadow a tactical pivot, a portfolio rebalance away from Ethereum's ecosystem, or simply a classic profit-taking maneuver after a long run-up. Either way, their actions speak louder than any analyst report.

The Market's Next Move

All that freshly liquid ETH now sits on exchanges or with new buyers, creating immediate overhead resistance. It's a classic test of market depth. Can demand absorb this supply without a significant price dip? The answer will reveal whether the current bullish thesis is built on solid ground or the same speculative fumes that fuel every boom-and-bust cycle—because in crypto, sometimes 'smart money' is just early money looking for an exit before the music stops.

Ethereum Whale Selling Meets Long-Term Conviction

Arkham data shared by Lookonchain reveals fresh evidence of large-scale selling as ethereum trades under sustained pressure. Address 0x2802 sold 10,000 ETH, worth approximately $29.16 million, at an average price of $2,915.5 through decentralized exchanges.

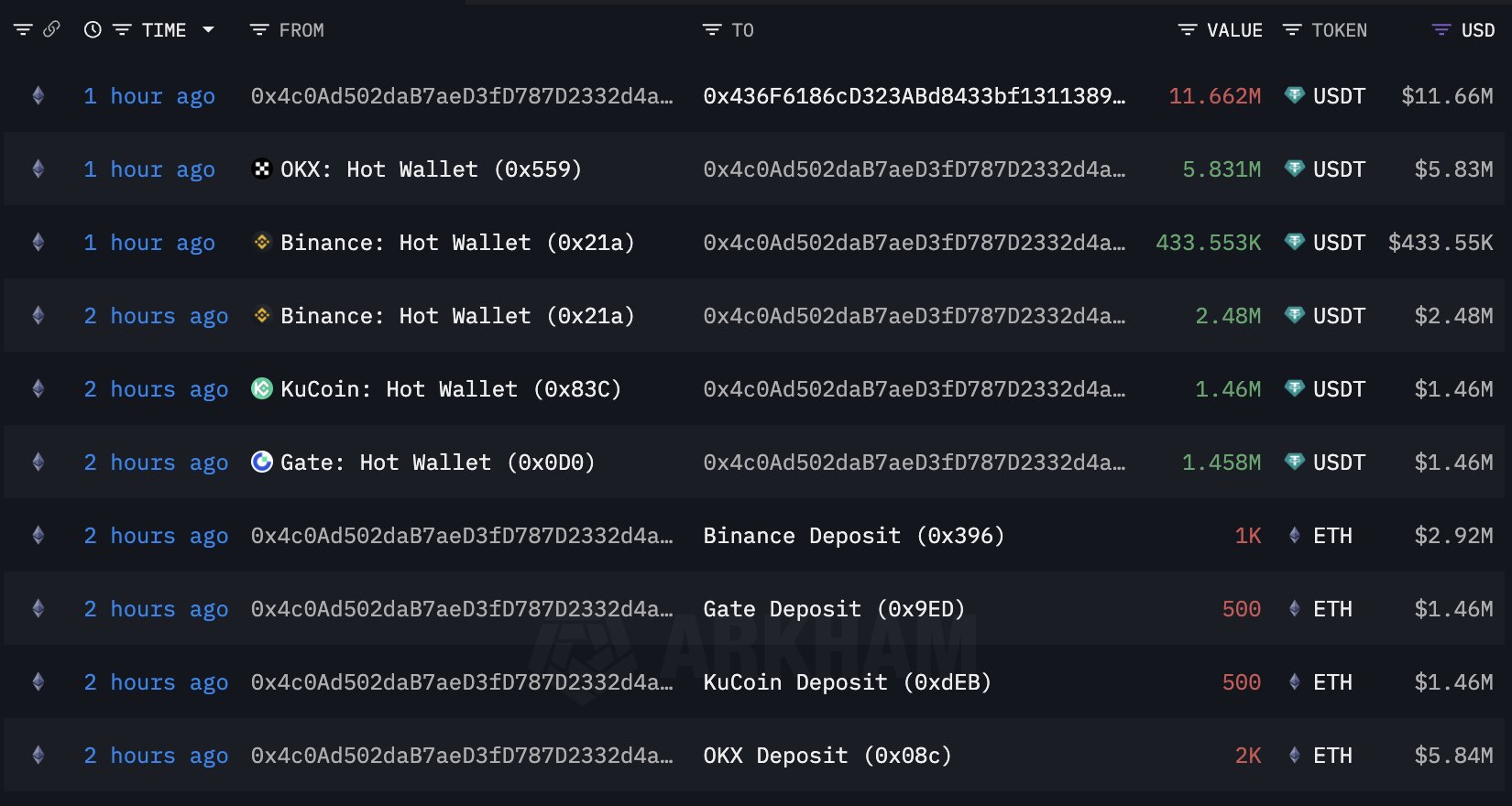

Shortly after, another whale, 0x4c0A, offloaded 4,000 ETH, valued at around $11.66 million, distributing the sale across multiple centralized venues, including OKX, Binance, KuCoin, and Gate. The timing and coordination of these moves reinforce the current bearish tone, particularly as liquidity remains thin and broader market sentiment leans defensive.

In the short term, such activity adds to downside pressure and fuels uncertainty among smaller investors, who often interpret whale selling as a signal of deeper weakness ahead. However, price action and sentiment do not tell the full story. Despite the drawdown, Ethereum’s fundamentals continue to strengthen at a pace rarely seen before. Institutional adoption is accelerating, not slowing.

Most notably, JP Morgan recently announced the use of Ethereum to launch its first tokenized money-market fund, a milestone that underscores growing confidence in Ethereum as a settlement and financial infrastructure layer. While markets may remain bearish in the near term, the divergence between price sentiment and fundamental progress is becoming increasingly difficult to ignore.

Ethereum Price Struggles to Hold Key Weekly Support

Ethereum continues to trade under pressure on the weekly chart, with price now sitting around $2,950 after a sharp rejection from the $3,200–$3,300 region. This area previously acted as a key pivot zone and has now clearly flipped into resistance. The inability to reclaim it confirms that sellers remain in control of the medium-term structure.

From a trend perspective, ETH is consolidating around its 200-week moving average (red line), a historically important level that often determines whether corrections remain cyclical or evolve into deeper bearish phases. So far, this moving average is acting as dynamic support, preventing a more aggressive breakdown. However, momentum remains weak, and upside follow-through is limited.

The 50-week and 100-week moving averages (blue and green lines) are beginning to flatten and converge, reflecting indecision and reduced trend strength. Volume also remains muted compared to prior expansion phases, suggesting that neither strong accumulation nor capitulation is taking place at current levels.

Structurally, ETH remains in a wide consolidation range between $2,500 and $3,300. A weekly close below the $2,800–$2,900 area WOULD expose downside toward the lower end of that range. Conversely, reclaiming $3,300 is required to reestablish bullish momentum. Until then, Ethereum remains technically fragile despite its long-term fundamentals.

Featured image from ChatGPT, chart from TradingView.com