Solana’s Epic Breakout Gains Massive Momentum From Two Powerful Forces — What’s Next for Price?

Solana just caught fire—and two major catalysts are fueling the surge.

The Institutional Stamp of Approval

Big money finally woke up to Solana's potential. Major funds are allocating serious capital, recognizing the network's blistering transaction speeds and growing ecosystem. This isn't retail FOMO—this is smart money positioning.

The Technical Breakout Confirmation

Price smashed through key resistance levels with conviction. The chart tells the story: clean breakout, surging volume, and no looking back. Technical analysts are calling this one of the cleanest setups they've seen all year.

Where Does SOL Go From Here?

All signs point north. The combination of fundamental backing and technical momentum creates a powerful bullish narrative. Of course, traditional finance pundits will call it speculation—right up until they quietly open their own positions. The pattern's familiar: dismiss, then FOMO.

Watch the key levels. If SOL holds above recent resistance-turned-support, the path clears for another leg up. The market's voting with its wallet—and right now, it's betting big on Solana.

Whales Pick Up, Exchange Flows Confirm Strength

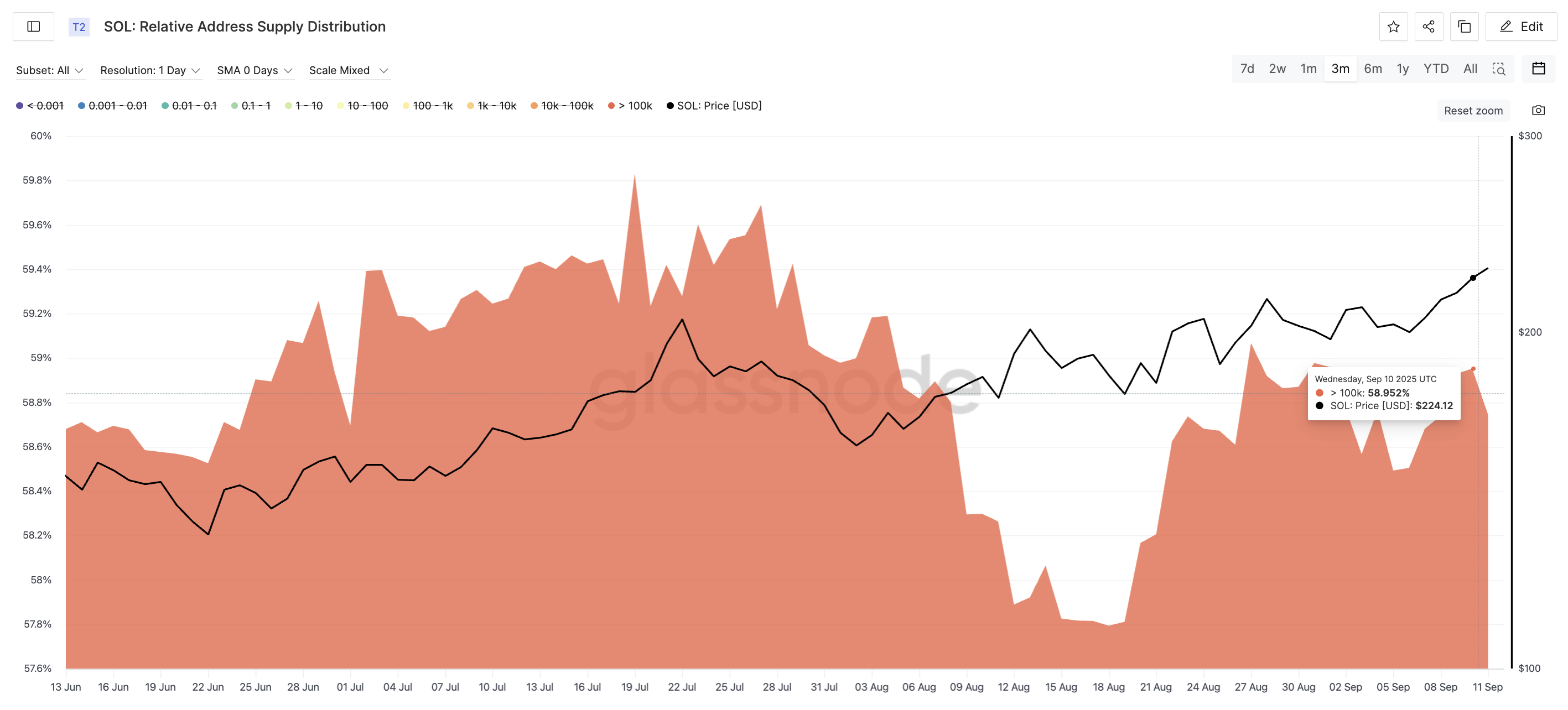

The relative address supply distribution metric, which tracks the amount of supply held by wallets of different sizes, indicates that holders with more than 100,000 SOL (whales and sharks) have resumed accumulating. Since August 19, their holdings ROSE from 57.81% to 58.95% of the total circulating supply.

History shows why this matters. On July 1, when solana traded near $146, these whales held 58.69%. They increased that position to 59.83% while Solana climbed to $205 — a gain of nearly 40%. Their decision to add again while Solana trades above $230 suggests they expect further upside.

Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

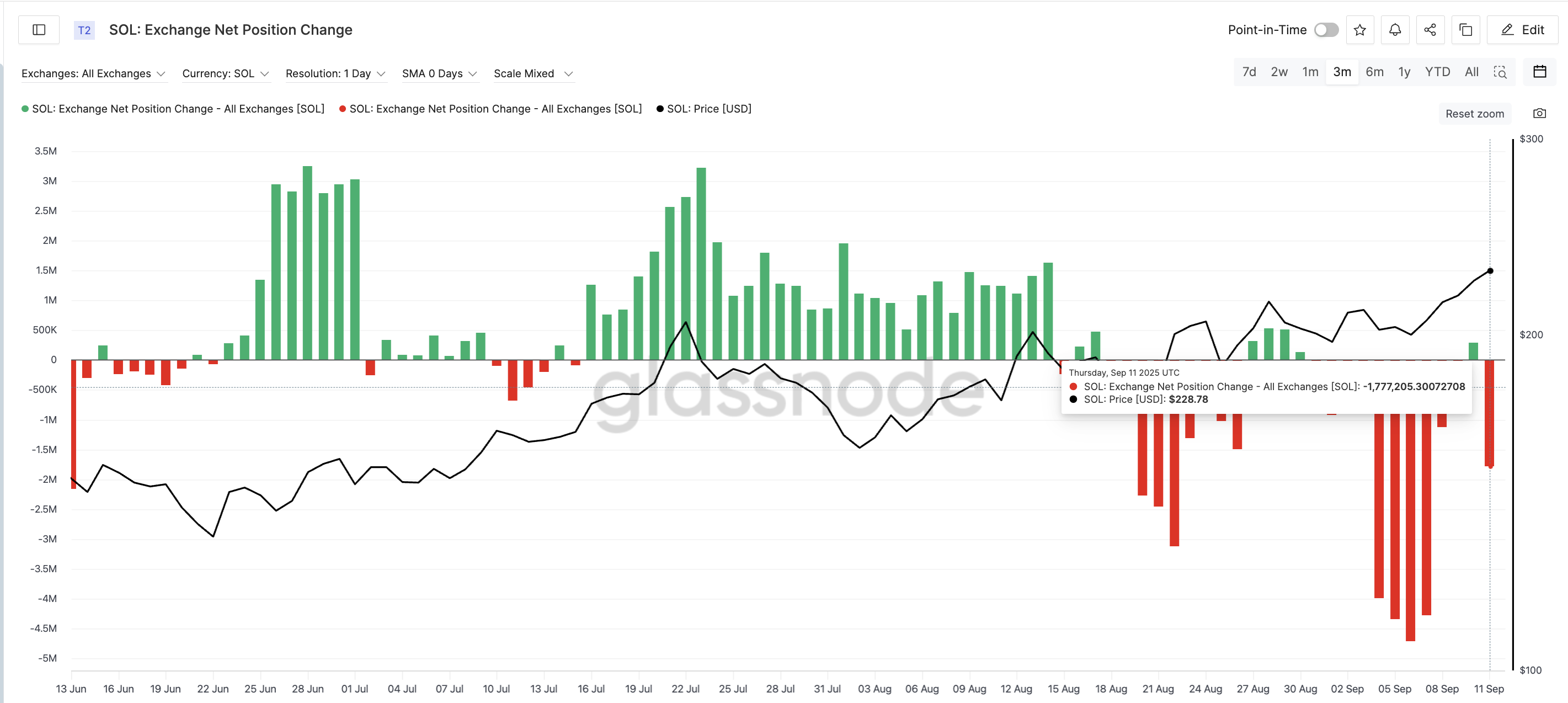

This activity is also reflected in the exchange net position change metric. On September 10, while Solana was rising, almost 291,000 SOL flowed into exchanges. Normally, such inflows signal profit-taking. However, just one day later, as Solana crossed $227 (a key level from the price chart later), the balance shifted sharply negative, indicating outflows of 1.77 million SOL.

This is unusual compared to recent weeks, where traders sold rallies quickly. The shift suggests holders are moving tokens away from exchanges, reducing immediate selling pressure. Although the three-month average of both these metrics is not yet at prior peaks, the trend is closing in; another signal that momentum could be building.

Smart Money Bets On Breakout As Key Solana Price Levels Form

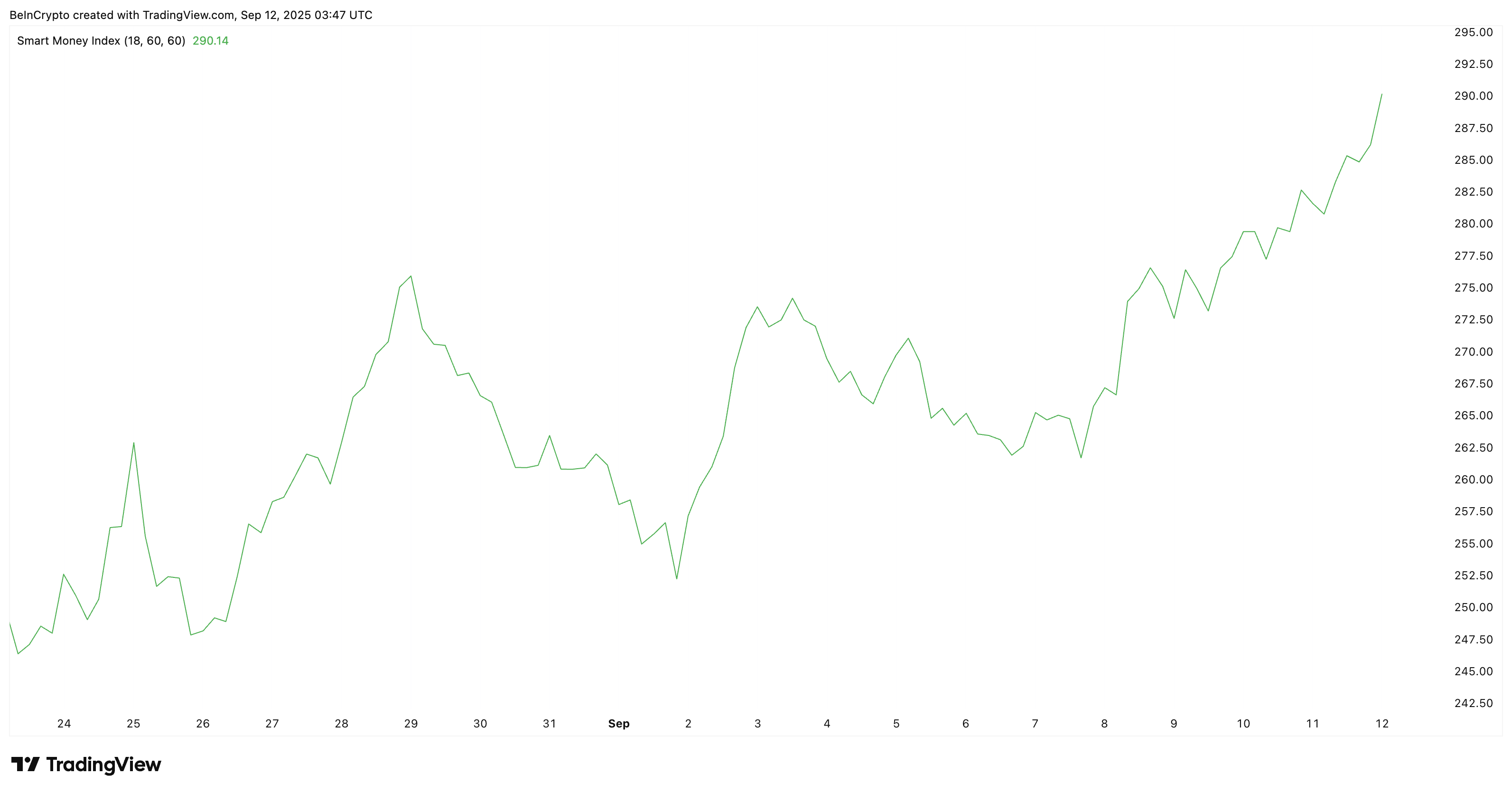

Alongside the whales, the Smart Money Index, which tracks activity from high-conviction addresses, has surged from 261.62 on September 7 to 290.14 today. These wallets often buy into strength and sell quickly into rallies. Their rising activity signals bets on a continued price surge.

On the 4-hour Solana price chart, SOL trades inside an ascending channel pattern, a formation that often breaks upward. The next test lies at the upper trendline. A clean 4-hour candle close above the upper trendline would confirm a breakout. If that happens, the measured move points to $244 as the next target for the Solana price.

Support remains layered below. Strong demand zones sit at $227 and $224, with deeper support at $211 in the near-term. A drop under that level WOULD weaken the current bullish structure.

But for now, the solana price setup looks positive, with both whales and smart money aligned on the bullish side. However, a breakout confirmation is still needed.