Wisdom of Crowds: Why Prediction Markets Still Shine in Dark-Side Risks

Prediction markets cut through the noise—turning collective intelligence into actionable foresight when traditional models falter.

How The Crowd Sees What Experts Miss

While Wall Street analysts chase lagging indicators, prediction markets harness real-time sentiment. They bypass bureaucratic delays and capture emerging risks faster than any risk committee ever could.

Dark-Side Risks: Where Wisdom Thrives

From geopolitical shocks to black swan events, these markets thrive on uncertainty. Participants bet on outcomes—not opinions—forcing honesty where conventional analysis often fails.

Finance’s Open Secret

Let’s be real: most risk models are just fancy spreadsheets dressed in suits. Prediction markets? They’re the uninvited truth-tellers at capitalism’s dinner party.

Bottom line: When the lights go out, the crowd’s wisdom doesn’t just shine—it becomes the only flashlight that works.

When Prediction Markets Become “An Asset Class”

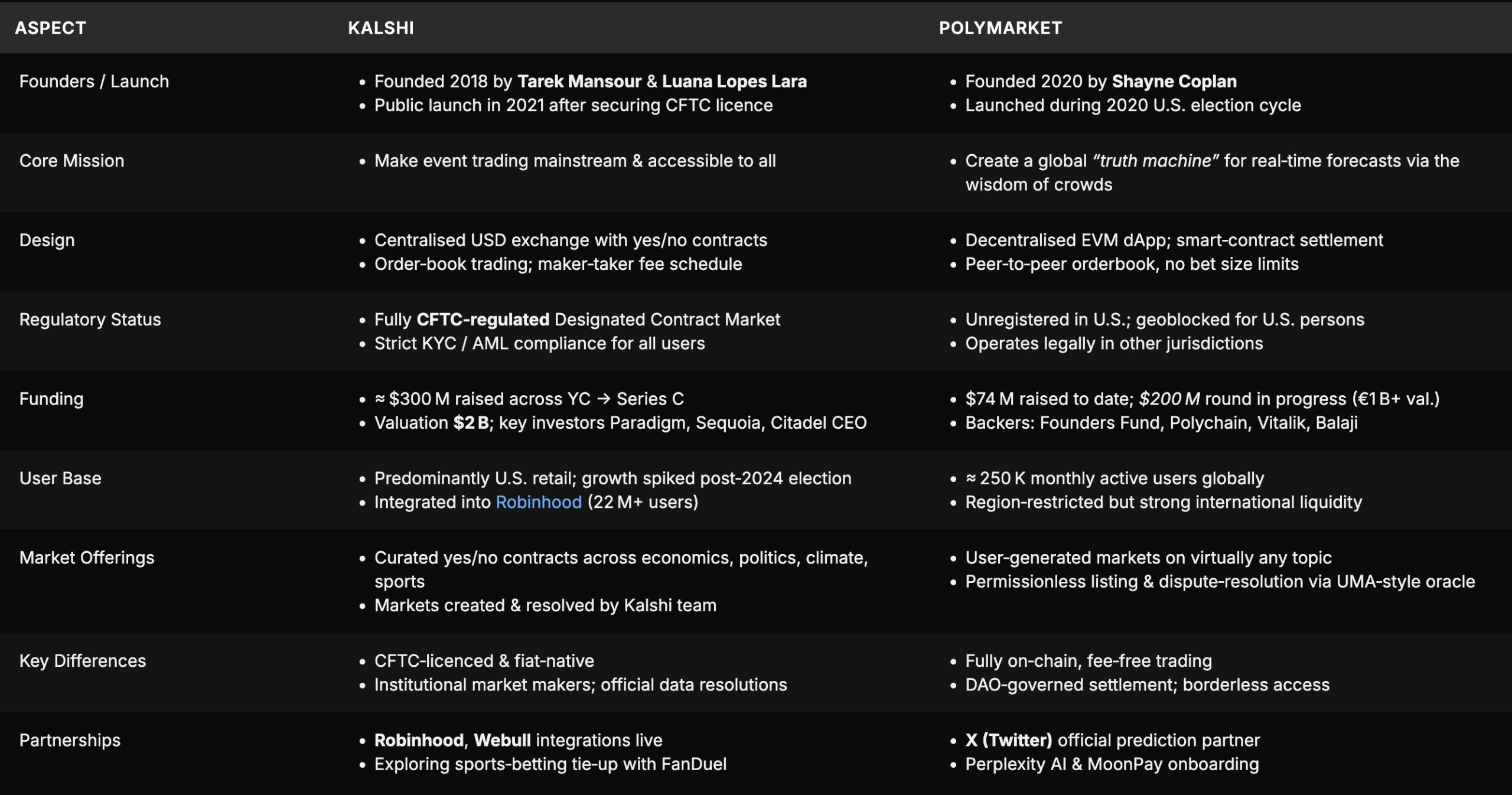

Prediction markets are emerging as forecasting tools and a new asset class within the crypto ecosystem. Platforms and venture funds are beginning to bet on commoditizing information and probabilities.

This has triggered a “prediction market war,” with massive fundraising rounds, backing from top venture capital firms, and expansion into new use cases — all fueling competition. It shows how the market is shifting from “news” to “odds” as a source of value.

Investors increasingly view prediction markets as a strategic asset class, not just entertainment or research products. While this competition accelerates innovation, it also introduces systemic risks if the business models are not yet sustainable.

Many community members call this the “next big wave” of the current cycle. They argue that the next generation of users won’t read headlines anymore but will “check the odds.”

In theory, prediction markets work well because they aggregate scattered information from many participants and turn it into a number representing collective wisdom — sometimes even more accurate than expert forecasts. This explains why protocols and projects focused on prediction highlight the “wisdom of crowds” advantage in pricing event probabilities.

On the other hand, this advantage only materializes when the market has enough liquidity, transparency, and protection from manipulation by significant capital.

The Dark Side

On the practical side, prediction markets have been tested across various contexts — from resolving launchpad wars on certain chains to pricing economic events, sports, and on-chain governance. These examples highlight their high applicability and raise concerns about dispute resolution mechanisms, potential oracle errors, and administrative costs when transaction volumes surge. Without proper frameworks, “settling results” could become a significant bottleneck.

The dark side of prediction markets should not be overlooked: risks of market manipulation by larger capital, front-running information, wash trading to distort odds, and even being exploited for money laundering or obfuscating transactions. These warnings have grown louder as the sector expands rapidly; without robust oversight and transparency, the so-called “supercycle” of prediction markets may lead to a faster erosion of trust rather than creating real value.

Moreover, regulatory acceptance remains a critical factor for the future of this space. Whether authorities classify prediction markets as legitimate financial instruments or gambling will directly affect retail adoption.

“The entire sector depends on whether regulators treat prediction markets as legitimate financial instruments or gambling, and whether institutional traders or retail speculators drive adoption.” an X user noted.