Crypto Unrealized Losses Hit $350 Billion, With $85 Billion From Bitcoin Alone

Digital assets are sitting on a mountain of paper losses—and Bitcoin's share is staggering.

The Unrealized Pain

Forget the price charts for a second. The real story is buried in the wallets. A collective $350 billion in unrealized losses is hanging over the crypto market. The kingpin? Bitcoin, accounting for a cool $85 billion of that red ink. That's not just a dip—it's a chasm of 'what could have been' for legions of holders.

Reading the Tea Leaves

This isn't necessarily a doom signal. In volatile markets, unrealized losses are the flip side of future potential gains. They represent the gap between purchase price and current value—a number that flips from red to green with a sustained rally. For seasoned crypto natives, these figures are less about panic and more about positioning. It highlights where the most significant investor pain—and therefore, the most pent-up selling pressure or diamond-handed conviction—might be concentrated.

The Bull Case in the Red

Paradoxically, large-scale unrealized losses can set the stage for the next bull run. They often signal that weaker hands have been shaken out and that remaining holders are more likely to be committed for the long haul. It creates a foundation that's potentially more resilient to further downside. When the market turns, that $350 billion in paper losses begins to evaporate, transforming into realized gains and fresh capital momentum. It’s the market’s way of resetting the clock—though your average Wall Street analyst would probably call it 'irrational exuberance' before ordering another martini on the company card.

The bottom line? The numbers look brutal, but in crypto, today's unrealized loss is often tomorrow's fuel. The market has a history of making comebacks that leave traditional finance scrambling for explanations.

Unrealized Loss Has Spiked In The Crypto Sector After Bearish Price Action

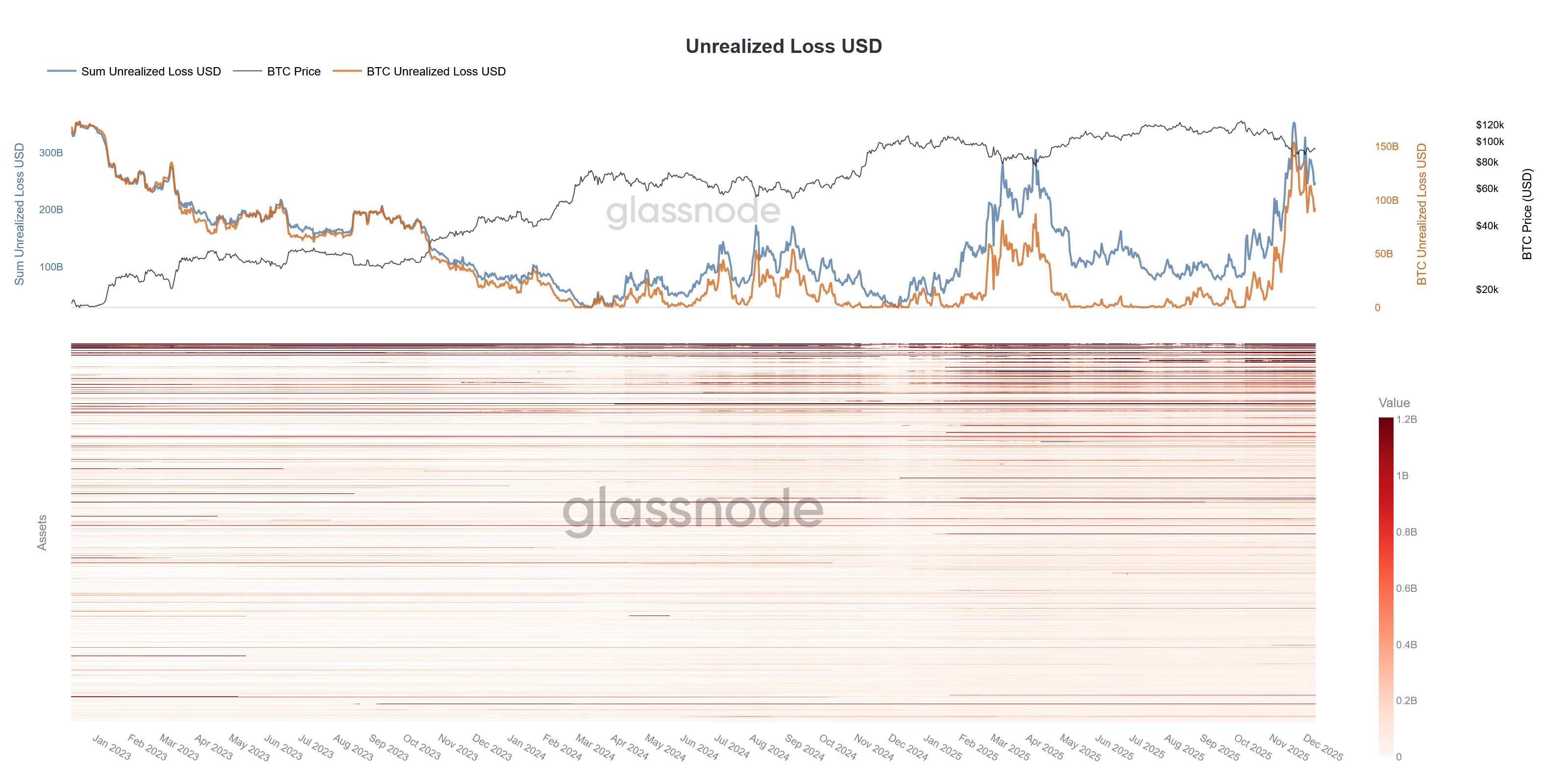

In a new post on X, on-chain analytics firm Glassnode has shared the data related to the Unrealized Loss in the crypto sector. This indicator measures, as its name suggests, the total amount of loss that investors are holding on their tokens right now.

The metric works by going through the transaction history of each token on a given network to find what price it was last moved at. If this last selling price of a token was less than the current spot price of the asset, then that particular coin is assumed to be underwater.

The exact amount of the loss involved with the token is equal to the difference between the two prices. The Unrealized Loss sums up this value for all coins being held at a loss.

Like the Unrealized Loss, there also exists the Unrealized Profit, keeping track of the supply of the opposite type. That is, it accounts for the coins with a cost basis lower than the latest spot price.

Now, here is a chart that shows the trend in the Unrealized Loss for the combined crypto market and Bitcoin over the last few years:

As displayed in the above graph, the Unrealized Loss across the crypto market has surged following the downturn that the sector has gone through since October.

At its peak, the indicator hit a value of $350 billion for the entire market, with bitcoin alone contributing about $85 billion. These are both elevated levels and showcase the degree of pain among the investors.

Glassnode explained:

With multiple on-chain indicators signalling shrinking liquidity across the board, the market is likely entering a high-volatility regime in the weeks ahead.

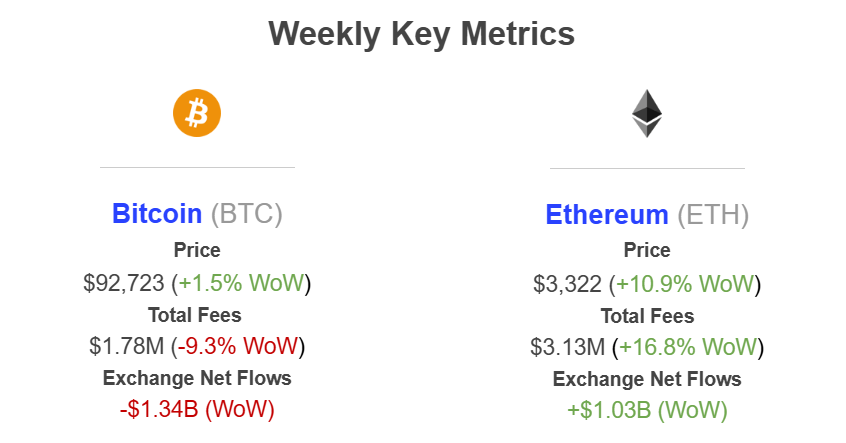

In some other news, Bitcoin and ethereum have shown strong divergence in the Exchange Netflow trend this week, as institutional DeFi solutions provider Sentora has pointed out in an X post.

As is visible above, the bitcoin exchange Netflow registered a significant value of -$1.34 billion over the past week. The value being negative implies centralized exchanges faced net withdrawals.

In contrast, the same indicator has witnessed a sharp positive value of $1.03 billion for Ethereum instead. Usually, investors deposit to exchanges when they want to participate in one of the services that they provide, which can include selling. As such, large exchange net inflows can be bearish for the asset’s price.

BTC Price

Bitcoin has again failed to maintain its recovery above $92,000 as its price is back to $90,000.