Why Altcoin Season Hype Crashed After Just 7 Days—Insider Analysis

Altcoin euphoria hits a wall—again. The much-hyped 'altseason' that had traders buzzing just last week has already fizzled out, leaving portfolios bruised and questions swirling.

Market Whiplash Strikes Fast

What took weeks to build evaporated in days. The usual pattern—Bitcoin dominance dropping as capital floods into alts—reversed sharply. Instead of sustained momentum, we got a classic pump-and-dump dressed in seasonal clothing.

Experts Point to Three Key Factors

First, macro uncertainty slammed risk appetite. Then, exchange inflows spiked—always a red flag. Finally, retail FOMO got front-run by smart money taking profits. Same story, different cycle.

When Hype Meets Reality

Altcoins promise disruption but often deliver dilution. Without real adoption or Bitcoin's stability, they're just leveraged bets on crypto sentiment. And sentiment, as we just saw, changes faster than a influencer's bio.

The Aftermath: Sobering Lessons

Another reminder that in crypto, seasons change fast—but the whales' playbook doesn't. Maybe next time we'll remember that before chasing the next shiny thing that promises 100x returns. Or maybe not. After all, hope springs eternal in the financial wild west.

Altcoin Season Hype Fizzles Fast as Google Trends Plunge

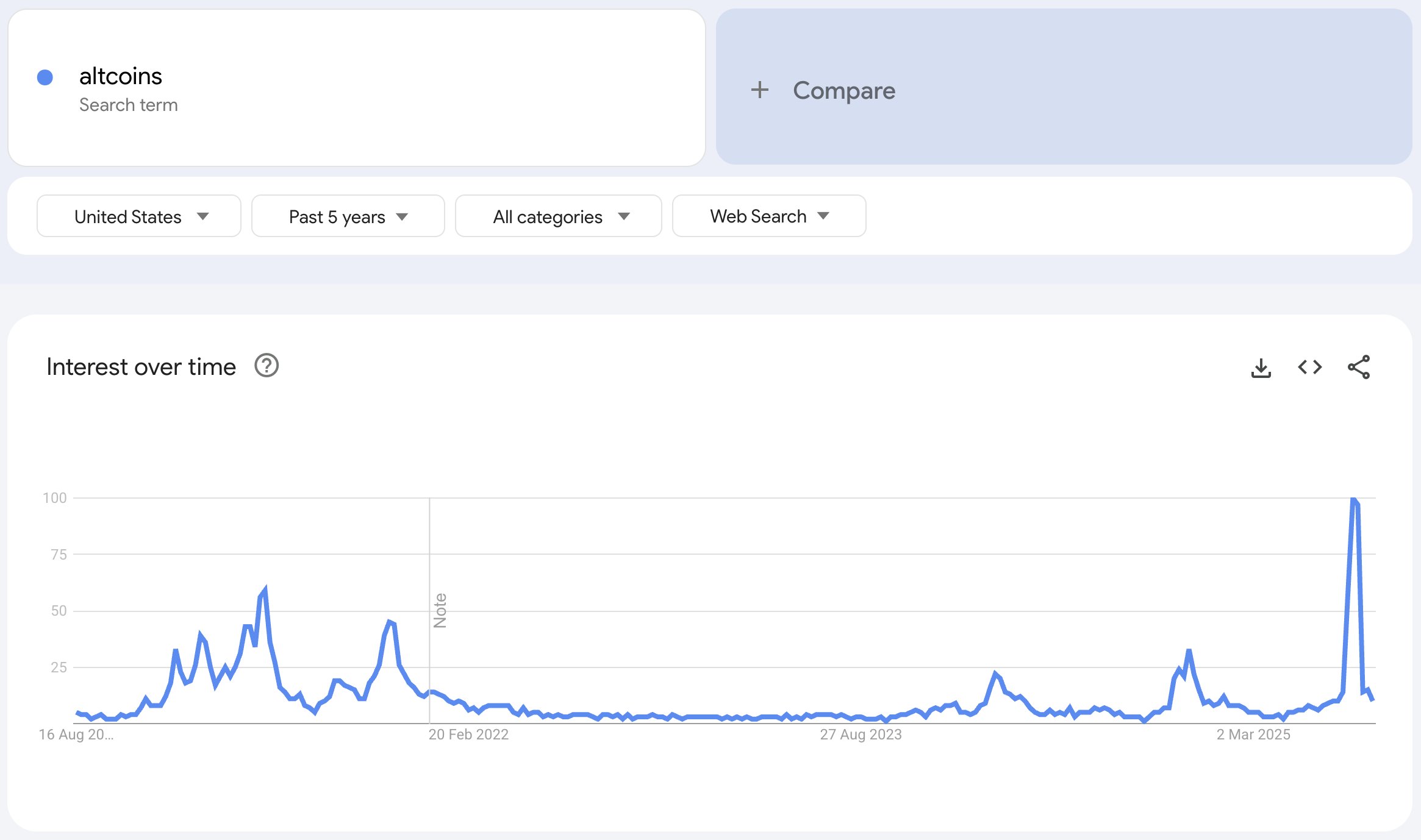

Many investors treat Google Trends as an indicator to gauge fresh retail interest. Historically, when a crypto-related term trends on Google, new capital often flows into related projects.

Something unusual happened in August. Google Trends data in the US showed that searches for “altcoin” spiked to a new high but dropped back to the bottom in just one week.

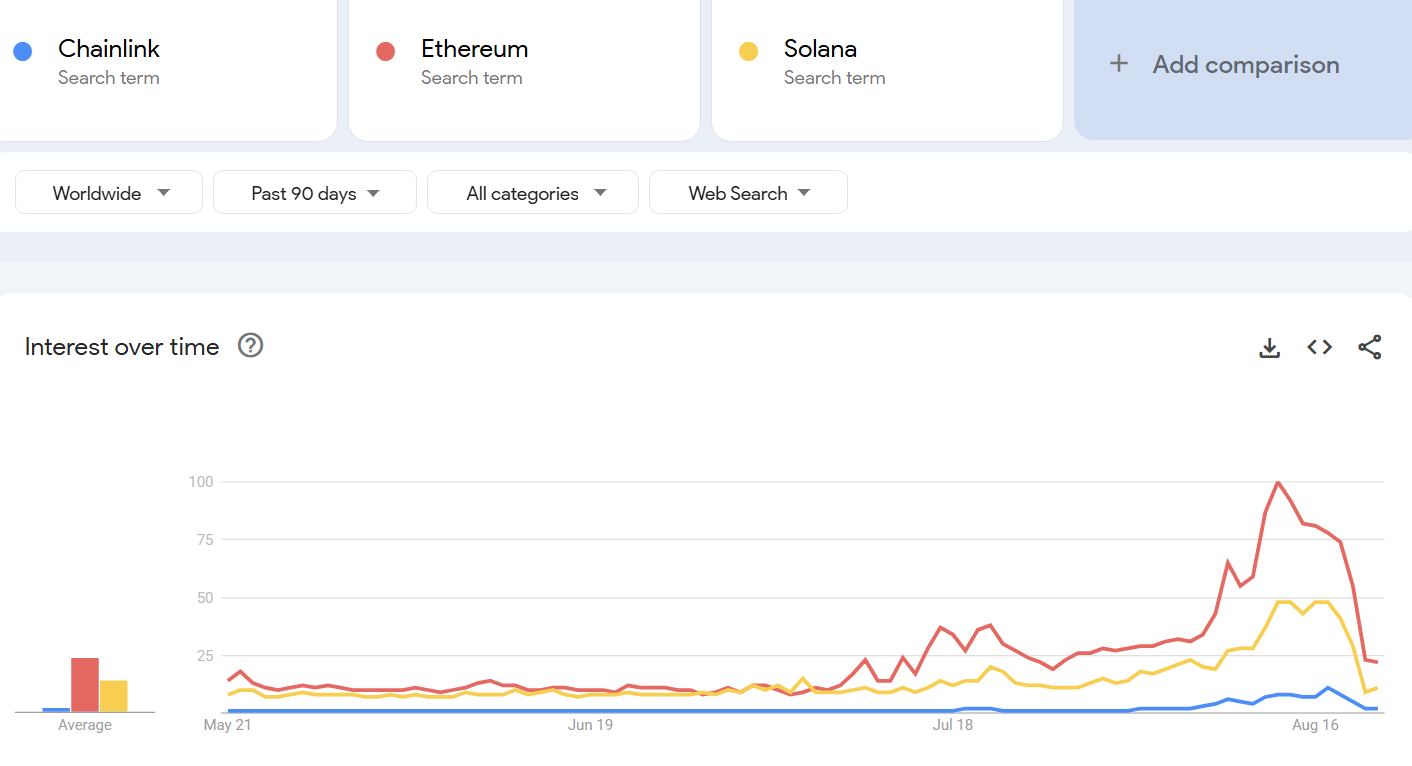

This was not limited to the US. On a global scale, Google Trends also recorded searches for “altcoin” peaking at the maximum score of 100 before collapsing to 16 within a week. A similar “pump and dump” pattern appeared with “alt season” and the names of top altcoins.

“Alt season Google searches pumped and dumped faster than a bundled memecoin,” Mario Nawfal’s Roundtable mocked.

The chart suggested that altcoin season may have ended almost as soon as it started. The market capitalization of altcoins (TOTAL3) mirrored this trend. It climbed from $1 trillion to $1.1 trillion, only to fall back to $1 trillion during the same period.

Some analysts remain optimistic. Cyclop, a well-followed analyst on X, believes the “altcoin” keyword spike still has a positive meaning. He argued that the term has become mainstream.

“That altcoin spike just means interest is higher than in 2021 – but probably because there are 1000x more coins now, and ‘altcoin’ became the common word. Back then, people just said ‘crypto.’ So I think this basically just shows that interest is starting to pick up – but it doesn’t mean we’ve hit the peak,” Cyclop said.

There are also other reasons why Google Trends may no longer be effective in measuring fresh retail demand. Investors now use AI tools to search for information. Broader market concepts have become so familiar that many investors no longer need to look them up on Google.

A Fragmented Altcoin Season in August

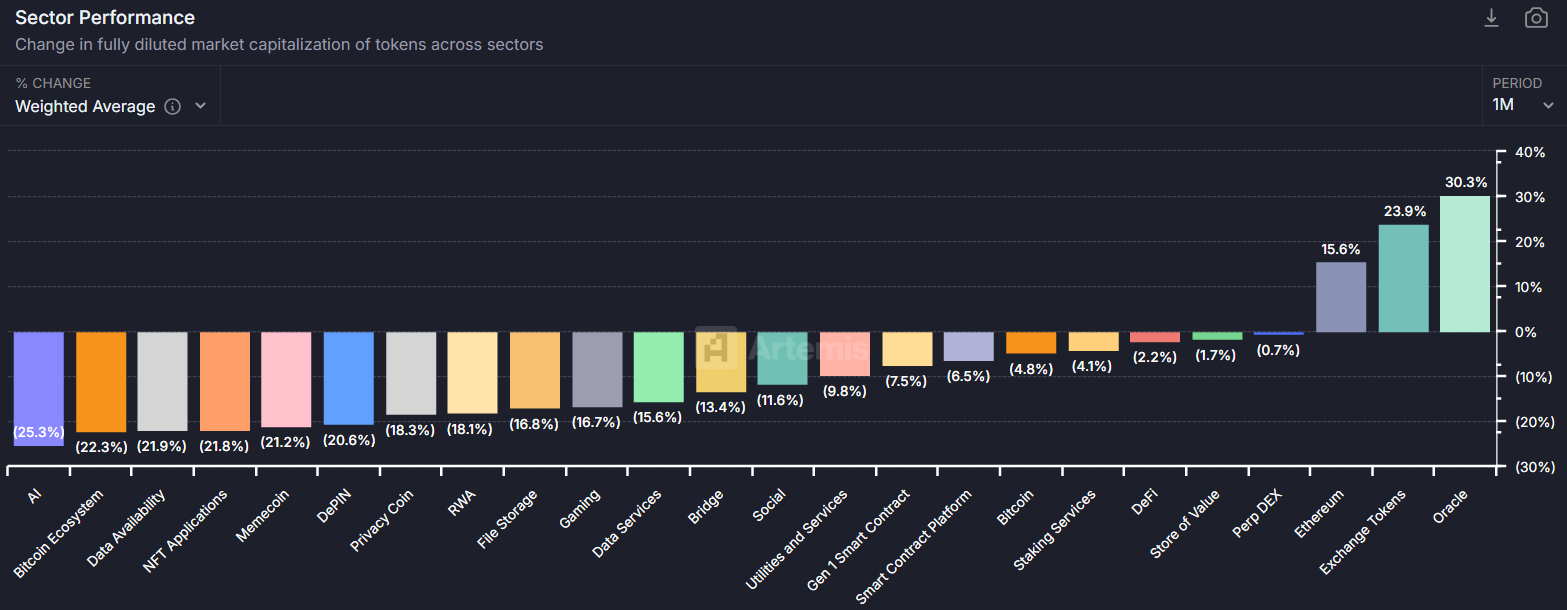

Artemis data provided deeper insights into how the altcoin season unfolded in August.

Although some altcoins rallied strongly, most categories posted negative performance over the past month. Only three narratives performed well: Ethereum, Exchange Tokens, and Oracles.

ETH benefited from accumulation by publicly listed companies. BNB and OKB’s rallies lifted the Exchange Tokens category. Meanwhile, Oracle tokens outperformed mainly thanks to Chainlink’s (LINK) price surge.

Each successful altcoin had its driver. OKB rose due to large-scale token burns. LINK gained from the chainlink Reserve plan. As a result, altcoin season remains fragmented, falling short of investors’ expectations.

Sandeep, the CEO of Polygon, presents an argument for why future altcoin seasons are likely to see fewer tokens experiencing significant rallies compared to previous cycles. He highlights a key difference in intrinsic value.

While the altcoin seasons of 2017 and 2021 thrived largely due to marketing, today’s savvy investors are looking for practicality and real utility in the tokens they choose to invest in.

“Here’s what this tells me: retail is searching, but institutions aren’t buying the narratives yet. Old altcoin seasons were driven by speculation and promises and narratives and marketing. Institutional money is smarter money. It cares about real utility and cash flows. The next “alt season” won’t look like 2017 or 2021. It’ll be fewer tokens with actual usage, not just tokens with better marketing.” Sandeep said.

Still, analysts have not given up hope on a broader altcoin season. crypto exchange Coinbase and asset manager Pantera Capital predicted that a new altcoin season could begin as early as September.