3 Altcoins Dominating August With Unstoppable Bullish Momentum

August's crypto surge defies traditional finance logic—again. While Wall Street analysts debate inflation metrics, these three altcoins are quietly printing generational wealth.

BNB: Exchange Token Titan

Binance's native token rips through resistance levels like they're tissue paper. Trading volume spikes 300% month-over-month while institutional flows hit record highs. The ecosystem's relentless expansion—new chain integrations, burning mechanisms, DeFi partnerships—creates perpetual demand pressure that'd make any traditional ETF manager blush.

Solana: The Speed Demon's Revenge

Network upgrades slashed transaction costs by 80% while maintaining sub-second finality. Developer activity skyrockets as NFT minting wars return with vengeance. Retail FOMO meets institutional infrastructure builds—a cocktail that propelled SOL past its previous ATH while legacy systems still process settlement paperwork.

XRP: Regulatory Clarity Pays Off

After years of legal purgatory, judicial victories transform regulatory uncertainty into competitive advantage. Payment corridors reactivate overnight as corporate treasury flows resume. Banking partnerships previously stuck in 'wait-and-see' mode now drive adoption curves that resemble vertical lines rather than gradual slopes.

These assets aren't just outperforming—they're demonstrating blockchain utility while traditional finance struggles with paperwork. Maybe that's why hedge funds are suddenly 'crypto-curious' after years of dismissing the space. Nothing sparks innovation like watching early adopters retire before forty.

1. Aerodrome Finance (AERO)

Aerodrome Finance (AERO) currently has an 89% bullish sentiment, the highest in the market, according to CoinMarketCap.

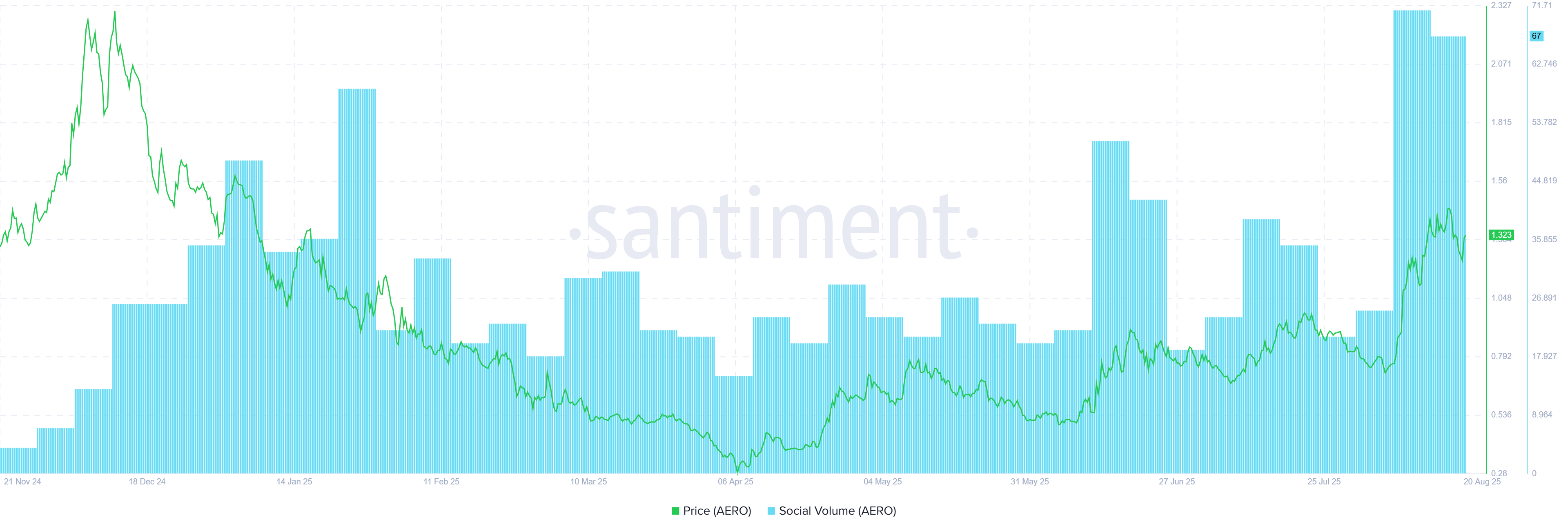

Santiment data also reveals that AERO’s social discussion volume in August reached an all-time high, reflecting growing investor interest in the project.

The positive sentiment aligns with AERO’s price rally. Since the beginning of August, its price has jumped 80%, climbing from $0.72 to $1.32.

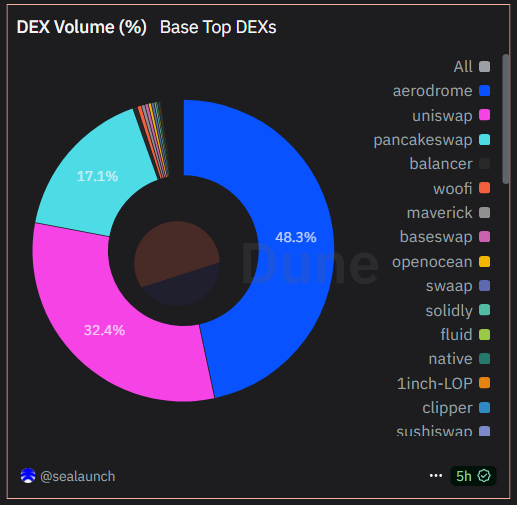

Since Coinbase integrated Aerodrome’s decentralized exchange (DEX) into its main app, Aerodrome now handles 48.3% of DEX volume on Base. It has even surpassed big names like Uniswap and Pancakeswap.

In addition, Aerodrome announced that its 24-hour DEX trading volume reached $1 billion, while total fees surged past $250 million.

These milestones strengthened investor confidence. Many expect prices to keep rising in August. A recent analysis from BeInCrypto suggested AERO could climb to $1.85 if favorable conditions continue.

2. Kaspa (KAS)

CoinMarketCap data shows that Kaspa (KAS) also had a bullish sentiment of 89% in August despite its unimpressive price performance.

KAS has been on a rollercoaster. Its price went from $0.08 to $0.10, then fell back to $0.085. However, the community remains bullish for reasons beyond price action.

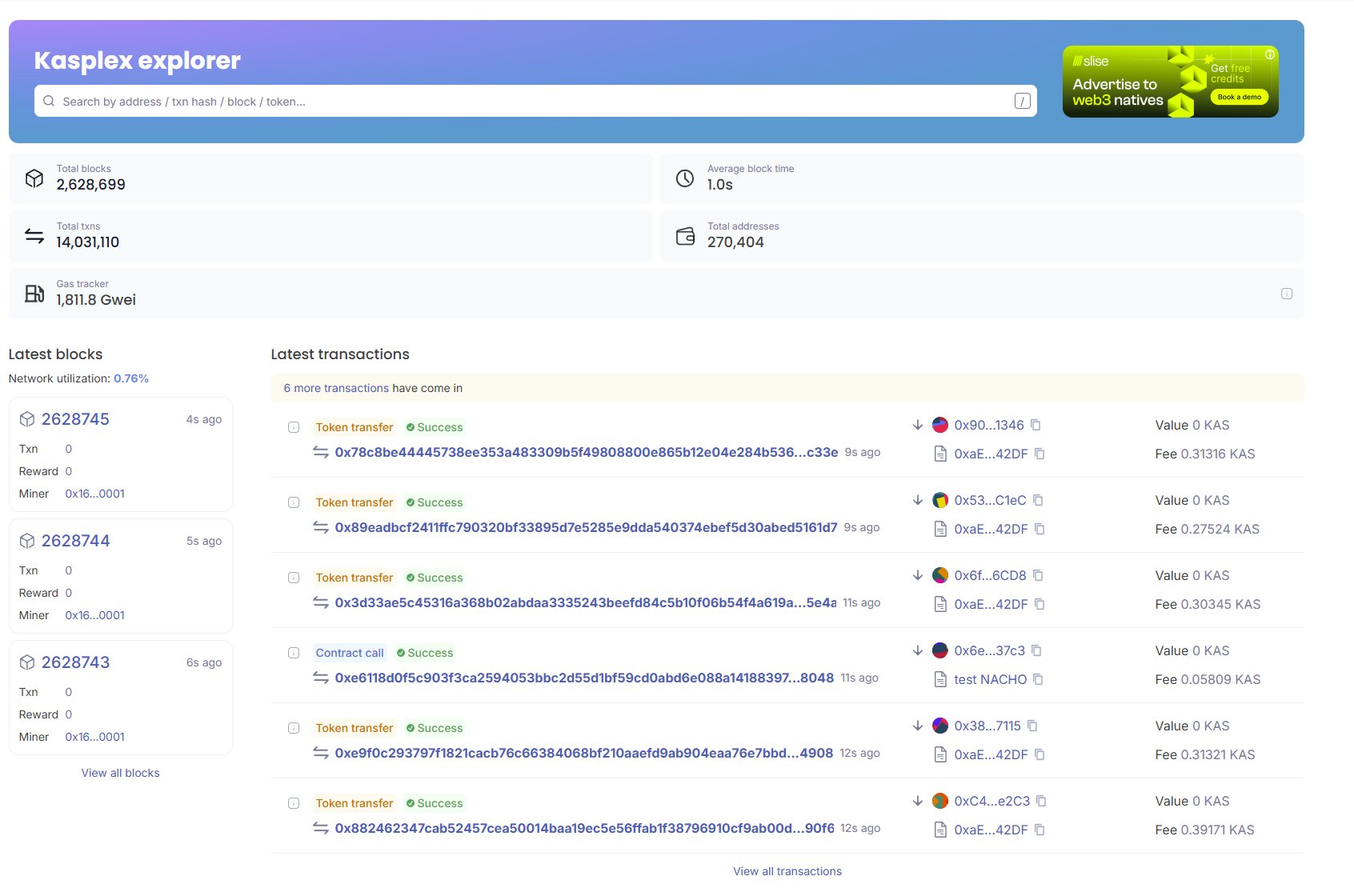

The main driver is the anticipated launch of Kasplex LAYER 2 on August 31. This upgrade will pave the way for smart contract applications. Layer 2 will bring new utilities to the KAS ecosystem, enabling decentralized apps and scaling the network.

The testnet already shows strong engagement, with over 270,000 active wallet addresses and 14 million transactions processed.

This momentum has attracted fresh investor interest, as reflected by the spike in Google search trends for the project.

Adding to the hype, a well-known investor on X, Sjuul, recently highlighted Kaspa’s strong community support.

“Competing with Bitcoin is tough, but there seems to be a huge community of $KAS users. After scavenging multiple sources, we found that Kaspa achieves an estimated 25k daily users, with over 540,000 unique network users! In total, over 197M transactions and climbing, the Kaspa network seems to be picking up traction. But the question is, can it handle mass adoption?” Sjuul said.

3. Sonic (S)

CoinMarketCap data shows the Sonic (S) community is also bullish, with 83% positive sentiment in August.

At the same time, Sonic’s total value locked (TVL) has dropped 60%, from over $1 billion in May to $415 million in August. Still, investors remain optimistic thanks to new developments. One highlight was co-founder Andre Cronje’s fundraising call for the Flying Tulip DEX.

Flying Tulip is now raising capital. If you are a USA based fund interested in investing, reach out to [email protected]

Flying Tulip is a high-performance full featured exchange, built entirely on-chain, with liquidity powered by a synthetic delta-neutral liquidity pool…

Flying Tulip is built entirely on Sonic’s Layer 1 blockchain. It aims to deliver a full-featured, high-performance decentralized exchange. This development is bullish for S because it expands Sonic’s DeFi toolkit and could attract advanced traders.

In August, Sonic also announced that its Testnet 2.1 integrated Ethereum’s Pectra upgrade, which includes EIPs for gas optimization and account abstraction. The project promises to launch its mainnet soon.

These positive updates boosted sentiment toward Sonic, even though its price only gained a modest 13% since the start of the month.

These three altcoins each have unique reasons behind the bullish sentiment. Sometimes, this Optimism does not directly translate into price rallies. Still, it remains an important factor for investors to consider when rebalancing portfolios.