Bitcoin Investors, Breathe Easy – Zero Negative Days for BTC in 2025

Bitcoin just pulled off the impossible—a full calendar year without a single down day. The streak that started in January is now the stuff of legend, rewriting the rulebook on volatility and leaving traditional finance scrambling for explanations.

The Unbreakable Streak

Forget the old patterns of gut-wrenching dips and panic selling. The 2025 chart tells a different story: a relentless, uninterrupted climb. Analysts who built careers predicting crashes are now staring at a flat line where red used to be. The market didn't just stabilize; it entered a new phase of gravity-defying momentum that has skeptics checking their data feeds.

What's Fueling the Run?

This isn't luck. A perfect storm of institutional adoption, regulatory clarity, and a generational shift in asset allocation is pumping the tires. Major funds are finally going long and loud, treating Bitcoin not as a speculative toy, but as a core holding. The 'digital gold' narrative has evolved into 'digital bedrock'—the foundation portfolios are being built upon.

The New Market Psychology

The absence of negative days does more than boost portfolios; it rewires investor psychology. The fear of buying at a peak is being replaced by the fear of missing the next leg up. Hesitation gets punished by another up-move, creating a self-reinforcing cycle of FOMO that even the most cynical traders can't ignore.

A Jolt to the Old Guard

Meanwhile, over in traditional finance, fund managers are still trying to beat the S&P by half a percent—a quaint pursuit in an era where an asset goes an entire year without looking back. It's a stark reminder that sometimes, the biggest risk isn't volatility; it's irrelevance.

So, is this the new normal, or a statistical anomaly waiting to correct? Only time will tell. But for now, the trend is your friend, and it's wearing a permanent smile.

No Negative Days Left In 2025, But 2026 Could Feature A Deep Correction

On Saturday, December 6, Alphractal CEO and founder Joao Wedson took to the X platform to share what to expect from the Bitcoin price in the last days of 2025. According to the on-chain expert, the market leader is likely to close the year in a sideways price range.

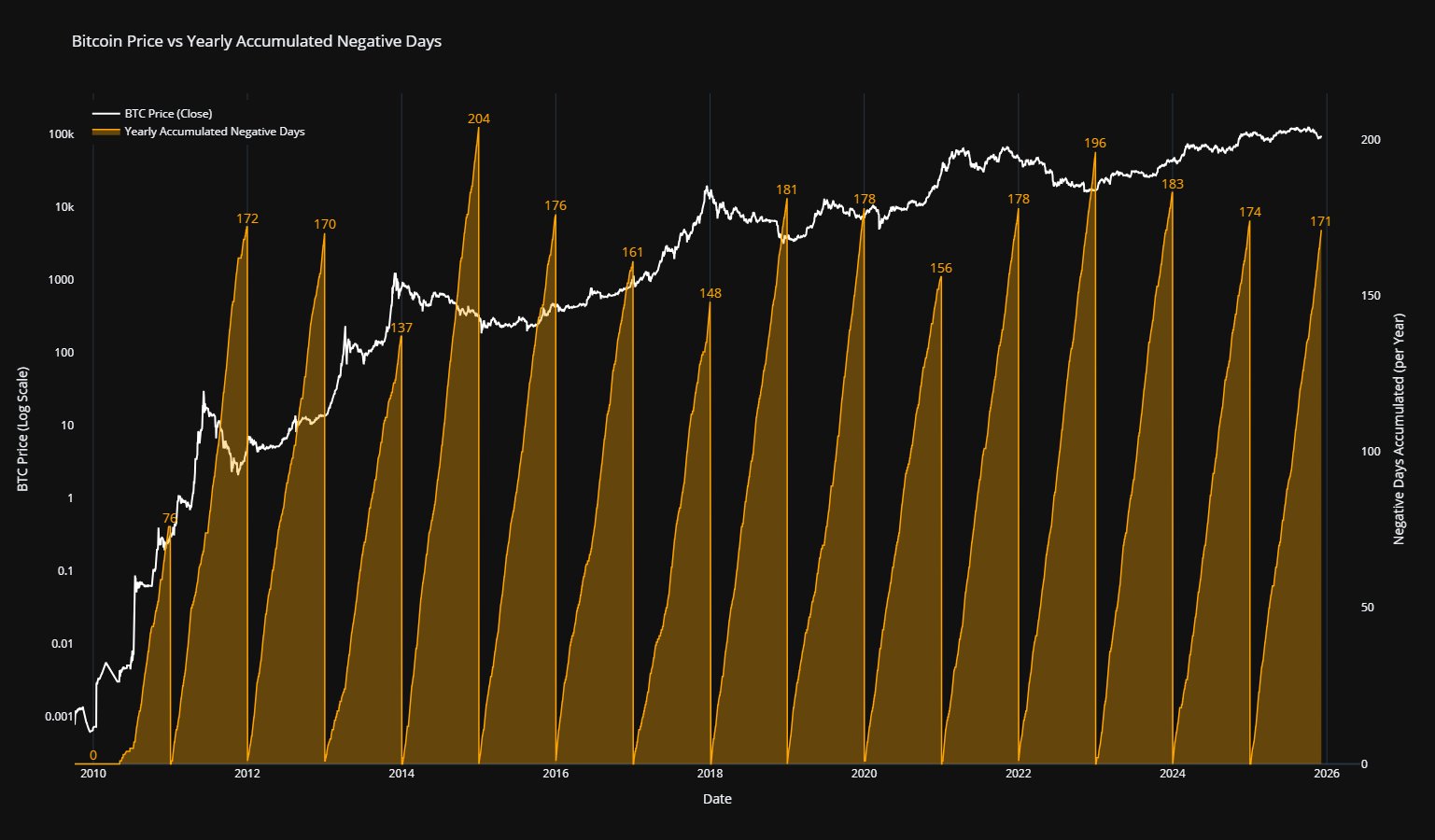

The relevant metric here is the Yearly Accumulated Negative Days, which tracks market resilience by measuring the number of days in a year where an asset’s daily price candlestick closed in the red.

According to historical data and patterns, Bitcoin typically witnesses an average of 170 days of negative price movement in a year. This mean figure or level provides insight into the stress threshold for the world’s largest cryptocurrency by market cap.

When the number of negative days is approaching or exceeds this threshold of 170 days, as bitcoin already has in 2025, the selling pressure in the market tends to wane as fatigue sets in among the bears. Wedson revealed that the premier cryptocurrency has already accumulated 171 negative days so far in 2025.

The on-chain expert noted that exceeding this threshold “strongly suggests” that the price of Bitcoin might not witness any more negative days in the final few weeks of 2025. Wedson said that if a deeper correction is imminent for the market leader, it will most likely happen in the next year.

However, as the Alphractal founder highlighted, the bitcoin price is more likely to end the year within a consolidation range. Adding further credence to this postulation is the lack of market demand, as seen with reduced capital influx into spot Bitcoin exchange-traded funds.

Bitcoin Price At A Glance

As of this writing, the price of BTC stands at around $89,397, reflecting a mere 0.3% drop in the past 24 hours.