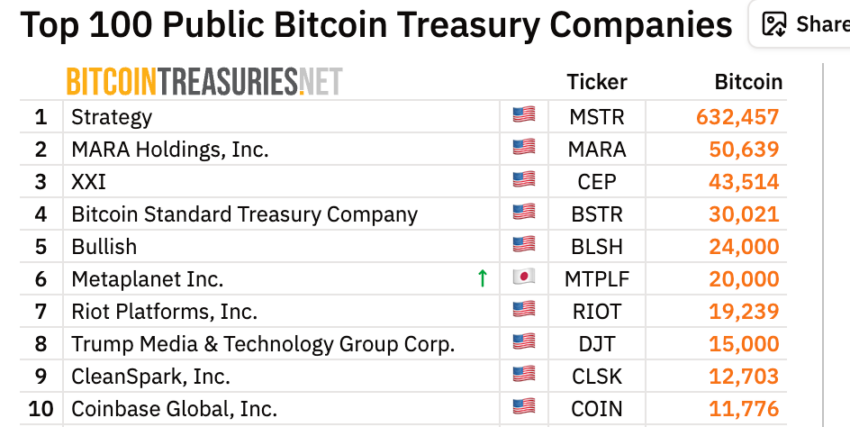

Metaplanet Shatters Records: Now Holds Over 20,000 BTC, Ranks Among World’s Top 6 Corporate Treasuries

Another legacy finance giant gets Bitcoin religion—just as the old system creaks under its own weight.

THE BITCOIN BET THAT'S PAYING OFF

Metaplanet's treasury now bulges with over 20,000 BTC, catapulting the firm into an elite global club. They've joined the ranks of the top six corporate holders worldwide—a move that's turning heads and raising eyebrows across traditional finance circles.

WHY CORPORATIONS ARE FLOCKING TO BITCOIN

Smart money ditches inflationary fiat for hard-cap digital assets. Treasury strategies evolve from boring bonds to bold Bitcoin acquisitions—because sitting on cash is like watching melting ice.

THE NEW CORPORATE PLAYBOOK

Forward-thinking companies now leverage Bitcoin as a primary reserve asset. It’s not speculation—it’s strategic balance sheet optimization for the digital age.

Watch traditional treasuries scramble to catch up while the pioneers reap the rewards. Sometimes the best investment strategy is simply not doing what everyone else is doing.

Metaplanet Overtakes Riot Platforms

This latest acquisition pushes the firm’s total holdings beyond 20,000 BTC, with a cumulative acquisition cost of $2.06 billion (¥302.3 billion). Just a week earlier, on August 25, the company had added 103 BTC, highlighting its accelerated accumulation strategy.

Data from BitcoinTreasuries.net show that Metaplanet now holds more Bitcoin than Riot Platforms, a US-based mining company. For the third quarter of 2025, Metaplanet posted a BTC Yield of 30.7%, reflecting the growth of Bitcoin reserves compared with its fully diluted share count. The surge highlights how Metaplanet ties shareholder value directly to Bitcoin accumulation.

Metaplanet combines capital market activity with its bitcoin strategy. In August, it issued its 20th round of stock options to EVO FUND, creating 60 million new shares. The proceeds financed the latest Bitcoin purchases and an early repayment of the 19th series corporate bonds.

Despite the aggressive buying, the market showed little reaction. On the announcement day, Metaplanet’s shares closed at 831 yen, -5.46% from the previous day

Metaplanet’s holdings confirm its place among the world’s largest corporate Bitcoin owners. The company says it will continue accumulating Bitcoin in line with its capital strategy and market conditions. Investors and the crypto industry are watching closely as this Japanese-listed firm pursues Asia’s boldest Bitcoin treasury policies.