Ethereum Fills Crucial CME Gap: Is $10K ETH the Next Target?

Ethereum just smashed through a critical technical barrier—closing that notorious CME futures gap that traders have been eyeing for months. The move signals serious momentum building beneath the surface.

Why This Gap Matters

CME gaps aren't just chart artifacts—they're psychological battlegrounds where institutional money meets retail sentiment. Filling this one suggests Ethereum's playing in the big leagues now, whether traditional finance wants to admit it or not.

The $10K Question

With the gap cleared, there's little technical resistance left between current levels and that psychological five-figure mark. Traders are repositioning, options are heating up, and the whispers are getting louder—this could be the run everyone's been waiting for.

Of course, Wall Street will probably try to take credit if it happens—nothing like slapping a price target on something after it's already moved 200%.

Buckle up. This isn't just another pump—it's a statement.

CME Gap Closed After Market Decline

Ethereum extended its decline this week, with heavy liquidations hitting long positions as the price dropped from above $4,600 to NEAR $4,000. The move completed the closure of the CME futures gap between $4,050 and $4,100, a level closely tracked by traders.

At the time of writing, ETH trades at around $4,200, down 1% in 24 hours and lower by 9% over the past week. Analyst CW commented,

“long positions on $ETH have been destroyed, and the CME gap has been filled. Now the next target will be the short position.”

$ETH has filled the CME gap.

And a rebound is beginning. pic.twitter.com/XOqY8vD4em

— CW (@CW8900) August 20, 2025

CME futures gaps often act as price magnets. As CryptoPotato reported, the last time ethereum filled a major gap, the asset gained more than 40% in the weeks that followed.

Order book heatmaps show that liquidity around the $4,200–$4,400 range has been absorbed during the decline. With the gap now filled, ETH has begun to stabilize near support levels, raising the possibility of upward pressure on short positions.

Long-Term Breakout on Monthly Chart

Analyst Merlijn The Trader highlighted a major breakout on the monthly timeframe. ETH has moved above a four-year descending resistance line and formed a MACD golden cross. He wrote,

“This isn’t noise. This is liftoff. Next stop: $10,000 Ethereum.”

The breakout ends years of repeated rejections at the same trendline. A confirmed MACD cross is viewed by many chart analysts as a sign of longer-term momentum shifting in favor of buyers.

THE $ETH BREAKOUT EVERYONE WAITED FOR.

Ethereum just shattered a 4-year downtrend.

Monthly MACD golden cross → confirmed.

This isn’t noise.

This is liftoff.

Next stop: $10,000 Ethereum pic.twitter.com/Mm83ZMvCAh

— Merlijn The Trader (@MerlijnTrader) August 19, 2025

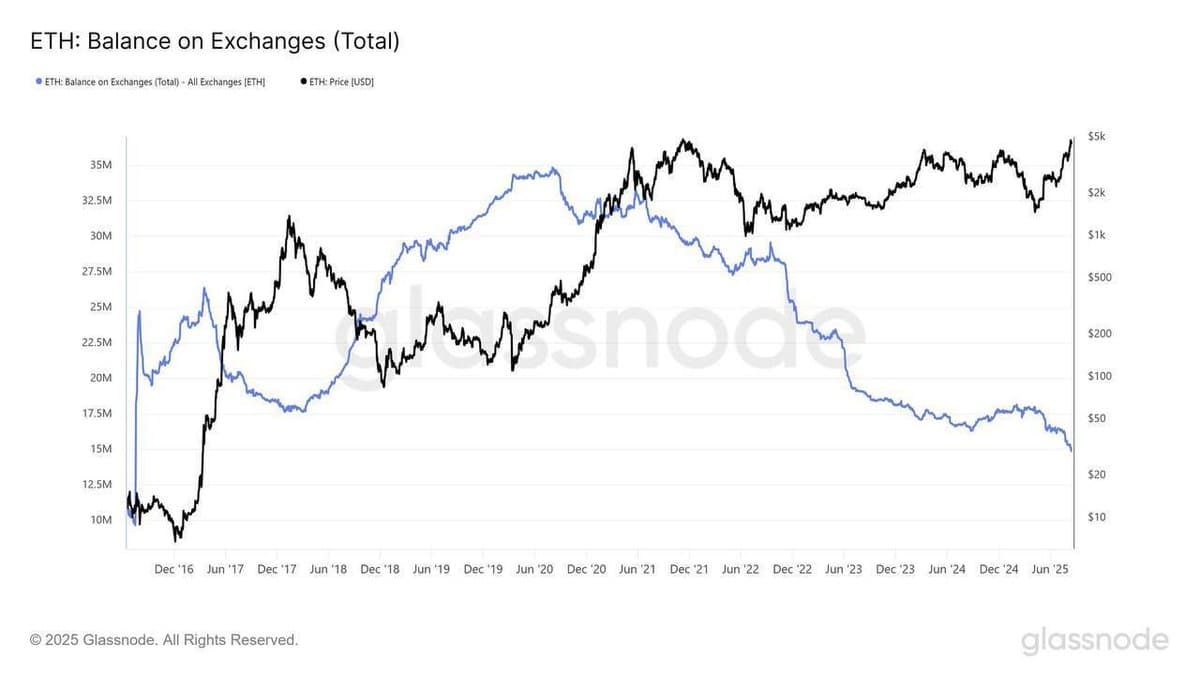

Exchange Supply at Multi-Year Lows

Analyst Cas Abbé pointed to exchange data showing a sharp drop in available ETH.

“$ETH supply on CEX has now dropped to 9-yr low. Big money is buying loads of ETH and then taking it off from the exchanges,” he noted.

According to Abbé, exchange balances are now comparable to levels last seen when ETH traded at $30. They added,

“This seems like an even bigger supply crunch than BTC, and it has not been fully priced yet.”

With exchange supply shrinking and technical patterns turning positive, Ethereum’s price action is being closely tracked for signs of a potential rally.