Bitcoin ETF, Treasury Firms Might Have Stopped Buying — But How Much Have They Offloaded?

Institutional flows for Bitcoin ETFs have flatlined. The big question now isn't when they'll resume buying, but what they've already sold.

The Great Unwind

Wall Street's brief, intense love affair with spot Bitcoin ETFs appears to have hit a wall. After a historic launch frenzy that saw billions pour in, the tap from traditional treasury and asset management firms has seemingly shut off. The data shows a clear stall in net inflows. The silence is deafening, and the charts are painting a picture of consolidation—or distribution.

Reading the Tape

Analysts are scrambling to decode the ledger. Without fresh buys, every tick down in price whispers the same story: potential offloading. The mechanics are simple. Authorized Participants create and redeem ETF shares in massive blocks. A halt in creation requests often precedes a wave of redemptions. The market is now left to guess the size of the overhang—the unseen inventory that could hit the market if sentiment sours further.

Pressure Points

This isn't just about crypto volatility. Macro pressures are squeezing traditional portfolios, forcing treasurers to rebalance and raise cash. Bitcoin, still tagged as a 'risk asset' in many models, often gets cut first when liquidity gets tight. The ETF structure made buying easy; it makes selling just as effortless. The very vehicle that brought institutions in could facilitate a rapid exit.

A cynical take? This is classic finance: pile into the narrative on the way up, then hire expensive consultants to justify the exit on the way down. The real test for Bitcoin's 'digital gold' thesis isn't during the bull run—it's when the quarterly reports need polishing and the board asks uncomfortable questions about that 'speculative' line item.

The market holds its breath. The next major move will reveal whether this is a strategic pause or the start of a great institutional retreat.

Are Bitcoin Treasury Firms Offloading Their Coins?

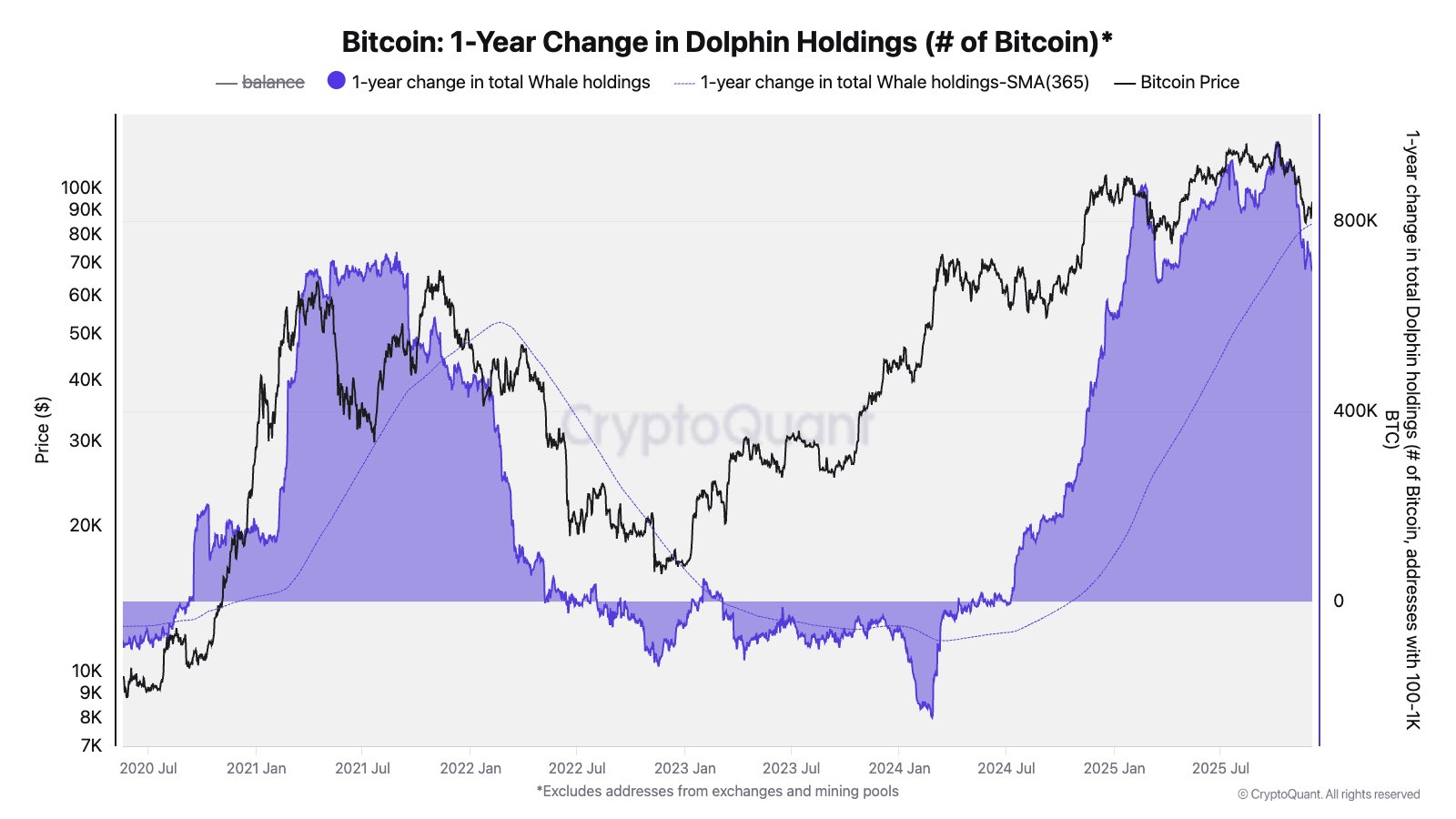

In a new post on X, CryptoQuant’s Head of Research, Julio Moreno, shared an on-chain insight to support the hypothesis that the bitcoin bear market has started. This conclusion is based on the Balance Growth of an investor group known as the “dolphins.”

Dolphins refer to a group of crypto investors holding substantial amounts of a coin, placing them between small investors (shrimps) and the largest investors (whales). Specifically, Moreno described dolphins as wallet addresses with significant BTC holdings between 100 – 1,000 coins.

According to the latest data from CryptoQuant, the growth in the Dolphins’ BTC holdings has slowed down in the past year and appears to be in a downward trend. Moreno believes that this negative change points to the emergence of a Bitcoin bear market.

Moreno revealed that these Dolphin addresses had increased year-over-year by roughly 965,000 BTC when the BTC price hit its current all-time high around $125,000. Now that the BTC price is nearly 30% below its record high, the Bitcoin Dolphins’ balance stands at around 694,000 coins.

Moreno wrote on X:

This address cohort includes ETFs and Treasury companies, which have also stopped buying.

More interestingly, the CryptoQuant Head of Research revealed that this investor group consists of ETF issuers and Treasury companies, which have stopped purchasing Bitcoin. According to data from SoSoValue, the US-based Bitcoin exchange-traded funds have posted net outflows in five out of the last six weeks.

Meanwhile, BTC and crypto treasury companies have struggled in the past few months, with retail investors losing tens of billions to the hype. While there have been rarely reports of crypto treasury sell-offs, this decline in these Dolphins’ holdings tells an entirely different story.

Bitcoin Price At A Glance

As of this writing, the price of BTC stands at around $89,151, reflecting an over 3% decline in the past 24 hours.