Ethereum Plunge Wipes Out Millions - Traders Reeling From Brutal Dip

Ethereum's sudden nosedive just vaporized seven-figure portfolios across the board—no one saw this coming, or at least no one who mattered.

The Domino Effect

Leveraged positions got liquidated faster than you can say 'decentralized finance.' Stop-losses triggered cascading sells that turned a correction into a bloodbath. Margin calls hit like wrecking balls—zero mercy for overexposed traders.

Market Psychology in Shambles

Fear spreads faster than algorithmic trading bots. The herd panics, dumps holdings, and amplifies the crash. Even 'diamond hands' folded under pressure—everyone's a genius in a bull market until reality bites back.

Silver Linings & Opportunistic Vultures

Bargain hunters already circle, sniffing for discounted ETH. Meanwhile, traditional finance bros smugly adjust their spreadsheets—because nothing says 'I told you so' like a predictable crypto volatility tantrum.

Ethereum’s Market Correction Hits Traders Hard

BeInCrypto Markets data showed that ETH has slipped 7.3% since the beginning of the week. This dip follows the second-largest cryptocurrency’s rise to multi-year highs.

Ethereum’s value has decreased 1.54% over the past day alone. At the time of writing, it was trading at $4,166.

While corrections are typical, they proved costly for those who wagered on the market moving upwards. CoinGlass data revealed total liquidations reached $486.6 million over the past 24 hours.

This figure reflected the liquidation of 136,855 traders. ethereum bore the brunt of the market drop, with $196.8 million in positions liquidated. Of this, $155.15 million came from long positions.

Lookonchain, a blockchain analytics firm, recently spotlighted a trader who profited millions by going long on Ethereum, only to see nearly all those gains wiped out within two days.

The trader began with a $125,000 deposit into Hyperliquid four months ago. He strategically entered long positions on ETH across two accounts. The trader used his profits to boost his position to 66,749 ETH.

With this strategy, his total equity surged from $125,000 to an impressive $29.6 million. Furthermore, earlier this week, this trader closed all 66,749 ETH long positions, securing a profit of $6.86 million.

However, amid the recent market crash, the trader re-entered the ETH market but was ultimately liquidated, losing $6.22 million in the process.

“Starting with just $125,000, he grew his accounts to $6.99 million (peaking $43 million+). Now only $771,000 remains—4 months of gains nearly wiped out in just 2 days,” Lookonchain noted.

James Wynn, a high-risk leverage trader, also experienced partial liquidation. Lookonchain reported that Wynn opened a 25x Leveraged long on ETH after claiming 19,206.72 USDC (USDC) in referral rewards. Nonetheless, as the market went south, his position was partially liquidated.

“James Wynn’s ETH long was partially liquidated, leaving him with a long position of 71.6 $ETH ($300,000),” the post read.

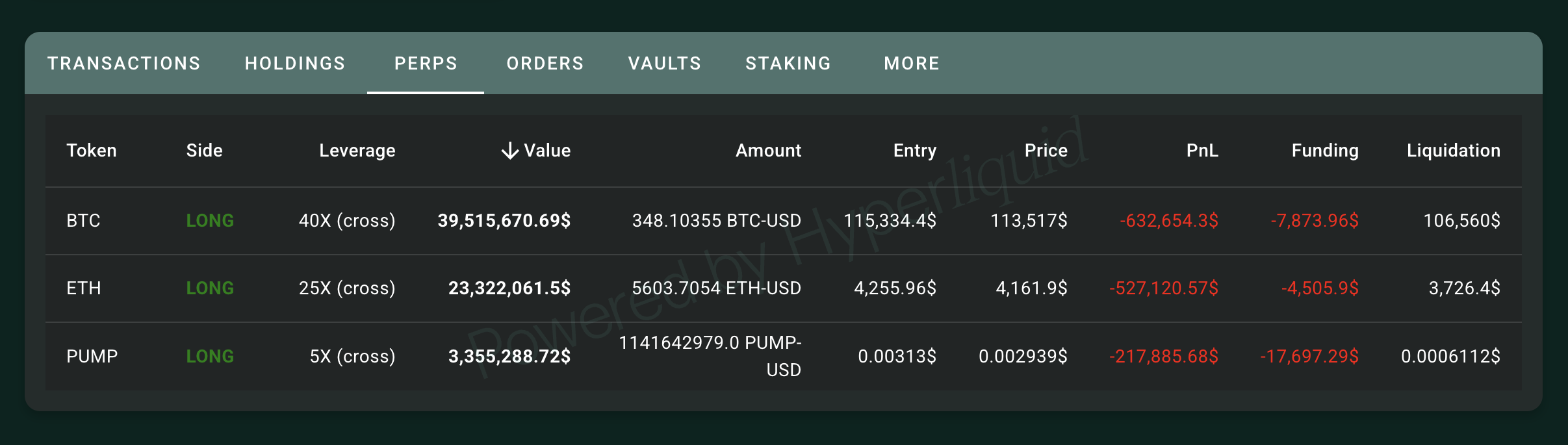

In addition, the blockchain analytics firm noted that a trader made a 1 million USDC deposit into Hyperliquid yesterday. The funds were used to open maximum-leverage long positions on ETH, Bitcoin (BTC), and Pump.fun (PUMP).

Nonetheless, the latest data from HypurrScan showed that the trader now faces unrealized losses exceeding $1 million.

Institutional Investors Are Buying The Dip

Amid the widespread liquidations, institutional investors are capitalizing on the ETH dip. Bitmine Immersion, the largest publicly traded ETH holder, acquired 52,475 ETH, pushing its total ETH holdings to 1,575,848 ETH worth nearly $6.6 billion.

“SharpLink bought 143,593 ETH($667 million) at $4,648 last week and currently holds 740,760 ETH ($3.19 billion). Together with Bitmine, they bought 516,703 ETH($2.22 billion) last week,” Lookonchain wrote.

Additionally, two institution-linked wallets, 0x50A5 and 0x9bdB, received 9,044 ETH, valued at approximately $38 million, from FalconX. Besides buying, panic-selling was also prevalent.

Whales are panic-selling $ETH as the market plummets!

0x1D8d deposited 17,972 $ETH($77.4M) to #Coinbase an hour ago.

0x5A8E deposited 13,521 $ETH($57.72M) to #Binance in the past 12 minutes.

0x3684 deposited 3,003 $ETH($12.89M) to #Binance 20 minutes ago.… pic.twitter.com/oxKPQsl9Nv

This highlights the diverse strategies investors are employing in response to market conditions. Still, institutional buying does signal strong confidence in Ethereum’s long-term potential.