Bitcoin’s 4-Year Cycle Reaches Critical Turning Point: Analyst Reveals Why This Cycle Defies All Previous Patterns

Bitcoin's four-year rhythm hits inflection point as institutional adoption rewrites the rulebook.

The Halving Effect Redefined

Previous cycles followed predictable post-halving trajectories, but this time massive corporate treasury allocations and spot ETF inflows create unprecedented demand pressure. The traditional supply shock narrative gets amplified by institutional FOMO that wasn't present in earlier cycles.

Macro Meets Crypto

Global monetary policy convergence with digital asset adoption creates perfect storm conditions. Central bank balance sheet expansion coincides with Bitcoin's scarcity mechanism—timing that previous cycles never enjoyed. Traditional finance finally understands what 'hard money' means, even if they still can't explain blockchain without PowerPoint slides.

Technical Breakout Confirmed

On-chain metrics scream bullish divergence from historical patterns. Exchange reserves plummet while accumulation addresses hit all-time highs—a supply squeeze scenario that makes 2017 and 2021 look like warm-up acts. The charts suggest we're not just repeating history; we're rewriting it.

Will Bitcoin's new institutional overlords bring stability or just create bigger bubbles? Either way, the four-year cycle just got a trillion-dollar upgrade that makes previous retail-driven rallies look like amateur hour.

Bitcoin’s Fourth Cycle: A Stable and Mature Market Phase

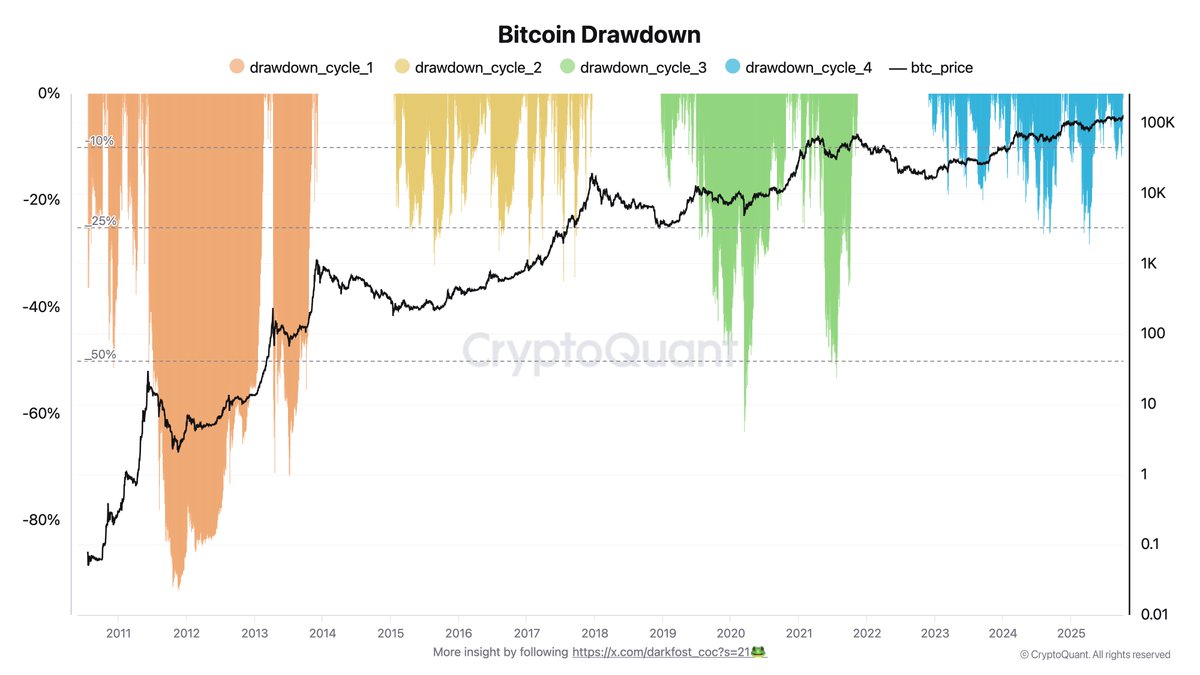

According to top analyst Darkfost, Bitcoin’s current cycle stands out as the most stable in its history. During this bullish phase, BTC has not experienced a single correction exceeding 28%, a stark contrast to previous cycles where violent retracements were common. Most drawdowns have remained within a modest 10%–20% range, and only four corrections have surpassed 25%, marking this as the least volatile Bitcoin cycle so far.

For perspective, between 2020 and 2022, Bitcoin endured multiple 50% drawdowns, creating sharp waves of fear and euphoria that defined the market’s rhythm. Today, the picture is very different. Volatility has dropped to its lowest levels since the last bear market, reflecting a new level of market maturity. As Darkfost points out, this decline in volatility has also led to a tightening of the Bollinger Bands’ standard deviation, signaling growing price stability and disciplined market behavior.

This shift suggests that Bitcoin’s market structure has fundamentally evolved. It no longer mirrors the chaotic, retail-driven cycles of the past. Instead, adoption continues to climb, regulation has become more favorable, and, most importantly, the investor base is changing. Large institutional players and corporate treasuries — particularly in the United States — are entering the market, absorbing selling pressure that once triggered DEEP corrections.

As a result, Bitcoin’s fourth cycle is rewriting the rulebook, built on deeper liquidity, stronger hands, and long-term conviction rather than speculation. This may be the first cycle where Bitcoin transitions from a volatile asset to a globally recognized, maturing store of value.

Price Consolidation Continues Around $121K

Bitcoin (BTC) is currently trading around $121,800, consolidating after a volatile week that saw strong resistance NEAR the $126,000 all-time high. The 4-hour chart shows that BTC is moving sideways within a narrow range, struggling to reclaim the short-term 50 EMA (blue line), which has now turned into dynamic resistance.

The immediate support level sits near $120,000, while the key horizontal level at $117,500 — highlighted in yellow — remains the most crucial zone to maintain the broader bullish structure. As long as the price holds above this area, the uptrend remains intact, with potential for a renewed push toward the $124,000–$126,000 zone.

Momentum indicators suggest that buyers are still defending critical support, though market indecision dominates. The 100 and 200 EMAs (green and red lines) continue trending upward, reinforcing mid- and long-term bullish sentiment. However, failure to close above $122,500 in the coming sessions could expose Bitcoin to deeper retracements, with eyes on $118,000 as the next demand area.

The chart suggests a healthy consolidation phase after a major breakout. A decisive move above $123K WOULD confirm renewed bullish momentum, while a breakdown below $120K could mark the beginning of a deeper correction phase.

Featured image from ChatGPT, chart from TradingView.com