Ripple’s $12 Trillion Repo Market Gambit: Expert Analysis Reveals Game-Changing Potential

Ripple just took aim at the financial establishment's crown jewel—and the implications could reshape global finance forever.

The $12 Trillion Opportunity

While traditional banks shuffle paper and process delays, Ripple's technology slices through the repo market's complexity like a hot knife through butter. We're talking about the overnight lending market that keeps global finance liquid—and currently operates with all the efficiency of a 1970s paper-based system.

Breaking Down the Mechanics

Real-time settlement cuts counterparty risk to zero. No more waiting for trades to clear. No more wondering if your collateral will arrive tomorrow. The system bypasses the usual intermediaries—because who needs extra hands taking cuts when blockchain handles everything instantly?

The Institutional Shift

Major players are watching closely. When you can turn capital faster and safer, the old ways start looking... well, old. Traditional finance might scoff at digital assets, but they can't ignore 24/7 operational efficiency and risk reduction that actually works.

Of course, Wall Street will claim they saw it coming—right after they finish counting their manual settlement fees.

Ripple's move isn't just another crypto story—it's a direct challenge to how money moves when the sun goes down. The repo market will never be the same.

Ripple Eyes Entry Into $12 Trillion Repo Market

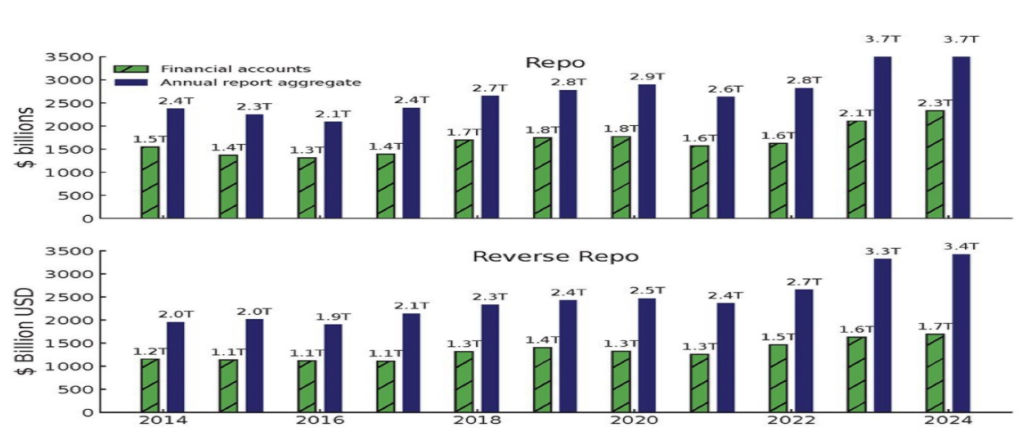

A recent X post by a crypto analyst known as ‘X Finance Bull’ has ignited discussions in the crypto community, claiming that Ripple’s latest acquisitions signal a direct entry into the US repo market. Contrary to the previously cited $6 trillion valuation, the expert disclosed that the repo market’s actual value may be nearly twice as high, approaching $12 trillion and making it one of the largest liquidity pools in the world.

The repo market, which X Finance Bull calls the “real liquidity backbone of the global finance system,” plays a vital role in facilitating short-term funding and liquidity throughout international economies. Ripple’s strategic entrance into this domain could mark a new chapter in how capital moves across borders and institutions. Moreover, the analyst mentioned that Ripple’s recent acquisition of cloud-based SaaS platform, GTreasury and prime brokerage Hidden Road appears to be pivotal in its strategy to tap into the $12 trillion repo market.

According to the analyst, these moves extend Ripple’s reach beyond traditional remittance and cross-border payment solutions, unlocking idle capital that resides within some of the world’s most powerful financial markets. GTreasury, for one, provides Ripple access to sophisticated capital management infrastructures. Combined with Hidden Road, the crypto company now sits at the intersection of traditional finance and digital asset liquidity.

X Finance Bull stressed that Ripple is building “the foundation of modern monetary plumbing,” and now it is paired with 24/7, 365-day real-time settlement powered by a decentralized ledger. He urged market observers not to focus solely on the xrp price but on Ripple’s strategic positioning.

Ripple CEO Announces Complete Acquisition Of Hidden Road

Ripple CEO Brad Garlinghouse announced on October 24 that the company has officially finalized the acquisition of Hidden Road, which will now operate under the name “Ripple Prime.” This development marks the crypto firm’s fifth major acquisition in roughly two years, joining GTreasury last week, Rail in August 2025, Standard Custody in 2024, and Metaco in 2023.

With these acquisitions, Garlinghouse revealed that Ripple is building solutions toward enabling an “internet of value.” The CEO reminded the community that XRP remains central to every aspect of Ripple’s expanding network. The launch of Ripple Prime also marks a significant milestone, making Ripple the first-ever cryptocurrency firm to own and operate a global, multi-asset prime brokerage.

Featured image from Wallup, chart from TradingView