Binance’s BTC Futures Hit Record Highs: Is a Price Rebound Imminent?

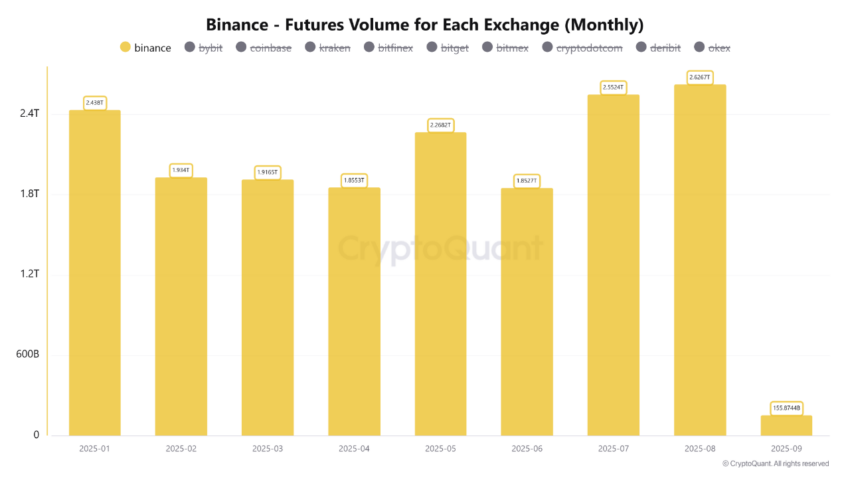

Binance's Bitcoin futures just shattered all previous records—trading volumes exploding as institutional money floods back into crypto markets.

The Volume Surge That's Shaking Markets

Massive open interest and unprecedented trading activity suggest whales are positioning for what comes next. When derivatives markets move this aggressively, spot prices typically follow.

Timing the Bitcoin Bounce

Historical patterns show futures volume spikes often precede major price movements. This isn't retail FOMO—this is smart money building positions while mainstream media still obsesses over regulatory noise.

Will history repeat? The charts scream bullish, but then again, Wall Street's 'experts' still think Bitcoin's just for buying drugs online.

Is This a Sign of Institutional Comeback?

The return of hedge funds and institutional investors may be a key factor driving this growth. Arab Chain noted that “data shows rising institutional activity across both long and short positions on Binance, especially following a period of relative stabilization in ETF momentum.”

The analyst also highlighted that “open interest reached elevated levels alongside the trading volume spike, indicating that the increase was driven not just by liquidations, but by the buildup of new positions.” This suggests many new participants are entering the market rather than simply closing out existing positions.

While the numbers are impressive, not everyone sees this as a guaranteed bull run. Arab Chain also warned that such high momentum often precedes a market correction. “For sustained futures momentum, support from spot markets and cash flows—particularly from stablecoins and reserves—is critical,” he stated.

The analyst’s caution reminds the industry that the derivatives-led rally could quickly lose steam without fresh liquidity. A lack of strong cash inflows could result in a sharp correction if open positions aren’t supported.

However, recent data on stablecoins shows promise. The global stablecoin market cap, which was at $276.2 billion on August 1, grew by approximately 7.38% over the month. This growth has continued into September, rising another 0.65% to reach $298 billion at the time of writing. If this trend holds, a derivatives-fueled rally could be on the horizon.