XRP Primed for Comeback as Selling Pressure Fades – Bulls Take Note

XRP shows signs of shaking off bearish fatigue as technical indicators hint at a potential reversal. Traders eye key levels for confirmation—will the embattled token finally catch a bid?

Market Pulse: After weeks of relentless selling, XRP's oversold conditions are triggering divergence signals. The RSI whisper network suggests exhaustion among sellers, though skeptics warn this could just be another 'dead cat bounce' in crypto's theater of volatility.

Key Levels to Watch: The $0.55 support zone emerges as critical infrastructure. A clean hold here could fuel momentum toward $0.68 resistance—where paper-handed traders traditionally cash out to buy back lower (rinse, repeat).

Macro Context: While XRP's fundamentals remain unchanged—pending regulatory clarity as always—the token's 90-day correlation with BTC now sits at 0.82. Translation: when Bitcoin sneezes, XRP still catches pneumonia.

Closing Thought: If this rebound materializes, credit technicals over fundamentals. If it fails? Well, there's always next week's 'game-changing partnership' announcement to pump the charts.

Percent Supply in Profit Drops; But That’s Historically Bullish

On August 17, XRP’s Percent Supply in Profit stood at 93.53%, the lowest in nearly two weeks. For context, just ten days earlier, on August 7, the same metric had reached its peak at 98.26%.

That’s a clear drop of nearly five percentage points, and it typically signals that fewer holders are sitting on massive unrealized gains.

This is important because when less of the network is in heavy profit, profit-taking slows. On August 5, a similar drop in this metric (94.75%) triggered a jump from $2.97 to $3.32 for XRP in just two sessions.

It repeated on August 11, when a dip to 94.37% preceded a rally from $3.13 to $3.27. With today’s levels NEAR the fortnightly low, the setup for another short-term bounce is here.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

Short-Term Wallets Are Accumulating the Dip

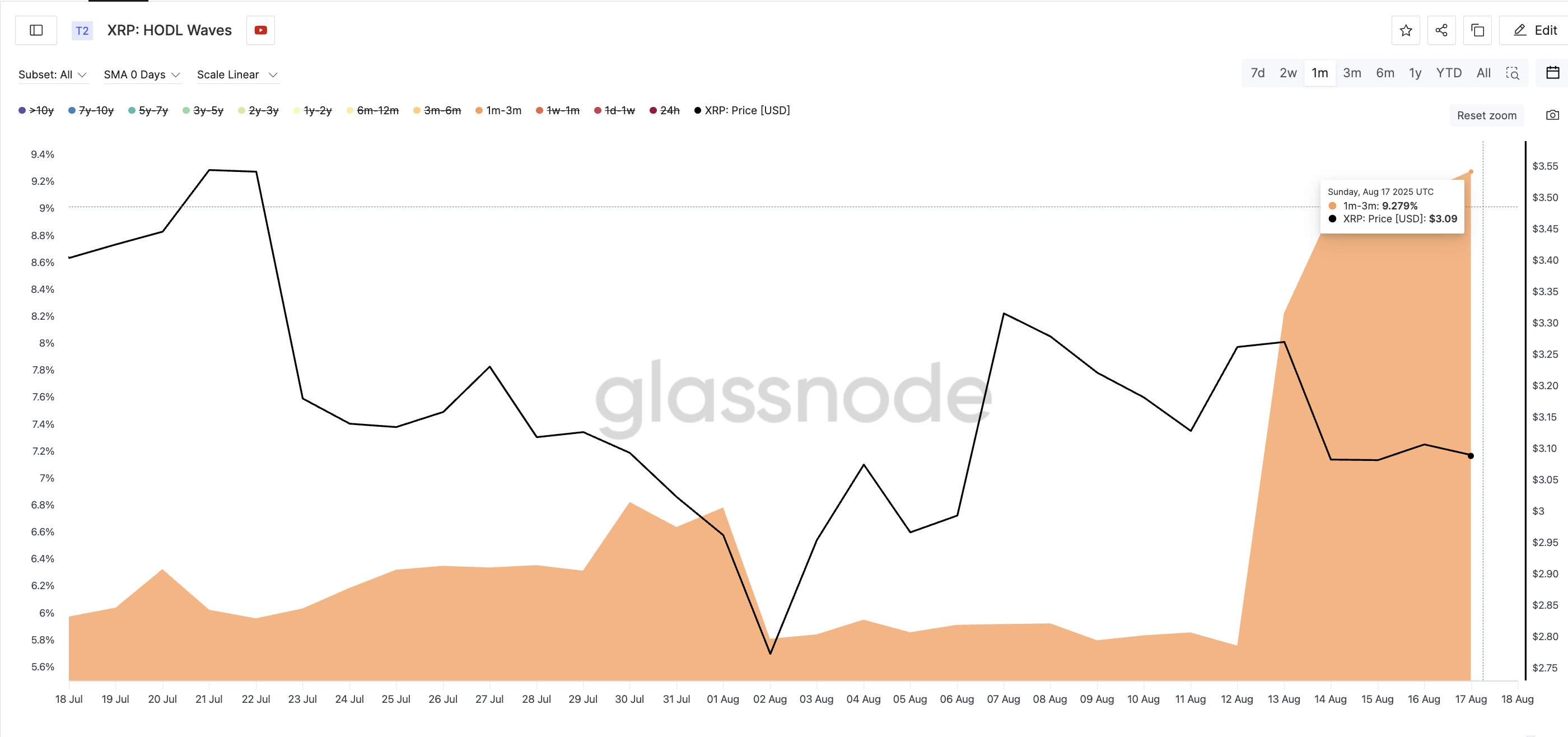

Backing this up is wallet behavior. According to Glassnode’s HODL Waves, the 1-month to 3-month holding cohort has spiked notably after XRP hit its August low of $2.77.

On August 1, the 1m–3m cohort made up just 5.81% of the XRP supply. By August 17, this jumped to 9.28%. This shift tells us that recent buyers are holding, not dumping — and they’re doing it despite volatility and the whale selling narrative.

This kind of behavior usually shows growing conviction. These short-term holders are stepping in during corrections, a pattern that tends to front-run trend reversals. The last time this group grew this quickly, XRP’s price saw sustained upward momentum within a week.

XRP Price’s Bullish Structure Still Intact, But Watch These Levels

Zooming out to the daily chart, the xrp price is still holding inside an ascending triangle — a bullish continuation pattern. Price is currently hovering around $2.96–$3.08, just above the triangle’s base.

Here are the key zones to watch:

- Resistance: $3.15, $3.33, $3.55, and $3.66

- Support: $2.95 (short-term), and $2.72 (final invalidation)

The $3.33 resistance level is easily the strongest, as the XRP price has been rejected at this level quite a few times over the past few days.

If XRP closes below $2.95, the ascending triangle risks a breakdown, but not a full bearish reversal until $2.72 breaks.