$250M TON Buyback Bombshell: Is This The Breakout Catalyst?

TON just dropped a quarter-billion dollar mic—and the market's listening.

The Signal That Shook Crypto

A staggering $250 million buyback program launches today, sending shockwaves through Telegram's native token ecosystem. This isn't just corporate maneuvering—it's a strategic nuclear option against market skepticism.

Supply Shock Mechanics

Massive token removal from circulating supply creates artificial scarcity. Basic economics: reduced availability plus sustained demand equals upward pressure. Previous buybacks across crypto have triggered 20-40% pumps within weeks—TON's scale dwarfs most historical precedents.

The Institutional Wink

Smart money watches these moves closely. A buyback of this magnitude signals fundamental confidence from insiders who see current prices as outright steals. Meanwhile, traditional finance still argues about dividend yields—how quaint.

Breakout Territory Ahead?

Technical indicators suggest TON's been consolidating for explosive movement. This announcement could be the catalyst that finally shatters resistance levels. Market sentiment shifted from cautious to greed within hours of the news.

Remember: buybacks boost prices until they don't. Sometimes it's confidence—sometimes it's just expensive perfume on fading fundamentals.

Institutional Push

Toncoin has drawn attention with a series of institutional-level moves. The official announcement of TON Strategy’s $250 million buyback program signals capital growth expectations and proactive capital management, while not all buyback programs help increase token prices.

At the same time, AlphaTON Capital recently launched a digital asset treasury strategy focusing on the Telegram ecosystem. The company is expected to initially accumulate around $100 million worth of TON, creating an additional institutional demand channel and expanding TON’s potential for storage and utility.

Previously, Verb Technology held over $780 million in TON assets, marking a strategic shift toward Toncoin as its primary reserve asset.

TON at a Critical Juncture

On the market side, Toncoin is trading around the $3.1–$3.4 range, well below its recent short-term peak. Typically, the emergence of treasury funds and buyback programs helps reduce circulating supply and enhance holding sentiment, which could support a potential rally if substantial trading volumes confirm it.

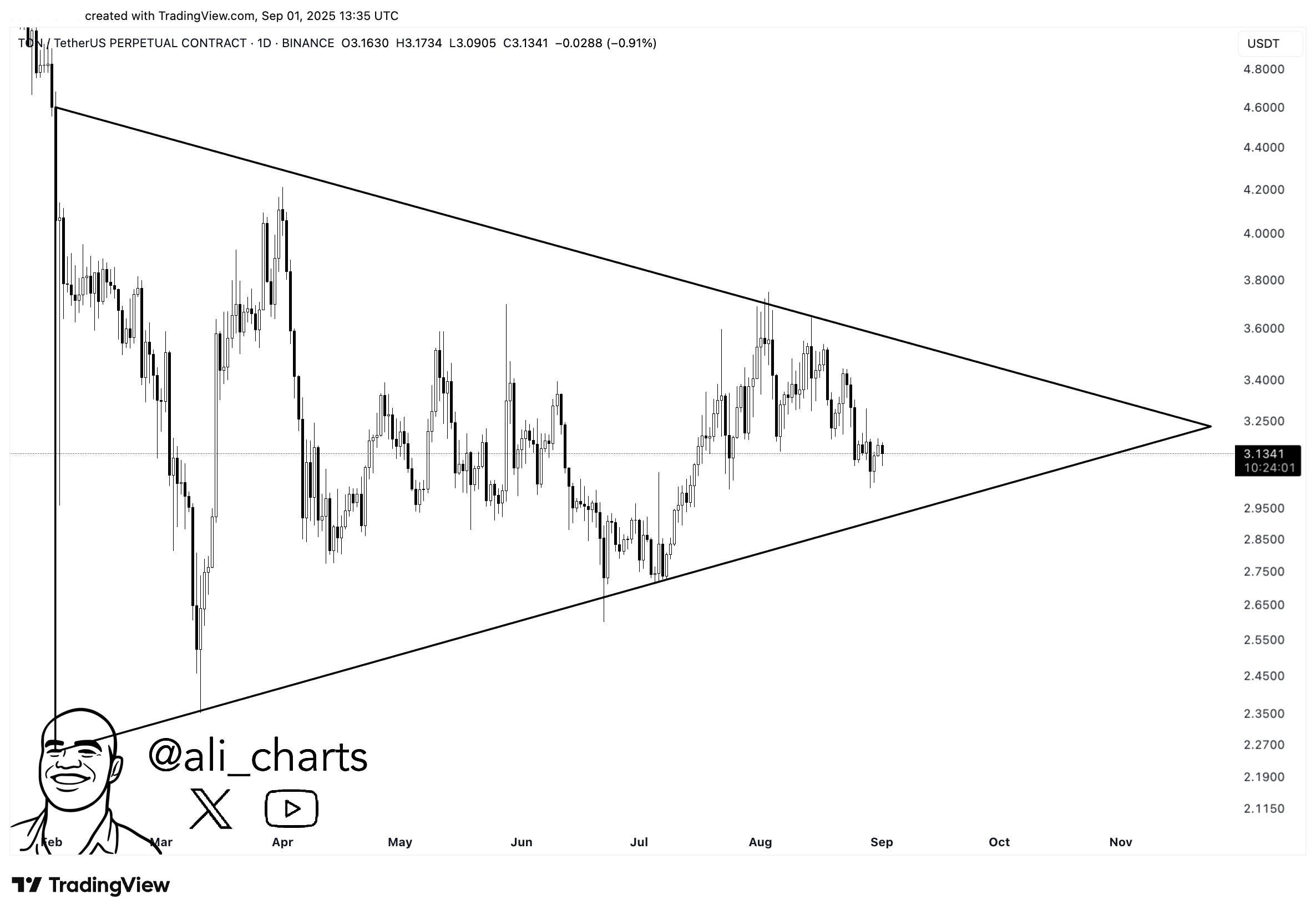

From a technical perspective, several analyses show that TON consolidates within a triangle pattern, often a precursor to major price movements. Analyst Ali notes that if a decisive breakout occurs, the price could swing as much as 50%.

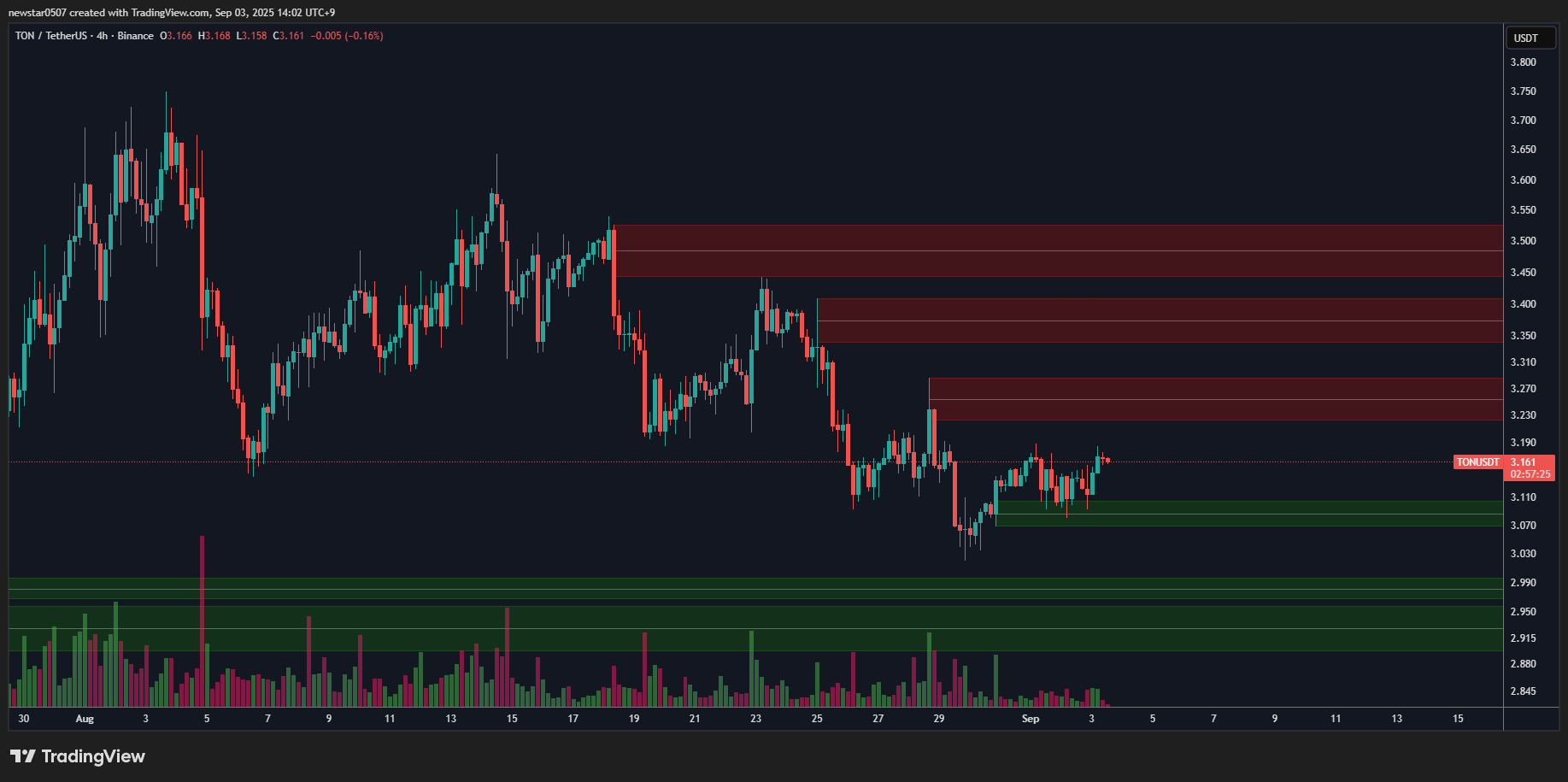

However, in shorter timeframes, the market faces large “sell walls.” Before reaching $3.525, TON must break through three more sell walls, which could act as near-term resistance to its upward momentum.

In the short term, supply-demand dynamics are evident: TON has been repeatedly rejected around the $3.4–$3.45 zone, widely viewed as a strong supply block. Without sufficient buying pressure, the price could retest the $3.00–$3.27 levels before choosing its next direction. In a less optimistic scenario, TON might even retrace toward $2.68.

“Market structure shows EQL formed, which often acts as liquidity magnets. A clean sweep here could fuel a MOVE back up into the imbalance zone,” one X user noted.