Veteran Bitcoin Whale Makes Big Bet on Ethereum as DeFi Fever Heats Up

Crypto's old money is shifting stacks—and it's not what you'd expect.

From BTC to ETH: The Whale's Gambit

A longtime Bitcoin holder just dumped a chunk of their holdings into Ethereum, signaling a potential sea change in institutional crypto strategy. No percentages were disclosed—just cold, hard blockchain evidence of capital migration.

Why Ethereum? Blame the Yield Farmers

With DeFi protocols offering APYs that make traditional finance weep, even OGs are chasing alpha. The whale’s move coincides with Ethereum’s L2 adoption hitting record highs—because nothing screams 'smart money' like paying $50 gas fees to earn 8% on a stablecoin.

The Punchline

When Bitcoin maximalists start hedging, it’s either genius or the ultimate top signal. Meanwhile, Wall Street still thinks 'HODL' is a typo.

Bitcoin Whale Moves to Ethereum Amid ‘Ethereum Season’

In a recent post on X (formerly Twitter), Lookonchain, a blockchain analytics firm, highlighted that the whale had acquired 14,837 BTC seven years ago from HTX and Binance at an average price of $7,242. The stack, then valued at $107.5 million, is now worth over $1.6 billion.

The old whale deposited 670.1 BTC worth $76 million from its pile to Hyperliquid, a decentralized perpetual trading platform, and subsequently sold it. Following the sale, the whale opened long positions totaling 68,130 ETH (approximately $295 million) across four wallets. The whale used leverage of up to 10x on most trades.

“Bro knows BTC is cooked and it’s time for ETH now,” an analyst wrote.

According to the latest market data from HypurrScan, all his wallets are currently sitting on unrealized losses totalling $1.8 million.

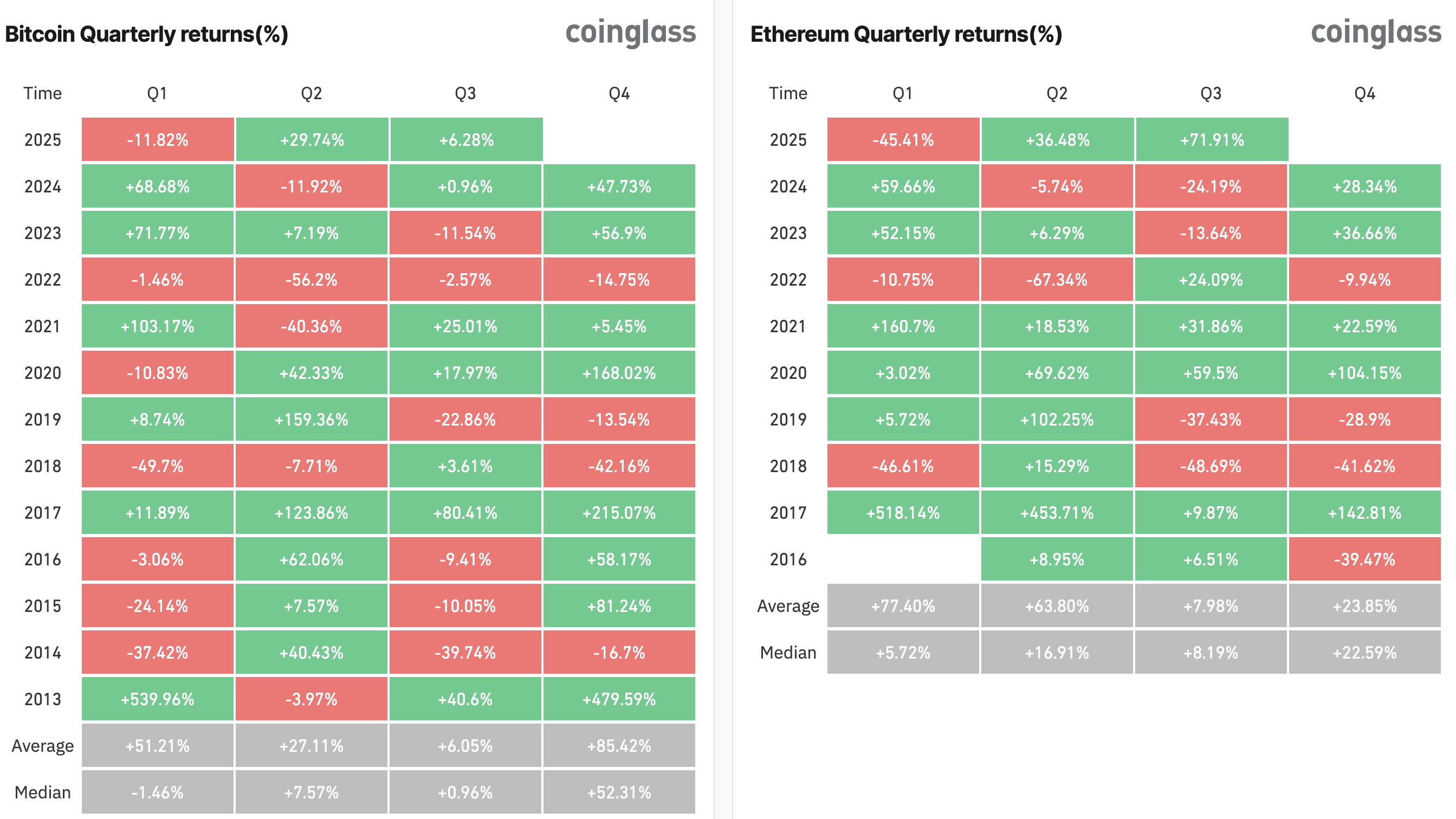

Meanwhile, this diversification into ETH suggests confidence in its upward trajectory, potentially influenced by Ethereum’s ongoing rally. The altcoin outperformed Bitcoin in the second quarter of this year. In addition, so far in Q3, this pattern continues to hold.

Coinglass data showed that ETH has delivered a 71.91% return in the third quarter to date. This contrasted sharply with BTC’s 6.28% return.

Earlier this week, BeInCrypto also reported that Ethereum ETFs saw a rapid influx of capital, condensing what WOULD typically take a year of growth into just six weeks.

“Ether ETFs Turn bitcoin Into ‘Second Best’ Crypto Asset in July,” Bloomberg’s senior ETF analyst Eric Balchunas posted.

Moreover, institutional interest is progressively moving from Bitcoin to Ethereum. BeInCrypto highlighted that firms acquiring Bitcoin for their treasuries have significantly decreased, with only 2.8 companies purchasing Bitcoin per day.

In contrast, Ethereum and other altcoins continue to draw attention from corporate investors. Additionally, the latest data from the Strategic ETH Reserve website indicated a significant surge in ETH holdings by entities, rising from $6 billion to $17 billion in just the last month, reflecting an 183% increase.

The preference for ETH comes amid the ‘Ethereum Season,’ which has seen the asset capture major market investments. Experts believe that this is the second phase of the market cycle, after which capital will FLOW into other coins, signaling the peak of the altseason.