WLFI Price Plummets—Traders Brace for New Lows as Demand Evaporates

WLFI's value tanks—traders position for fresh bottoms amid vanishing buyer interest.

Market Momentum Shifts

Selling pressure intensifies as holders rush for exits. No support levels held—pure freefall dominates charts.

Technical Breakdown Complete

Every key level shattered. Bears control the narrative now, pushing relentlessly toward uncharted territory.

Sentiment Turns Toxic

Social channels flood with panic—no bullish voices left standing. Even the perpetual optimists finally capitulate.

Another 'fundamental disruption' proving just how fragile crypto valuations remain when sentiment shifts. Welcome to digital finance—where today's innovation becomes tomorrow's bagholder regret.

WLFI Under Pressure as Traders Exit Positions and Bet on New Lows

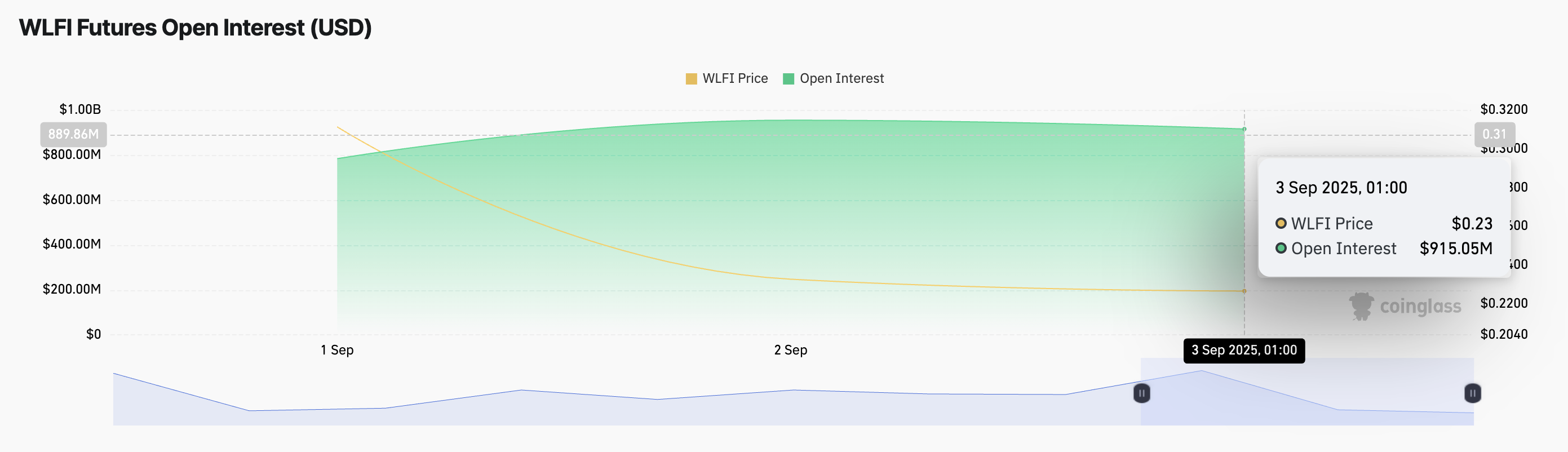

WLFI’s price dip in the past day has been accompanied by a decline in its futures open interest, confirming the retreat in market participation. Currently at $915.05 million, this has plunged by 4% in the past 24 hours, per Coinglass data.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

Open interest refers to the total number of outstanding futures or options contracts that have not yet been settled. It is used to gauge market participation and capital FLOW into an asset.

When an asset’s price falls alongside a drop in its futures open interest, traders are closing out their positions rather than initiating new ones. This trend reflects waning confidence in WLFI and suggests that its ongoing selloff is being driven more by investors exiting the market.

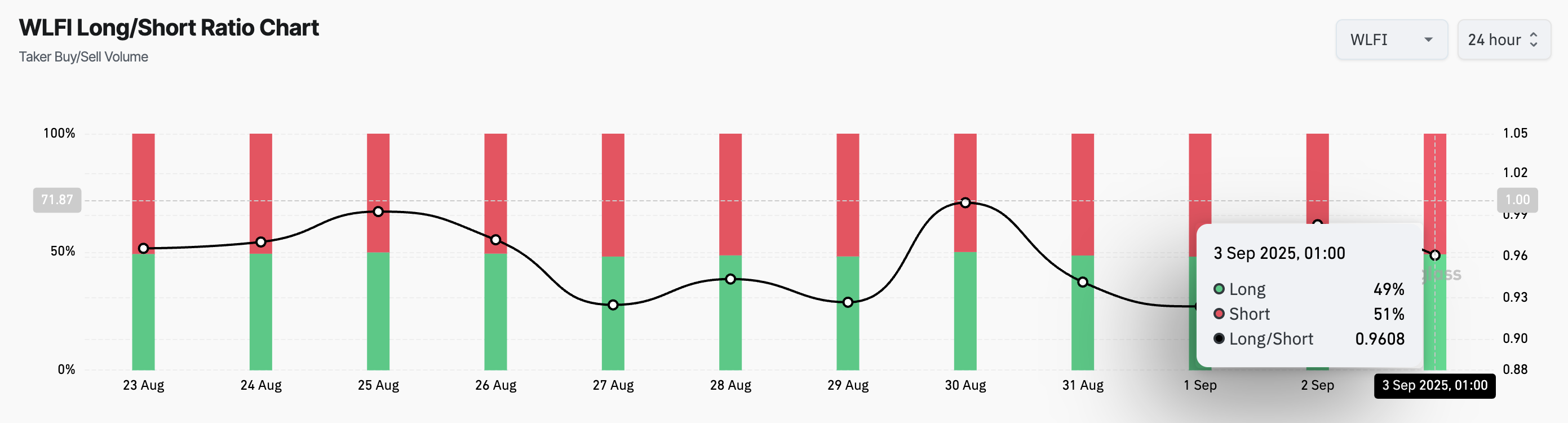

In addition, on-chain data shows WLFI’s long/short ratio leaning heavily toward shorts, indicating that traders are increasingly betting against the token. As of this writing, the metric stands at 0.96.

The long/short ratio measures the proportion of long bets to short ones in an asset’s futures market. A ratio above one signals more long positions than short ones. This indicates a bullish sentiment, as most traders expect the asset’s value to rise.

However, as with WLFI, a ratio below one means there are more short than long positions in the market. This reflects the prevalent bearish sentiment against WLFI, with its futures traders overwhelmingly betting on the asset’s price to decline rather than rise.

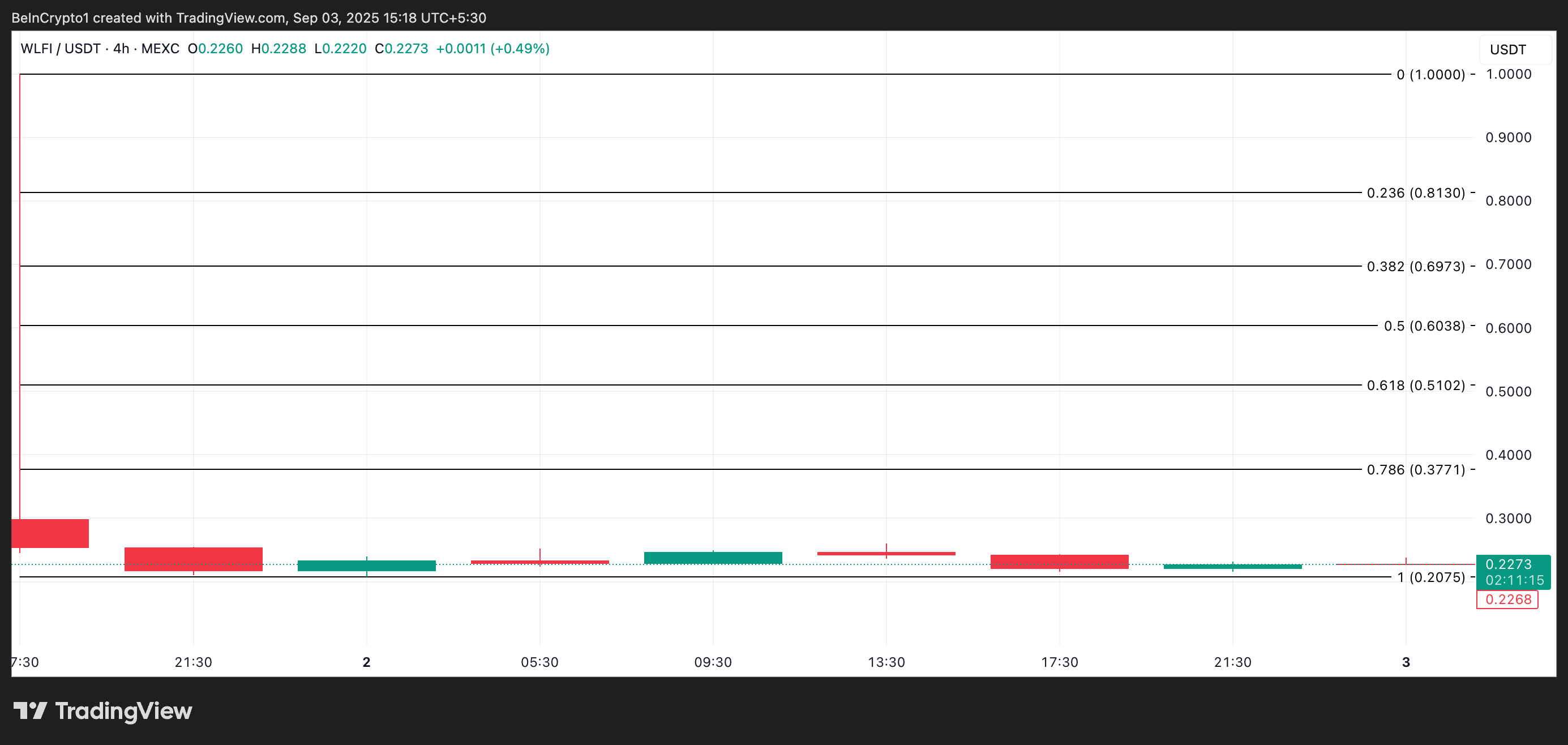

WLFI’s Next Target Could Be $0.2075 or $0.3771

Without renewed buyer interest, WLFI risks sliding further. If demand continues to lean, its price could fall to $0.2075.

On the other hand, an uptick in buy-side pressure could prevent this. If new buyers enter the market, they could trigger a rebound toward $0.3771.