Fed’s September Rate Cut Hopes Evaporate—What It Means for Your Crypto Portfolio

Markets slash bets on Federal Reserve easing as inflation fears resurface.

The Waiting Game

Traders who priced in dovish pivots now face reality—central bankers won't rescue overleveraged positions. Bitcoin's correlation with traditional risk assets strengthens just when decentralization promises should shine.

Liquidity Lifelines?

Higher-for-longer rates choke speculative capital flows. Altcoins bleed while institutional players hedge with gold—because nothing says 'innovation' like reverting to prehistoric stores of value.

Silver linings? Maybe. Tighter money separates diamond hands from degenerate gamblers. True believers keep stacking sats while fair-weather fans flee. The system's broken—but at least the exit scams become more obvious.

Crypto’s View on Rate Cuts

As President TRUMP keeps repeatedly pushing Fed Chair Jerome Powell to cut US interest rates, the crypto industry is losing its hope that they’ll happen any time soon.

Yesterday, the FOMC released the minutes of its July meeting, and the community anticipated that tariff woes had substantially changed the Fed’s position.

The minutes revealed that the Federal Open Market Committee (FOMC) left rates unchanged at 4.25%–4.5% in July. However, Fed Governors Christopher Waller and Michelle Bowman opposed the decision, favoring a 25 basis point cut instead.”

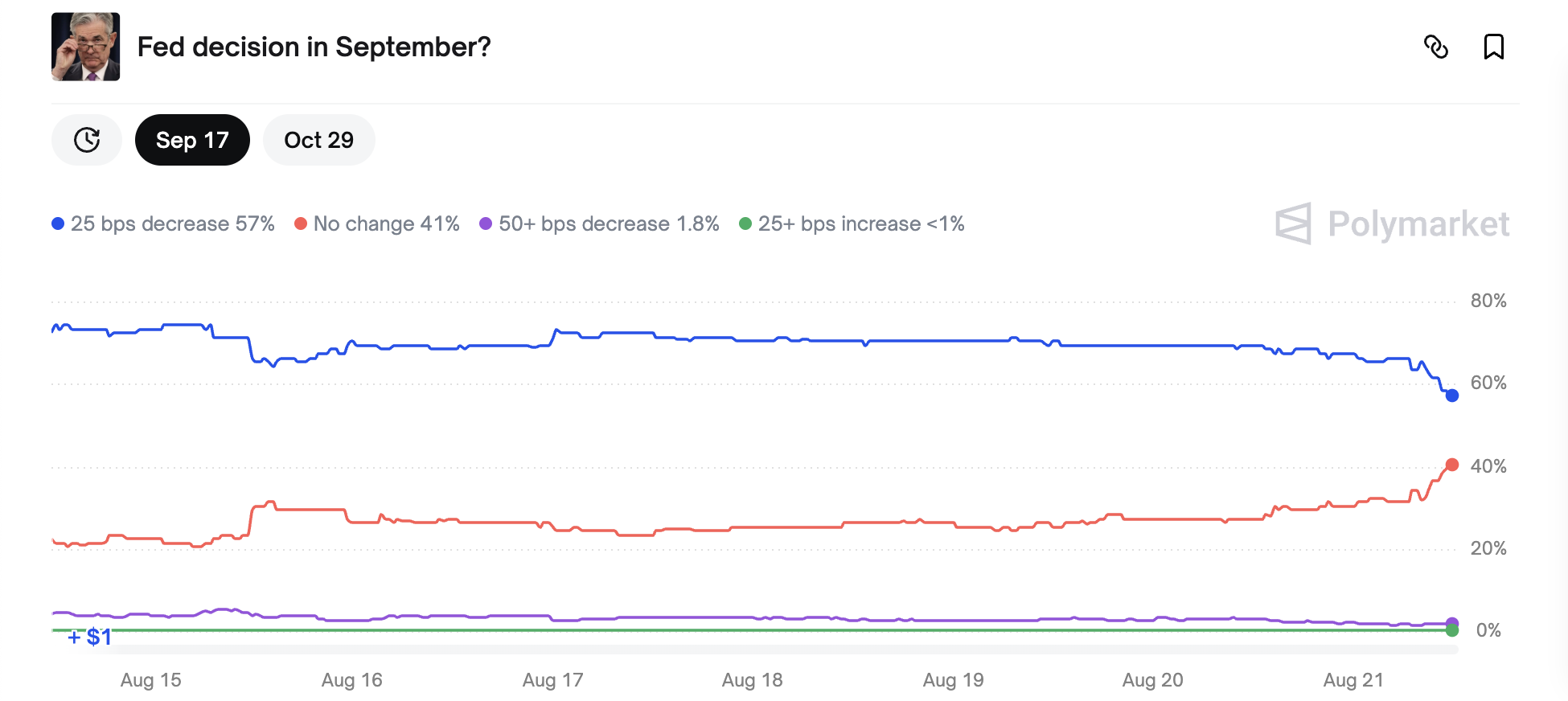

The next opportunity is 27 days away, and prediction markets like Polymarket and Kalshi are both reporting diminished hopes of a September cut. Believers still represent a majority, but it’s becoming quite a slim one.

The Big Picture for America’s Economy

So, what does this mean for crypto? Although the industry has spent most of the year hoping for rate cuts, markets have moved on and diminished their expectations several times.

However, with US stocks opening in the red today, this situation might be different.

Discouraging economic signals like this month’s US Jobs Report have fueled fears of a recession, but nothing substantial has materialized yet.

Ironically, increasing economic uncertainty may actually impede the Fed’s available toolkit for fixing potential crises. That is to say, the situation is so unsteady that Powell’s future rate cuts might not help matters:

The rate cuts are already not working https://t.co/b2tNsOqd1P

— Matthew Zeitlin (@MattZeitlin) August 19, 2025This situation is highly uncertain, and it’s impossible to predict how US policy, global markets, and crypto can intersect. Several scenarios are possible: AI turmoil could precipitate larger problems, the situation could improve, crypto could outperform TradFi markets, or unexpected things could happen. It’s all very fluid.

One thing seems more steady, though: the crypto industry isn’t pinning its economic hopes on an impending rate cut. If it happens, it’ll be influential, but Optimism is low and declining.