3 Altcoins Facing Major Liquidation Risks as September Kicks Off

Liquidation storms are brewing across crypto markets—and these three altcoins sit squarely in the crosshairs.

High Leverage, Higher Stakes

Traders piled into leveraged positions during August's rally, pushing open interest to dangerous levels. Now, with volatility spiking, margin calls loom large.

BNB Tests Critical Support

Binance's native token flirts with key technical levels. A break below could trigger cascading liquidations—just like old times.

Memecoins on the Brink

Speculative favorites saw massive futures buildup near all-time highs. Any downward pressure now risks wiping out overleveraged gamblers chasing yesterday's pumps.

DeFi Tokens Face Reckoning

Protocol tokens rallied hard but now face their first real stress test. Smart money's already rotating—retail bags looking heavier by the minute.

When the tide goes out, we see who's been swimming naked. And in crypto, that's usually everyone with more than 2x leverage.

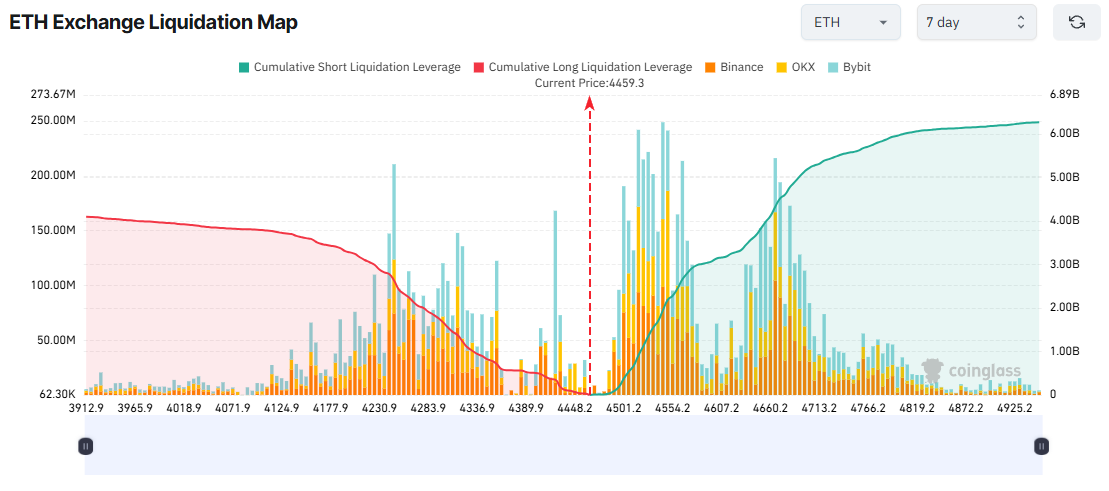

1. Ethereum (ETH)

Ethereum’s 7-day liquidation map shows a major imbalance. If ETH rises to $4,925 this week, accumulated short liquidations could exceed $6 billion.

On the other hand, if ETH falls below $4,000, long positions worth about $3.96 billion WOULD be liquidated.

Data indicates that short-term traders are leaning toward shorting ethereum this week. They placed larger bets and used higher leverage on short positions.

However, they may face setbacks. On-chain data from the first day of September shows large whale transactions selling BTC to buy ETH.

Lookonchain reported that Bitcoin whale wallets continuously sold BTC to purchase more than $4 billion worth of ETH.

This bitcoin OG has sold another 2,000 $BTC($215M) and bought 48,942 $ETH ($215M) spot over the past 4 hours.

In total, he has bought 886,371 $ETH($4.07B).https://t.co/qtQdgPt2CQ pic.twitter.com/ymvyHyirFo

This whale activity of swapping BTC for ETH could affect trader sentiment. It may drive ETH’s price higher and inflict losses on short positions.

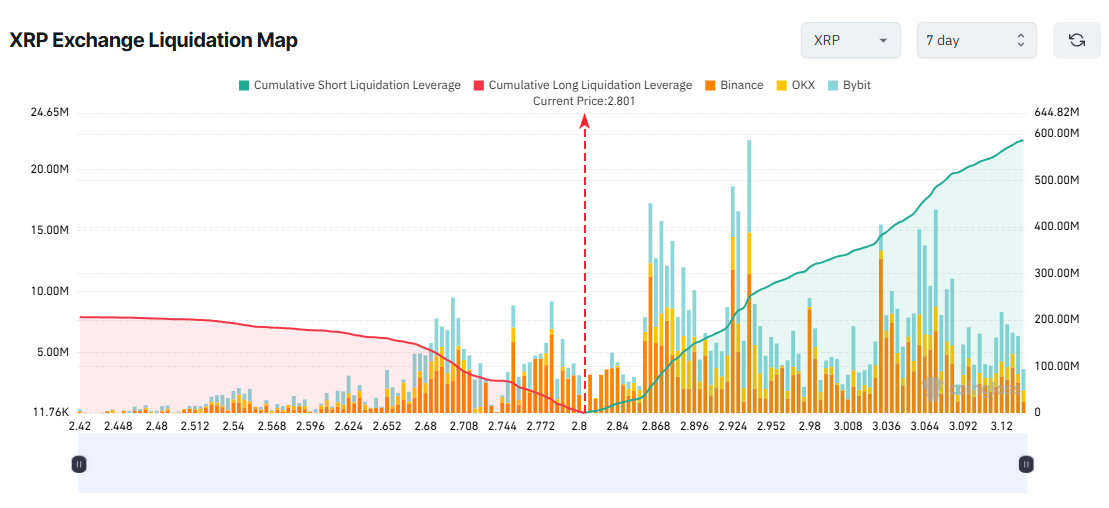

2. XRP

XRP’s 7-day liquidation map shows a severe imbalance. Short liquidations far outweigh long liquidations. Many short-term traders appear to be betting heavily on XRP’s decline in the first week of September.

If XRP climbs to $3, over $500 million in short positions would be liquidated. In contrast, if XRP falls to $2.42, only about $200 million in long positions would face liquidation.

From a technical perspective, analysts warn that the current $2.70 level acts as strong support. Prices may rebound from here, putting short positions at high risk.

In addition, 15 XRP ETF applications are still pending with the SEC. Any positive news regarding these ETFs could ignite a bullish wave among XRP investors.

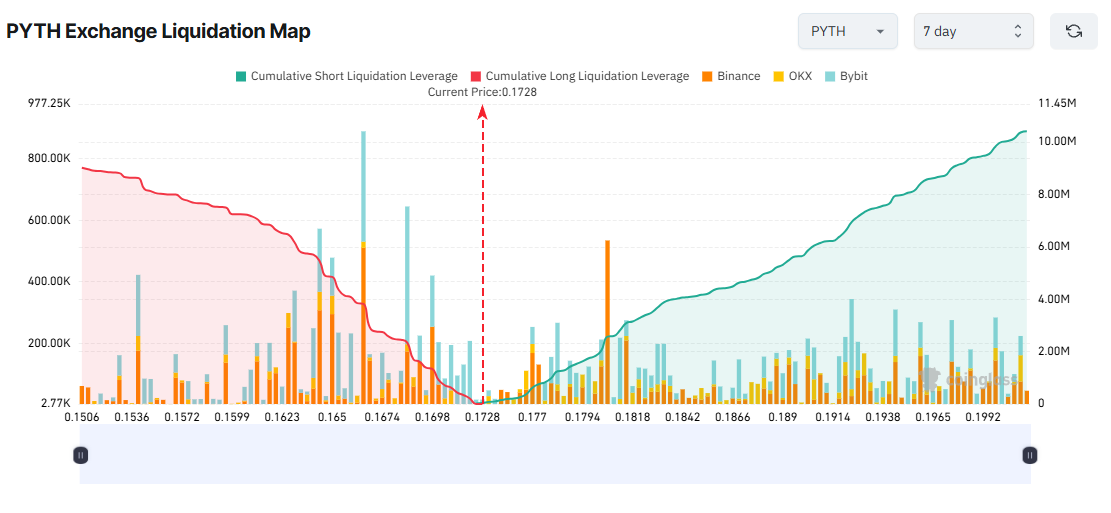

3. Pyth Network (PYTH)

On August 28, the US Department of Commerce surprised crypto investors by partnering with Pyth and chainlink to put GDP data on the blockchain. PYTH’s price doubled in one day.

That positive sentiment appears to be spilling into September. Short-term traders are actively going long on PYTH. They risk nearly $9 million in losses if PYTH drops to $0.15 this week.

Charts show that long liquidations accelerate faster as the price declines, reflected by taller bars on the left side of the distribution.

Conversely, if PYTH rises to $2 this week, accumulated short liquidations could reach $10 million.

Good news may fuel excessive short-term euphoria. Yet it could also trigger a “sell the news” event, as early buyers take profits. If that happens, PYTH may undergo a deeper correction than long traders expect.