Experts Predict Ethereum To Dominate The Explosive New Stablecoin Economy

Ethereum's poised to capture the lion's share of the booming stablecoin market—and traditional finance isn't happy about it.

The Infrastructure Advantage

Ethereum's established ecosystem gives it a massive head start. Major stablecoin issuers already built on its network—they're not moving. Developers keep choosing Ethereum-first for new projects. Liquidity naturally consolidates where it already exists.

The Regulatory Tailwind

Clearer regulations actually benefit Ethereum. Compliance frameworks favor established, transparent blockchains over newer, untested ones. Institutions feel safer deploying capital on a network with proven security and widespread adoption.

The Network Effect Flywheel

More stablecoins attract more users. More users attract more applications. More applications lock in Ethereum's dominance. It's a self-reinforcing cycle that's incredibly difficult to break—even for well-funded competitors.

Traditional finance finally understands blockchain's potential—right as Ethereum positions itself to eat their lunch. They'll still take their usual cut for 'managing' the assets, of course.

Ethereum’s Market Dominance

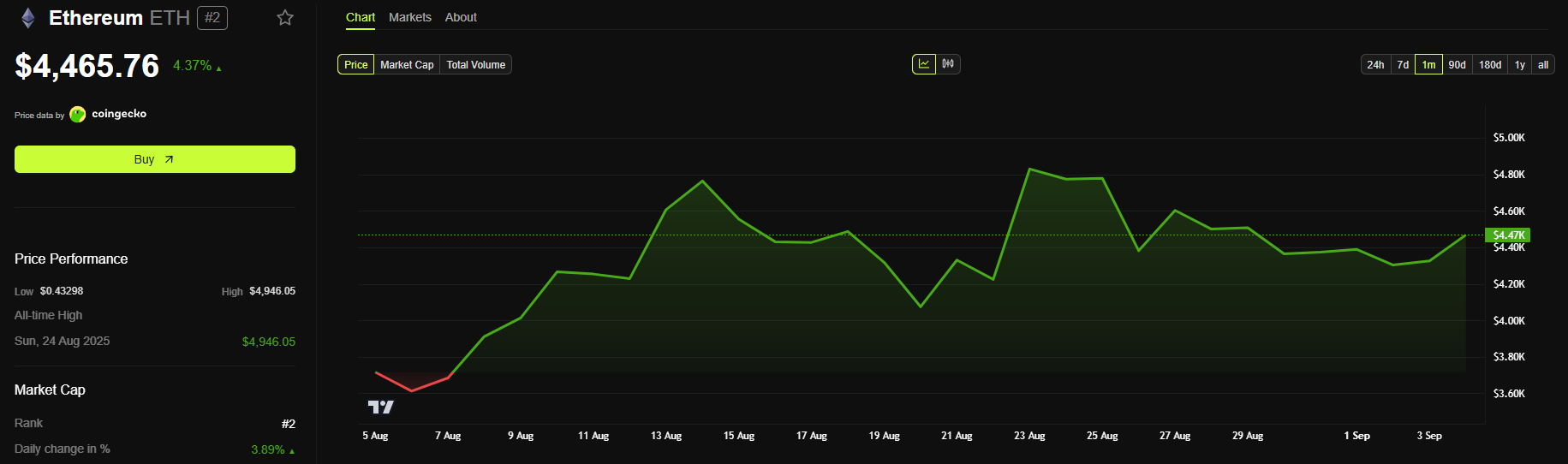

When US President Donald Trump signed the GENIUS Act into law last month, it triggered a significant price rally across the cryptocurrency market.

However, Ethereum’s performance was unmatched. It experienced the most positive and sustained effect, surpassing any competitor in the immediate aftermath.

In the days before the bill’s passage, Ethereum’s price surged, climbing more than 20% and surpassing the $3,500 mark. The momentum continued even after the bill was signed, with the network’s value peaking at $3,875 the following week.

At the time of writing, its price rests at $4,465.

This powerful market reaction reinforced investors’ confidence in Ethereum’s ability to capitalize on a new regulatory environment.

The GENIUS Act has effectively removed major hurdles, paving the way for wider stablecoin adoption and easier global access to the US dollar, and investors are betting on Ethereum to lead the way.

Will the GENIUS Act Make Ethereum a Financial Anchor?

Stablecoins are set to become a central component of the global financial system, serving as a mainstream dollar rail for various transactions, from savings and payroll to cross-border payments.

The regulatory clarity provided by the GENIUS Act is the key to unlocking this widespread adoption, enabling regulated institutions to issue and utilize stablecoins confidently.

![]() Ethereum is ripping and the GENIUS Act might be a big reason why.

Ethereum is ripping and the GENIUS Act might be a big reason why.

Here’s what’s driving $ETH (and why I think it’s just getting started):

Speculators seem to be front-running the narrative already (let’s be honest, many were likely positioning weeks ago), betting that… pic.twitter.com/gGJxIBEOVi

According to Shah, this transition will establish a new, open financial infrastructure, with Ethereum acting as an anchor.

“Regulated issuance will unlock distribution through banks and fintechs. Ethereum may anchor the open, global side of that system, with L2s handling high-throughput activity and L1 providing security and finality. ETH the asset may serve as the neutral, productive reserve collateral that underpins lending and other services across the finance stack,” he told BeInCrypto.

Since Ethereum already hosts most stablecoin liquidity, it will capture the lion’s share of this increased activity.

Why Ethereum Is Positioned to Lead

Ethereum’s existing stronghold is built on three key properties crucial for global, institutional adoption: global accessibility, safety for institutions, and resistance to government interference.

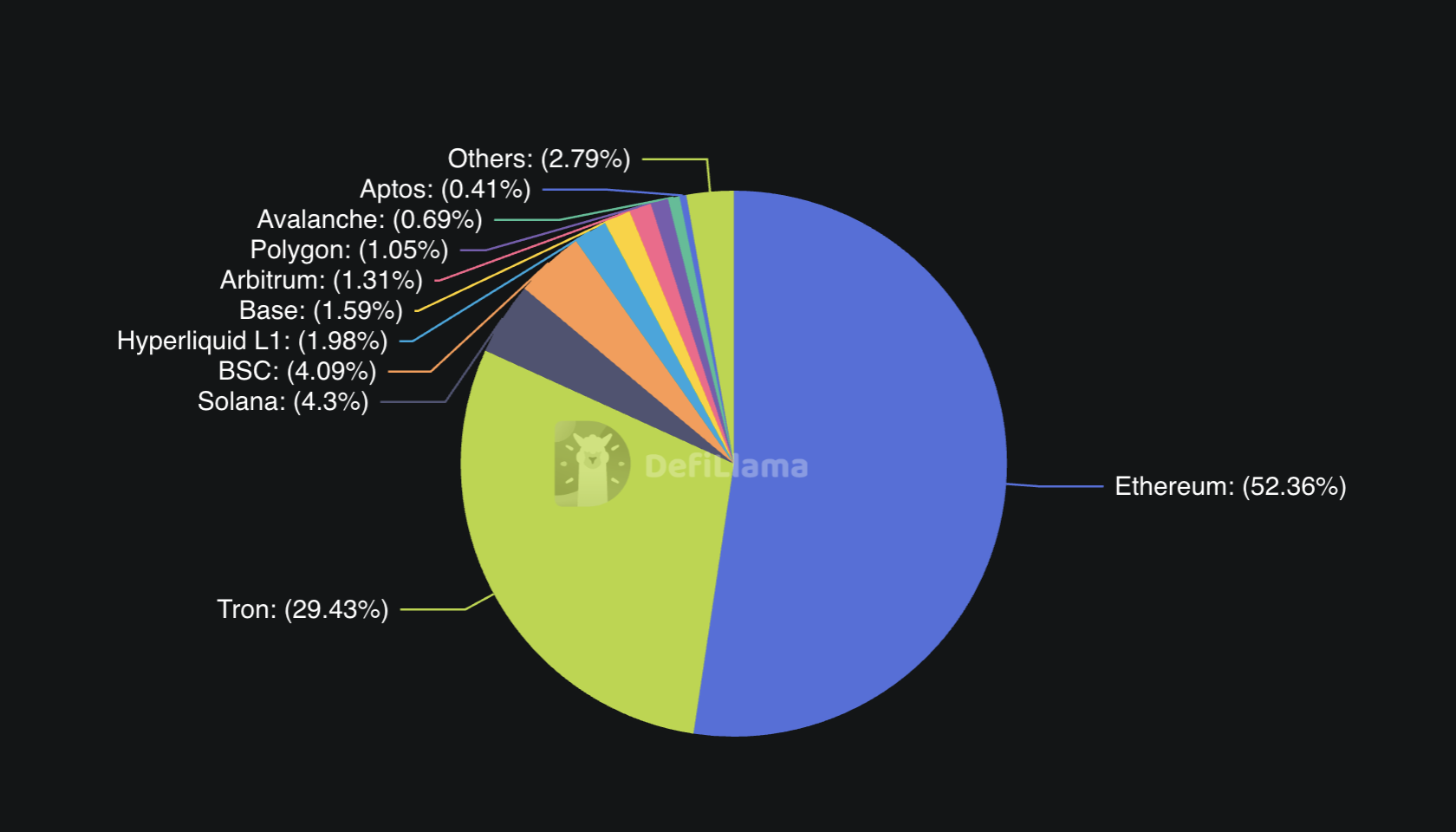

The legislation’s focus on compliance and security reinforces these qualities, drawing more participants into the network’s orbit. As is, Ethereum already commands the market.

According to recent data from DefiLlama, Ethereum is responsible for over 52% of the $278 billion stablecoin market capitalization.

“Ethereum may gain disproportionately from the GENIUS Act because it already dominates the parts of the crypto economy that the Act is likely to accelerate [like] USD-backed stablecoins and the financial services that grow around them,” Shah said.

He further reinforced this point by saying that the growth will naturally drift toward the established leader:

“Since Ethereum already hosts the majority of stablecoin issuance and liquidity, much of that growth may FLOW to its ecosystem, reinforcing the lead it already has.”

However, the incoming wave of stablecoin demand will inevitably place greater pressure on networks to process transactions effectively. This reality presents a significant challenge for Ethereum given its history of scalability issues.

According to Shah, it can easily rise to the occasion.

L2s: Addressing the Scalability Issue

Ethereum’s scalability issues have been a well-known concern in the crypto industry. Its mainnet has traditionally been limited to processing a small number of transactions per second, often leading to network congestion and elevated transaction fees during periods of high demand.

As the GENIUS Act goes into effect, the anticipated boom in stablecoin use will place unprecedented pressure on the network’s capacity.

According to public statements from Vitalik Buterin and the Ethereum Foundation, the network’s long-term answer to end a track record of scalability challenges lies in LAYER 2 solutions (L2s).

These L2s process the bulk of consumer and institutional stablecoin transactions in a highly efficient, low-cost manner. This approach ensures that the network can handle mass adoption without compromising on its Core principles of decentralization and security.

The Ethereum mainnet (L1) will serve a different but equally critical role as the secure settlement layer, handling the finality of transactions processed on the L2s.

According to Shah, this synergy is what makes the scaling solution viable.

“The bulk of consumer and institutional stablecoin throughput is designed to live on Ethereum L2s (e.g., Base, Optimism, Arbitrum), with L1 acting as the settlement and security layer, so scale comes from rollups while preserving Ethereum’s trust guarantees,” he said.

He also noted the flexibility and benefits this system offers to institutions:

“Today’s rollup architecture is built for high-volume, low-cost payments and financial apps, and it lets institutions choose the right trade-offs (throughput, fees, compliance features) without leaving Ethereum’s security umbrella.”

Despite the rise of competing blockchains, Ethereum’s dominance can remain firm in light of this enhanced infrastructure.

What Needs to Happen to Unseat Ethereum?

While rival blockchains like solana and Tron have made inroads in the stablecoin market, their challenge to Ethereum’s dominance is unlikely to succeed in the long term.

A network’s long-term success in finance depends on its foundational qualities. Decentralization and security create a virtuous cycle that attracts capital and talent. Ethereum’s proven security record and decentralized nature foster an environment of institutional trust, which draws in large pools of capital, creating DEEP liquidity.

This rich ecosystem attracts developers to build applications and financial services on the platform. Shah argues that these CORE factors make Ethereum’s position difficult to challenge.

“Speed and cost are also important factors, but without the same decentralization, security history, and institutional customization options, it may be hard to dislodge Ethereum’s lead in finance.”

This reality presents a compelling case for why regulated institutions may feel more inclined to choose Ethereum, even though they can now launch their own private stablecoins.

The Path of Least Friction

Though traditional financial institutions can explore launching their own private blockchains, they might gravitate toward open, public networks.

“Some banks will pilot proprietary or permissioned rails, but settlement liquidity tends to coalesce where counterparties already are. Private networks usually bridge back to where liquidity clears,” Shah told BeInCrypto.

Though the GENIUS Act opens up new opportunities for institutions, launching and operating a private stablecoin requires a substantial operational commitment.

“The Act lowers the barrier for banks and fintechs to issue, but the path of least friction may remain issuing on, or at least interoperating with, Ethereum’s liquidity hubs and L2s to access global counterparties and composable finance,” he added.

Based on current trends, all signs suggest that Ethereum will strengthen its position as the primary settlement layer for digital dollar transactions. The asset’s rising price and growing institutional interest in the network reinforce such a trajectory.