China’s Yuan-Backed Stablecoin Gambit: Beijing’s Bold Move to Challenge US Financial Dominance

Beijing launches direct assault on dollar hegemony with state-backed digital currency play.

The Digital Yuan Goes Global

China's plotting a stablecoin power move—backed by full faith and credit of the yuan. This isn't some decentralized experiment; it's geopolitical chess with blockchain as the board. The People's Bank drops algorithmic pretenses for cold, hard sovereign backing.

Infrastructure Over Ideology

Forget decentralized dreams—this is centralized efficiency on steroids. Instant settlements, bypassing SWIFT, 24/7 clearance. They're building financial rails that make Western banking look like dial-up. The Belt and Road just got a digital payment corridor.

Wall Street's New Nightmare

Treasury secretaries sweating over their morning coffee. Dollar dominance faces its first real structural threat since the euro—except this one runs on code instead of bureaucracy. The ultimate irony? Capitalism's future being secured by communist party backing.

Because nothing says financial innovation like state-controlled volatility—just ask anyone who's ever tried to short the yuan.

China is Considering Yuan-Backed Stablecoin

According to Reuters, the State Council will review a roadmap later this month to expand yuan internationalisation, including stablecoin pilots in Hong Kong and Shanghai.

If approved, the plan WOULD establish regulatory guidelines, risk controls, and usage targets to counter the overwhelming dominance of US dollar–pegged tokens.

[ ZOOMER ]

CHINA CONSIDERING EXPANDING USE OF YUAN INTO STABLECOIN, TO DISCUSS AT SHANGHAI SUMMIT THIS MONTH: RTRS

China’s move comes as Washington races ahead on stablecoin regulation under President Trump, seen with the GENIUS Act. Dollar-backed coins are cementing their role in crypto trading and cross-border payments.

Stablecoins are digital tokens designed to maintain a constant value, usually pegged to a fiat currency.

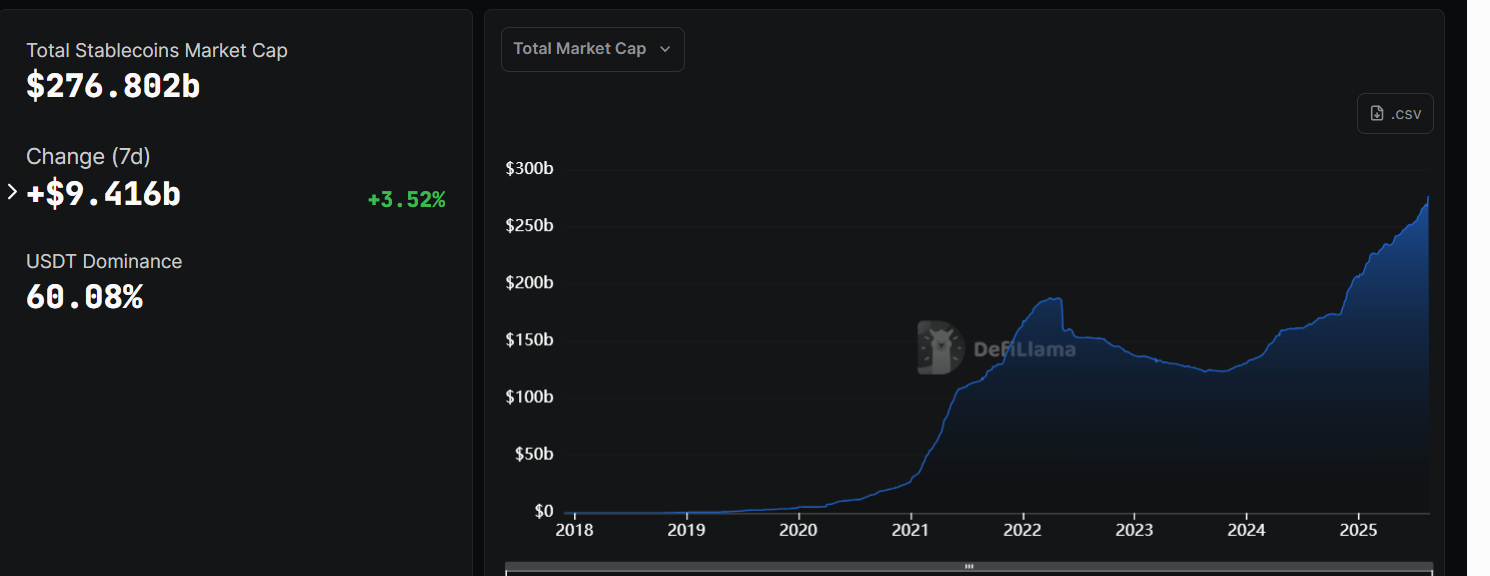

The global market is currently worth around $276 billion, with more than 99% pegged to the US dollar, according to the Bank for International Settlements.

Hong Kong and Shanghai in the Spotlight

Implementation will be fast-tracked in Hong Kong, which rolled out its long-awaited stablecoin ordinance on Aug. 1, and Shanghai, which is building an international hub for digital yuan operations.

Both cities are expected to play a critical role in deploying offshore yuan-denominated stablecoins.

Analysts see the initiative as part of Beijing’s broader push to counter US financial hegemony. Chinese exporters are already using dollar stablecoins at scale, a trend that highlights the yuan’s limited reach in global payments

If adopted, the decision would mark the biggest reversal since Beijing’s 2021 ban on crypto trading and mining. While capital controls remain a structural hurdle, yuan-backed stablecoins could give China new leverage in global finance, particularly in Asia, where Japan and South Korea are also moving forward with fiat-backed token pilots.

More details are expected as Chinese policymakers finalize consultations.