HBAR Traders Brace for $35 Million Liquidation Tsunami as Bitcoin Dominance Shakes Markets

Bitcoin's latest volatility surge sends shockwaves through altcoin markets—and HBAR holders are feeling the heat.

The Domino Effect

When Bitcoin sneezes, altcoins catch pneumonia. That old crypto adage proves brutally accurate as Bitcoin's price action triggers a cascade of leveraged positions across exchanges. HBAR traders now face a whopping $35 million liquidation threat—all thanks to Bitcoin's market-moving power.

Liquidation Mechanics Unleashed

Margin calls don't discriminate. Overleveraged HBAR positions hit critical thresholds as Bitcoin's movement drags entire markets. Exchanges automatically unwind these positions—adding sell pressure and creating a vicious cycle that amplifies losses.

Market Realities Hit Hard

Welcome to crypto—where one asset's volatility becomes everyone's problem. The $35 million liquidation risk exposes the fragile interdependence in digital asset markets. Traders chasing altcoin gains often forget Bitcoin remains the ultimate market maker.

Timing is everything—except when it's not. HBAR's correlation with broader market moves highlights the perpetual risk of trading against the crypto king. Sometimes diversification just means multiple ways to lose simultaneously.

Hedera Traders Should Be Worried

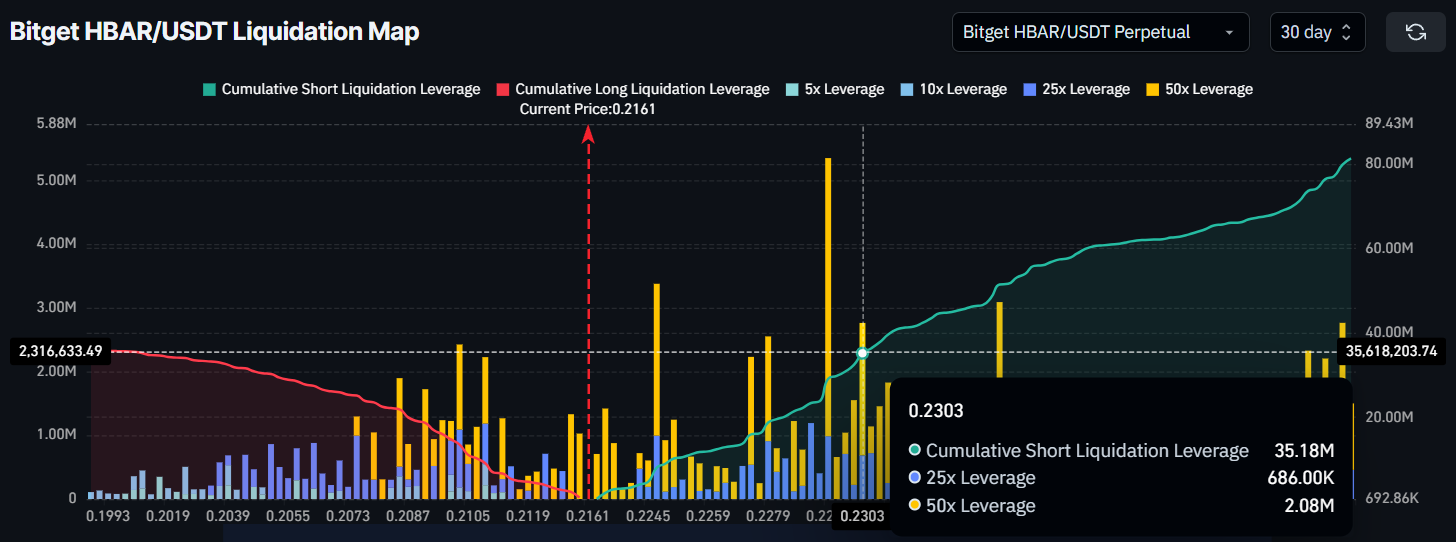

The liquidation map shows that more than $35 million in short positions could be liquidated if HBAR climbs to $0.230. Such a development WOULD create a large-scale short squeeze, potentially driving further bullish momentum across the market. This would provide an opportunity for HBAR to extend its rebound.

For traders, this means that a MOVE past $0.230 could bring heightened volatility. While liquidations would add fuel to upward momentum, they also represent a critical price zone.

A successful push through this level could increase capital inflows as bullish investors attempt to capture the upside.

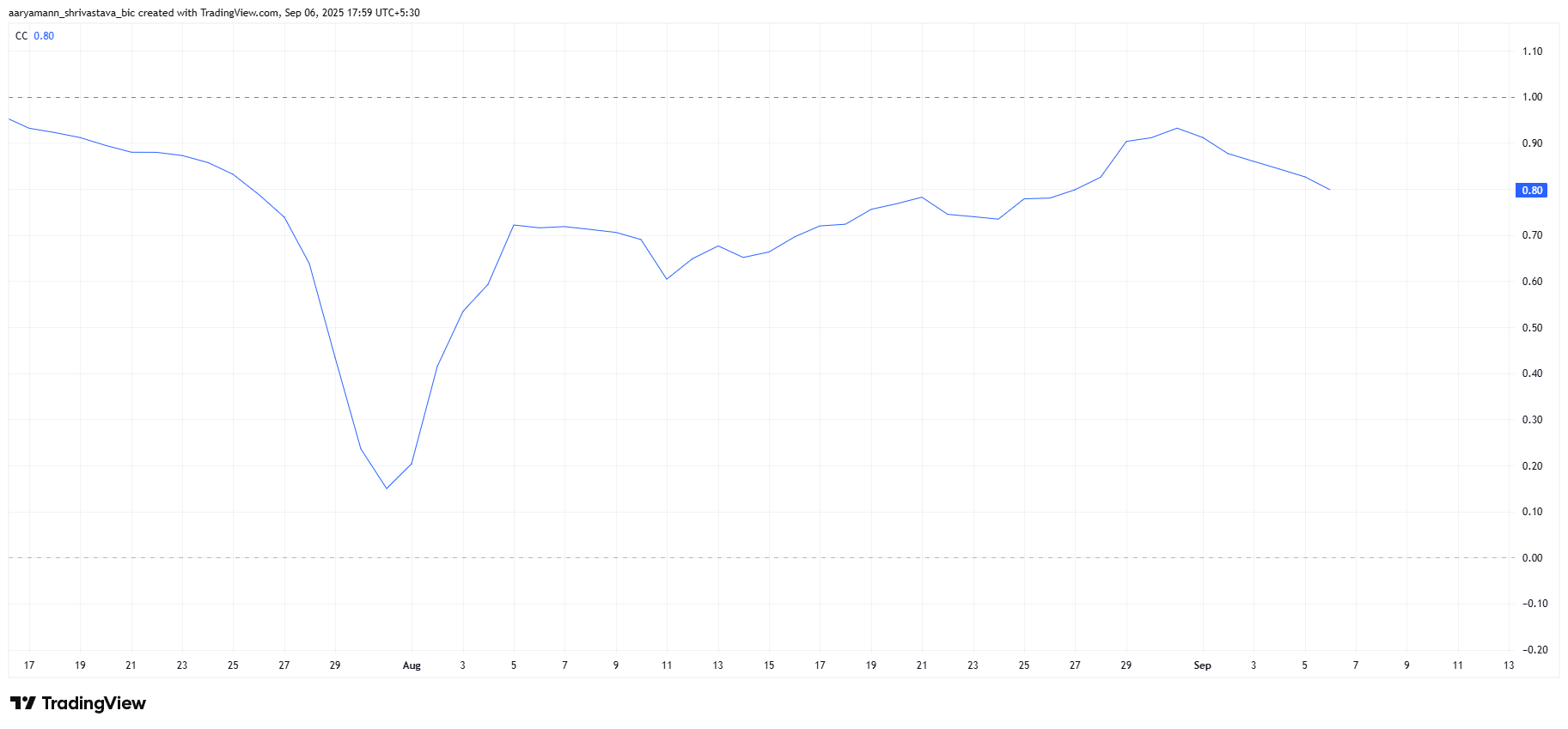

On a broader scale, Hedera’s trajectory is closely tied to Bitcoin. The altcoin shares a 0.80 correlation with BTC, indicating a strong price relationship.

As long as Bitcoin maintains support above $110,000, HBAR’s price is likely to benefit from positive spillover effects.

This correlation gives HBAR some cushion against downside risk. With bitcoin stabilizing in the six-figure range, Hedera could leverage this momentum to test higher resistance zones. The BTC trend will play a crucial role in determining whether HBAR sustains recovery or remains rangebound.

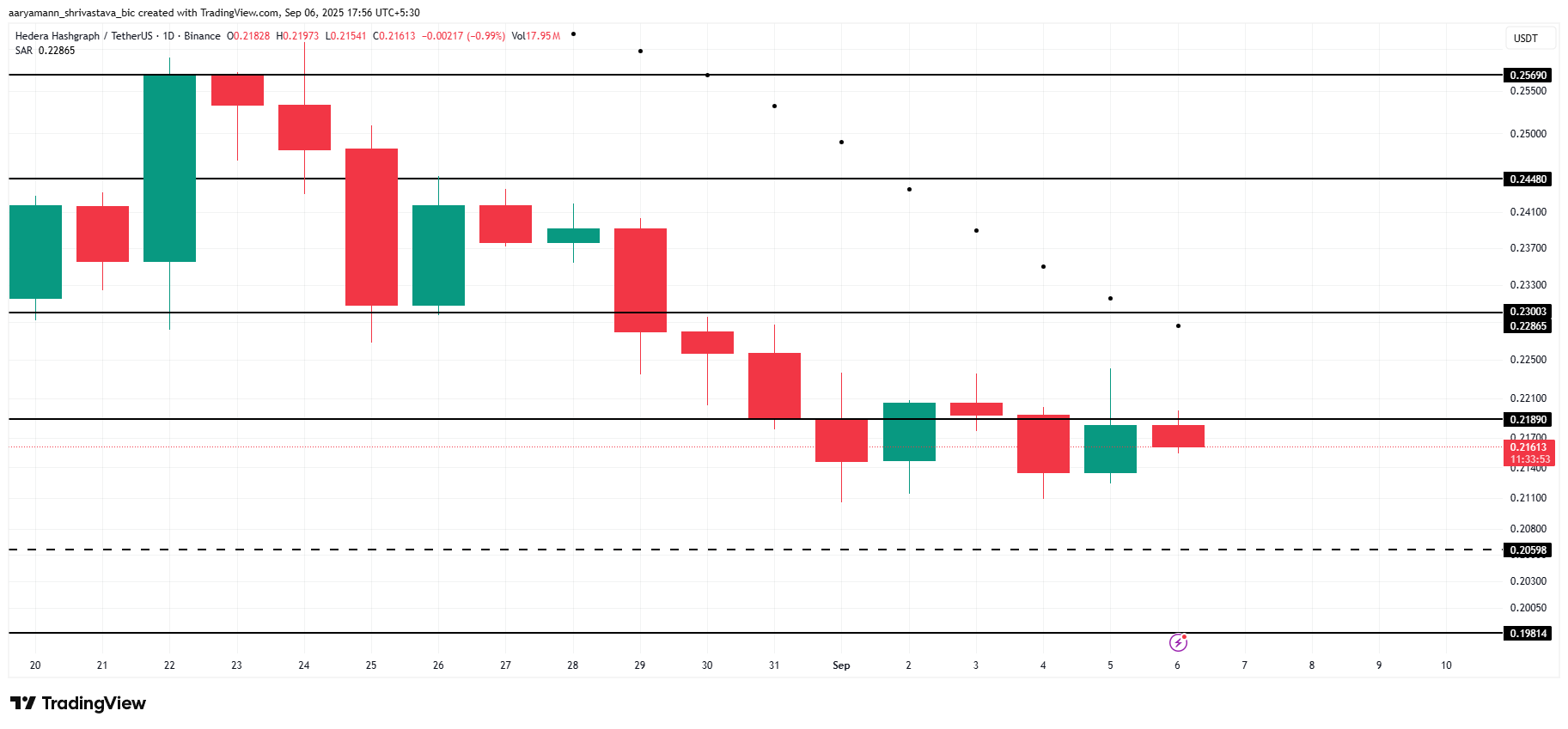

HBAR Price Is Facing Resistance

HBAR is trading at $0.216, sitting just below the $0.218 resistance level. This barrier has proven difficult to breach in recent days, but a breakout could allow HBAR to build momentum toward higher targets.

The next key resistance lies at $0.230. If HBAR manages to reach this level, the liquidation of short positions worth over $35 million could occur. This short squeeze scenario has the potential to drive the altcoin higher, pushing it toward $0.244.

However, if bullish momentum stalls, HBAR may consolidate within the $0.218 to $0.205 range. This sideways movement would invalidate the immediate bullish outlook and delay the potential breakout, leaving HBAR vulnerable to further stagnation.