Real-World Assets Tokens Stage Spectacular September Comeback

Real-world asset tokens roar back to life this September—defying skeptics and shaking up traditional finance.

Market Momentum Builds

Tokenized assets surge as institutional players finally wake up to blockchain's potential. Physical assets—from real estate to commodities—get digital passports on-chain.

Traditional Finance Gets Disrupted

Wall Street veterans scramble to keep pace. Legacy systems look downright archaic next to instant settlements and global liquidity pools. Another quarter, another reminder that innovation doesn't wait for permission.

Regulatory Hurdles Remain

Watchdogs circle—because nothing gets bureaucrats moving faster than actual progress. Compliance becomes the new battleground for tokenization projects.

The Bottom Line

Real-world assets aren't just making a comeback—they're rewriting the rulebook. Traditional finance can either adapt or get left behind. Again.

Institutional Adoption Spurs Rally in RWA-Based Tokens

The recent surge in the value of RWA-based tokens is being fueled by increasing institutional adoption. Major financial giants are moving decisively into tokenized markets, with BNY Mellon and BlackRock leading the charge.

Both firms have integrated tokenized money-market funds into their platforms, with BlackRock’s BUIDL fund having already surpassed $2 billion in total value locked (TVL). This highlights how widely tokenization is spreading across global finance,

Here are some RWA-based tokens whose performance you should watch this week.

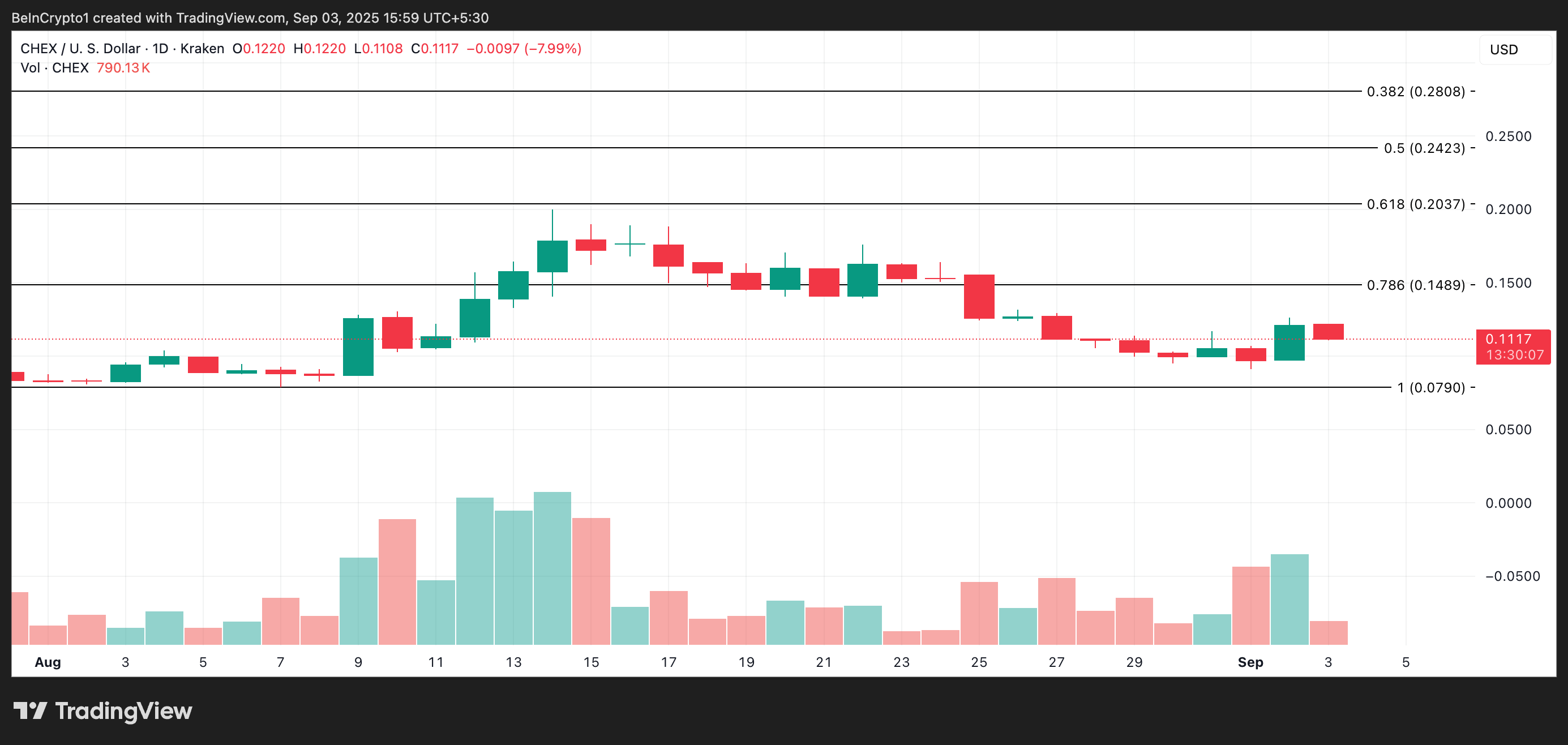

CHEX Surges 10% Amid Rising Trading Volume

Utility token CHEX has gained 10% over the past 24 hours, with trading volume surging 34% to reach $2.7 million at press time. This combination of rising prices and increasing trading activity indicates strong market interest.

It suggests that buyers are actively entering the market rather than price movements being driven by a few isolated trades. If this buying momentum continues, CHEX could see its price climb toward $0.148.

On the other hand, if selling pressure returns, the token could retrace to around $0.079.

ONDO Climbs on Strong Buying Pressure, Bulls in Control

At press time, ONDO trades at $0.9703. Readings from the ONDO/USD daily chart confirm the market’s bullish pressure.

For example, the Balance of Power (BoP) indicator currently sits at 0.66, signaling that buyers are in control. The BoP measures the strength of buyers versus sellers over a given period: a positive reading indicates bullish dominance, while a negative reading signals that sellers have the upper hand.

For ONDO, the positive BoP reading suggests that demand currently outweighs selling pressure. If this momentum continues, ONDO’s price could climb toward $1.05.

Conversely, if selling resumes, the token could fall below $0.9601.

SYRUP Eyes Upside as RSI Suggests More Room to Grow

SYRUP has gained 5% over the past week, and its climbing Relative Strength Index (RSI) indicates room for further upward movement. At press time, the RSI is at 55.13.

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100. Values above 70 suggest that the asset is overbought and due for a price decline, while values under 30 indicate that the asset is oversold and may witness a rebound.

At 55.13, SYRUP’s RSI suggests that the asset is in an uptrend and not yet overbought, leaving space for continued gains.

If buying pressure persists, SYRUP could break above $0.502.

SYRUP Price Analysis. Source: TradingView

On the other hand, if profit-taking emerges, the token could retrace to $0.367.