Dogecoin ETF Frenzy and Surging Retail Demand Fuel Massive DOGE Rally in September

Dogecoin's making Wall Street sweat—and retail investors are loading up.

The ETF Effect

Speculation around a potential Dogecoin ETF has shifted from whisper to roar. Traders are piling in, betting that institutional validation could send DOGE soaring beyond previous resistance levels. The hype isn't just hot air—retail volumes have spiked, reflecting genuine belief in the meme coin's staying power.

Retail Never Sleeps

While traditional finance debates 'fundamental value,' Main Street's bypassing the noise. Demand charts look parabolic—weekend trading activity smashed records, proving once again that when retail gets a narrative, they ride it hard. No fancy models, just pure momentum chasing.

September's Perfect Storm

Combine ETF rumors with crypto's seasonal uptick and you've got a recipe for volatility. DOGE isn't just bouncing—it's threatening to break key levels. And let's be real: since when has the market ever needed more than a good story and a few billion in social media buzz?

So here we are—another 'irrational' rally making sense only to those holding the bags. Sometimes the dumb trade works until it doesn’t. And right now? It’s working.

Retail Investors Turn to DOGE Amid Hopes for a DOGE ETF

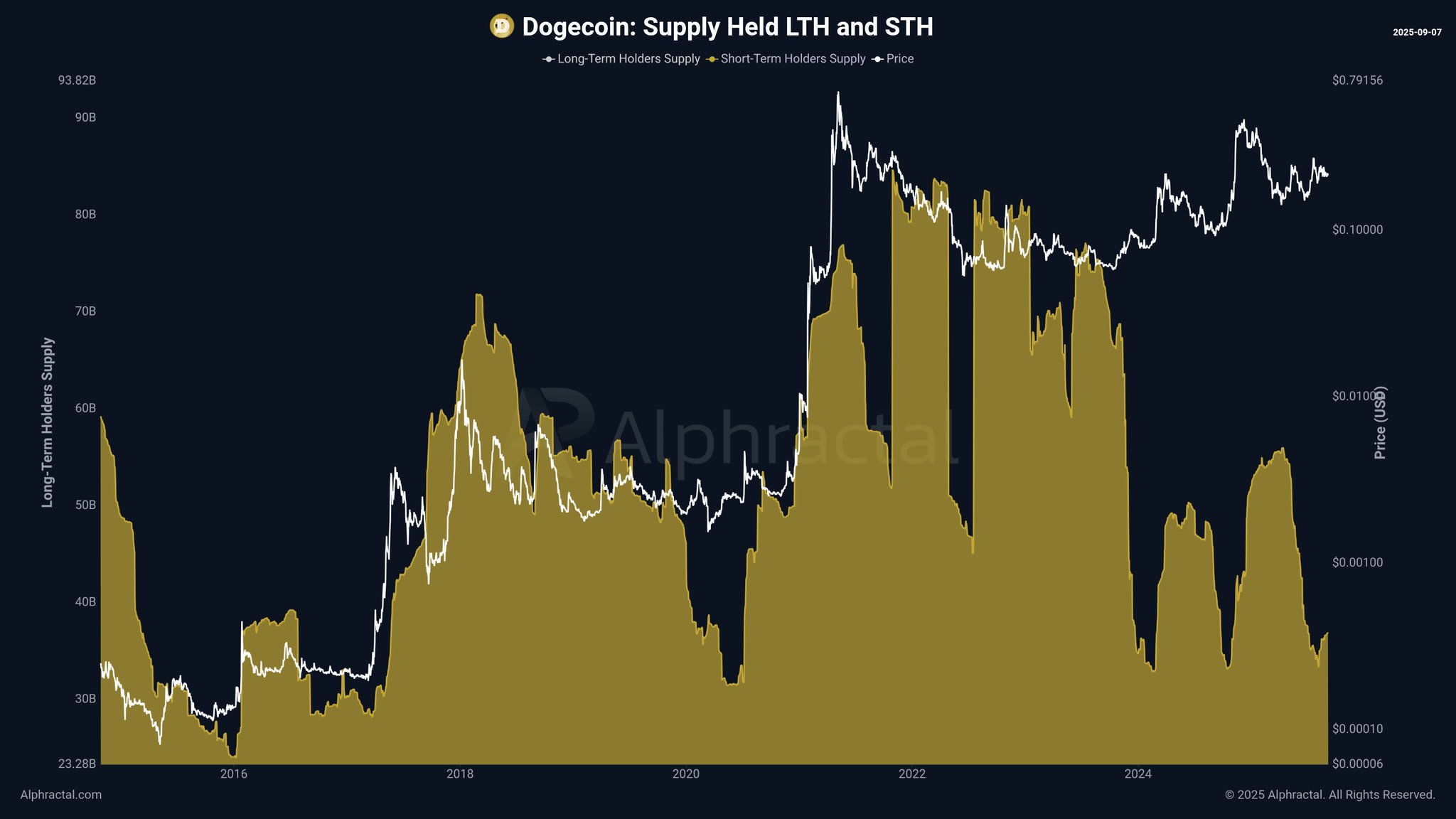

One of the most important indicators for dogecoin is the Short-Term Holder Supply (STH Supply). This metric is climbing, suggesting that short-term investors are starting to accumulate DOGE.

STH Supply measures the Doge held in wallets for less than 155 days. An increase in this metric reflects new capital from investors entering the market, often leading to higher buying pressure.

According to data from Alphractal, historical charts show that Dogecoin’s STH Supply surged during 2017 and 2021. These periods coincided with explosive bull markets, when DOGE prices multiplied.

In early September 2025, STH Supply is rising again after a period of decline. Although the trend is not yet strong, this signal suggests new capital flows into DOGE, possibly setting the stage for another price rally similar to past cycles.

“Dogecoin could rally if Short-Term Holders’ Supply continues to rise — and it looks like accumulation has already started. Historically, every time STH Supply increased, it triggered a violent Bull Market for Doge. In recent weeks, this metric has been climbing, and if the trend continues, it’s very promising for Memecoins,” Joao Wedson, founder of Alphractal, predicted.

Another key factor supporting capital inflows in September is investors’ expectations of an approved DOGE ETF.

Prediction market Polymarket shows that by September, the probability of DOGE ETF approval hit a new high of over 90% — the highest level this year.

Recently, Rex Shares and Osprey Funds announced the upcoming launch of DOJE, an ETF tracking the performance of the popular memecoin.

“DOJE will be the first ETF to deliver investors exposure to the performance of the iconic memecoin, Dogecoin (DOGE),” Rex Shares declared.

However, DOJE is not a spot ETF like the ones already approved for Bitcoin and Ethereum. Instead, it is a 40-Act ETF designed to shorten the approval process.

Meanwhile, the SEC continues to review applications for a spot Dogecoin ETF from issuers such as Grayscale, Bitwise, and 21Shares. At the same time, technical analysts highlight an expanding wedge pattern, suggesting DOGE prices could rise to $1.4 by the end of the year.