Ethereum Exodus: Long-Term Holders Dump Holdings - Is a Price Collapse Imminent?

Ethereum's bedrock investors are cashing out—big time. The very holders who weathered every crash and celebrated every peak are now offloading their stacks. Market tremors ahead?

The Great Unloading

Long-term ETH holders—the so-called 'diamond hands'—are executing massive sell orders. These aren't weak hands panicking; these are veterans taking profits after years of accumulation. Their movement signals a potential shift in market structure.

Price Pressure Cooker

When foundational holders exit, it creates sustained downward pressure. New buyers must absorb these volumes—and they might not have the appetite or capital to swallow billions in sell orders without price concessions.

Market Psychology Shift

This isn't just about supply dynamics. When the most committed participants exit, it rattles market sentiment. Other investors watch these moves closely—and may follow suit if they sense diminishing conviction among Ethereum's staunchest allies.

Institutional vs. Retail Dynamics

Some speculate this selling represents early whales making room for incoming institutional money—the classic 'old money out, new money in' rotation that Wall Street loves to orchestrate with someone else's assets.

The silver lining? Ethereum's network fundamentals remain robust despite the selling pressure. But when your strongest hands start folding, even the bull case needs a reality check—because in crypto, everyone's a long-term holder until the profit-taking urge hits.

Key Ethereum Holders Sell

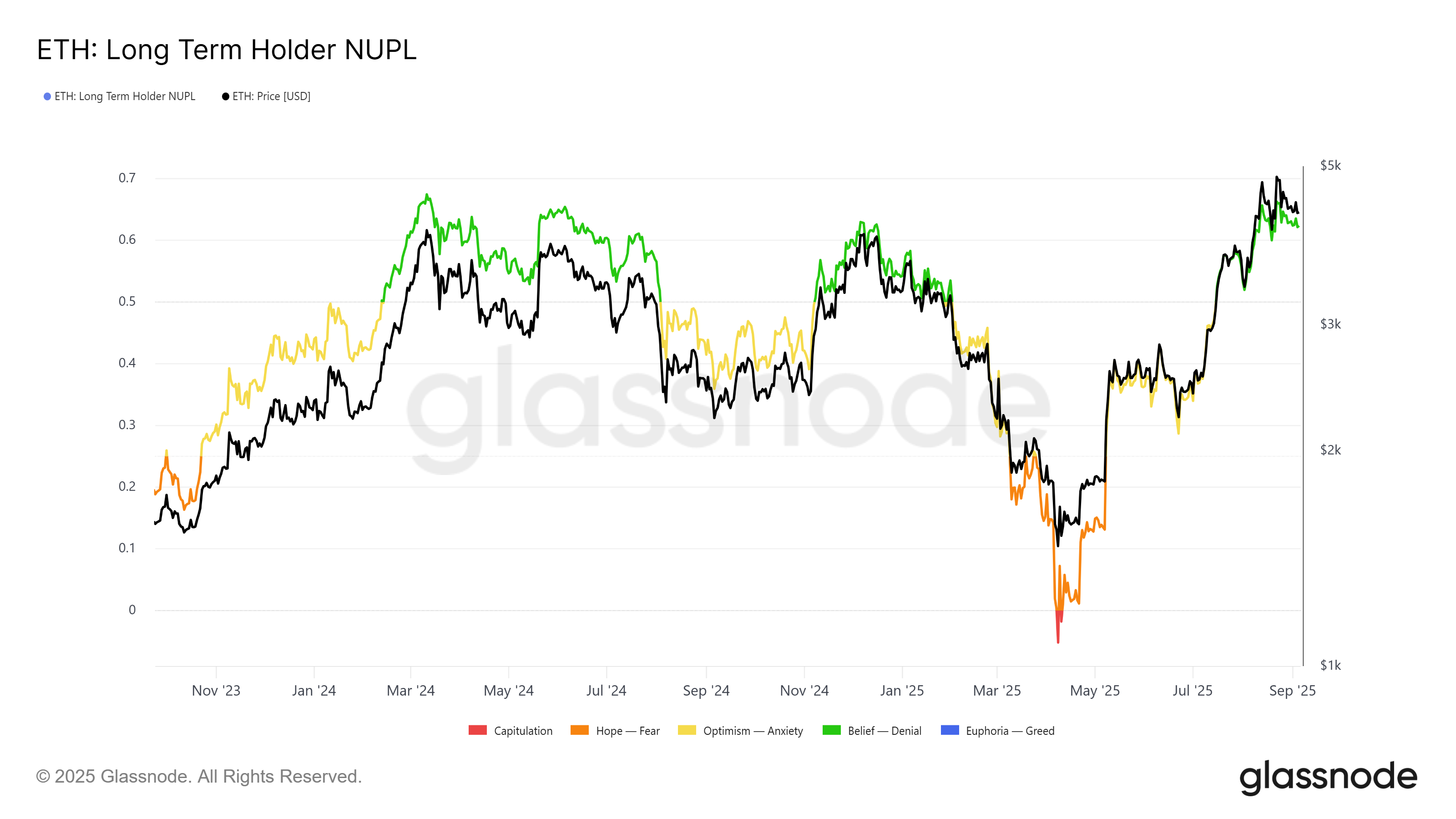

The LTH Net Unrealized Profit and Loss (NUPL) metric reveals that each time the indicator crosses the 0.65 mark, Ethereum’s price struggles.

This is because profit levels reach a saturation point where seasoned investors prefer to sell rather than hold, resulting in price stagnation or corrections.

Currently, ethereum reflects the same behavior as its past cycles. With LTHs realizing substantial profits, the sell-off is undermining ETH’s upward trajectory. Buyers hesitate to absorb the selling pressure, leaving ETH vulnerable to extended consolidation.

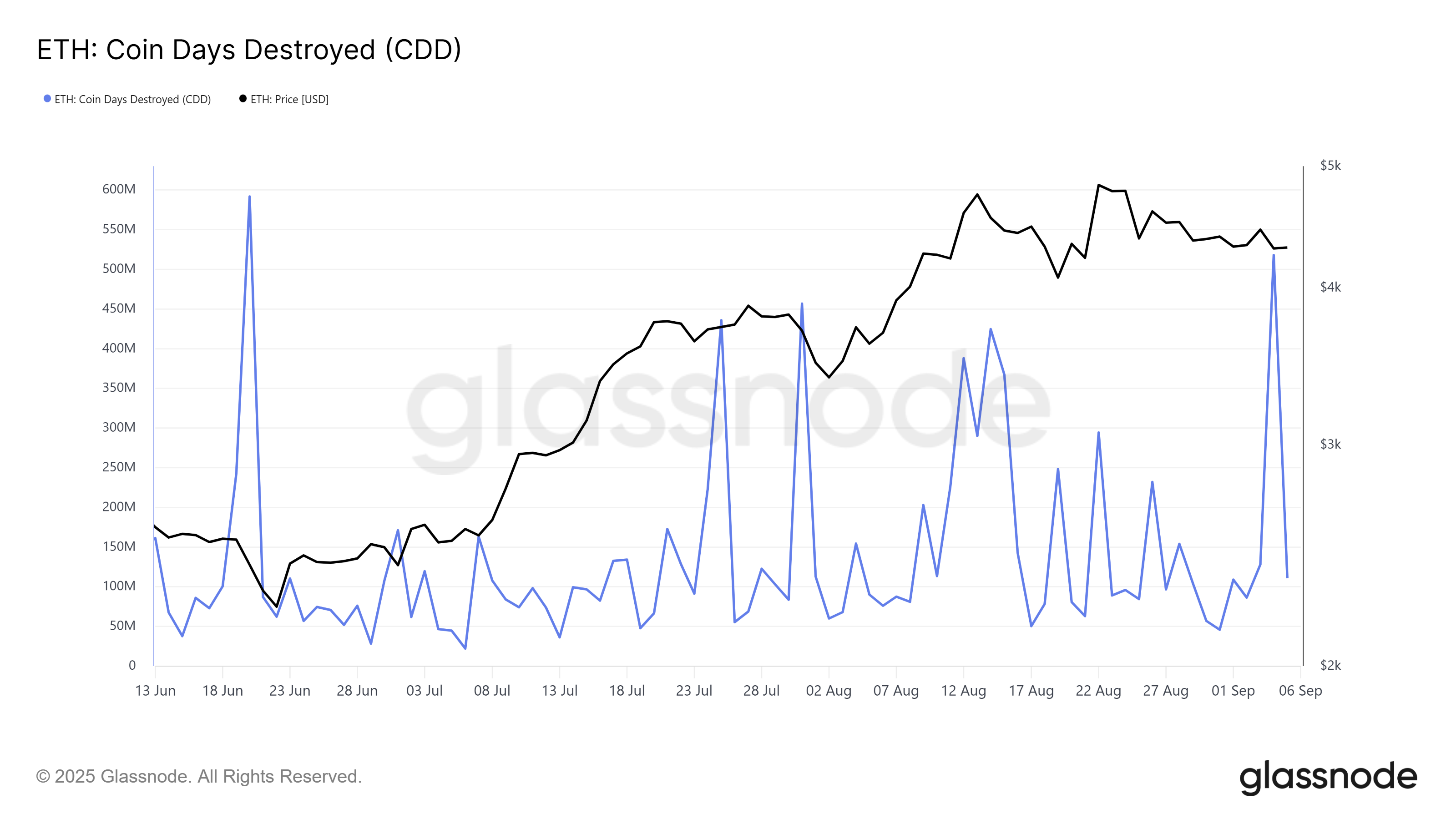

The Coin Days Destroyed (CDD) metric supports this trend, showing LTHs are actively liquidating holdings. In the past 24 hours, CDD registered its sharpest spike in two months, highlighting increased selling.

Such activity often signals further downside risk. LTH selling at elevated levels indicates a lack of confidence in immediate recovery. Unless offset by strong inflows from other investor groups, ETH’s macro momentum suggests a cooling period.

ETH Price To Remain Stagnant

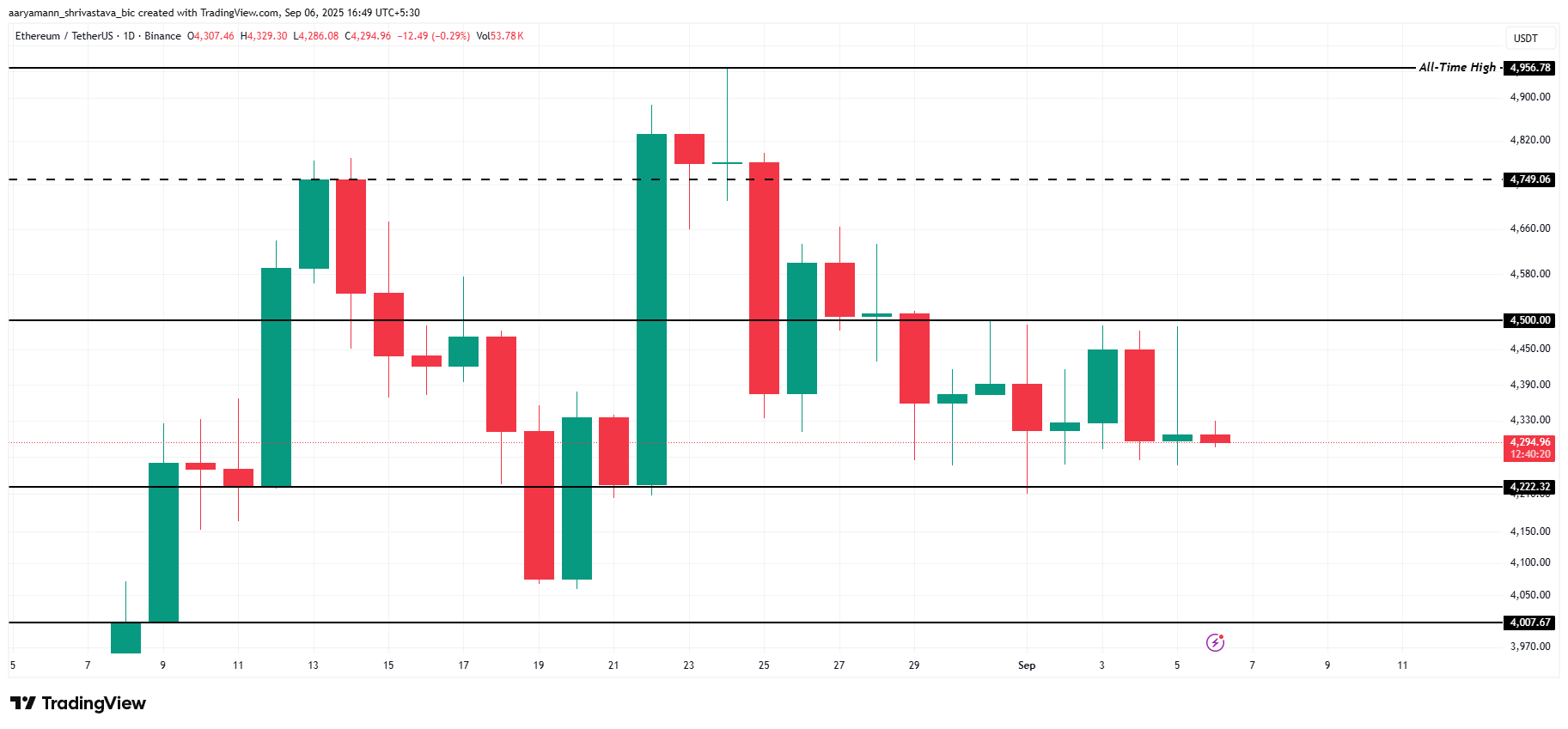

Ethereum’s price is currently at $4,294, holding above the $4,222 support level. The challenge remains ETH’s repeated failure to breach $4,500 over the past few days, a ceiling that now acts as a critical resistance barrier for the altcoin king.

This suggests ETH may remain rangebound in the NEAR term. With LTHs booking profits, upside potential is capped, leaving ETH oscillating between $4,222 and $4,500 until market conditions improve or demand absorbs the ongoing sell pressure.

If other investors step in to buy ETH offloaded by LTHs, recovery could still materialize. A successful breach and flip of $4,500 into support WOULD open the path for ETH to retest $4,749.

This would mark a potential resumption of its broader bullish trajectory.