Bitcoin Price Prediction 2025: $200K Target in Sight Despite Short-Term Volatility

- Where is Bitcoin's Price Headed in 2025?

- Why Are Institutions Betting Big on Bitcoin?

- What's Driving Bernstein's $200,000 Bitcoin Price Target?

- How Significant is Bitcoin's Integration on X Platform?

- Are There Any Bearish Counterarguments to Consider?

- What Do the On-Chain Metrics Reveal?

- Is Bitcoin a Good Investment in August 2025?

- Frequently Asked Questions

As we navigate mid-August 2025, Bitcoin presents a fascinating dichotomy - technical indicators suggest near-term consolidation while institutional adoption and bullish predictions point to massive upside potential. The cryptocurrency currently trades at $113,223, below its 20-day moving average but finding support at the lower Bollinger Band. Bernstein analysts project a $200,000 price target within 6-12 months, representing a potential 76% upside from current levels. This article breaks down the key technical and fundamental factors influencing BTC's trajectory, including institutional accumulation patterns, regulatory developments, and emerging use cases like Lightning Network integration on social platforms.

Where is Bitcoin's Price Headed in 2025?

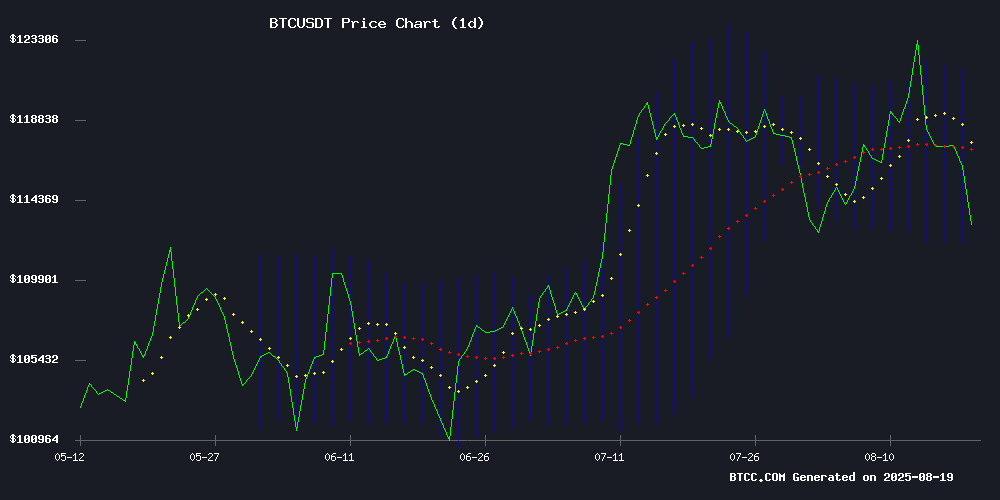

Bitcoin's current technical setup shows a classic consolidation pattern that could precede its next major move. The cryptocurrency sits at $113,223 as of August 20, 2025 - below the psychologically important 20-day moving average of $116,595 but finding tentative support at the lower Bollinger Band of $111,478. The MACD indicator reading of -1,207.72 confirms short-term bearish momentum, though this often precedes reversal periods in Bitcoin's volatile history.

Source: BTCC Trading Platform

What makes this consolidation particularly interesting is the context. We're seeing this technical pattern emerge against a backdrop of unprecedented institutional adoption. Just last week, healthcare firm KindlyMD acquired $679 million worth of bitcoin through its subsidiary Nakamoto Holdings, while Japanese homebuilder Lib Work allocated $3.3 million to BTC as an inflation hedge. This institutional demand creates what market veterans call a "compression spring" effect - where growing fundamental strength meets short-term technical resistance.

Why Are Institutions Betting Big on Bitcoin?

The institutional Bitcoin narrative has evolved dramatically in 2025. What began as a hedge against monetary inflation has transformed into strategic treasury management. KindlyMD's massive $679 million purchase isn't an outlier - it's part of a growing trend of corporations treating Bitcoin as a core reserve asset. Their stated goal of building a "one million BTC treasury" would represent about 5% of Bitcoin's total supply, highlighting how finite supply dynamics are driving institutional FOMO.

MicroStrategy continues leading the corporate adoption charge, now holding 226,331 BTC worth approximately $15.2 billion. Their recent policy shift to allow stock sales for additional Bitcoin purchases even when their modified NAV falls below 2.5x shows how aggressively they're doubling down. As Michael Saylor famously quipped at last month's investor meeting: "We're not accumulating Bitcoin - we're escaping fiat."

| Institution | BTC Holdings | USD Value | Acquisition Date |

|---|---|---|---|

| MicroStrategy | 226,331 BTC | $15.2B | Q2 2024 |

| KindlyMD | 5,743 BTC | $679M | August 2025 |

| Lib Work | ~29 BTC | $3.3M | August 2025 |

What's Driving Bernstein's $200,000 Bitcoin Price Target?

Bernstein's bullish prediction didn't emerge in a vacuum. Their analysts Gautam Chhugani and Mahika Sapra base the $150,000-$200,000 projection on three key pillars:

- Regulatory Tailwinds: President Trump's executive order enabling crypto in 401(k) plans and the SEC's "Project Crypto" initiative have created unprecedented institutional access

- Supply Shock Dynamics: With only 1.5 million BTC left to mine and Asian corporations like VCI Global planning $2.16 billion acquisitions, demand is outstripping new supply

- Monetary Policy: Expected Fed rate cuts (75 basis points projected by year-end) typically benefit hard assets like Bitcoin

Their projection of a bull market extending to 2027 breaks from Bitcoin's traditional 4-year cycles, suggesting this could be the first "super cycle" where institutional adoption fundamentally changes market dynamics. As Chhugani noted in a recent Bloomberg interview: "We're not just seeing hedge funds dip their toes anymore - we're watching corporations rebuild their entire treasuries around Bitcoin."

How Significant is Bitcoin's Integration on X Platform?

The Lightning Network integration on X (formerly Twitter) represents a watershed moment for Bitcoin's utility. With 500 million users now able to tip content creators instantly via BitBit and Spark's infrastructure, we're seeing Bitcoin transition from "digital gold" to a functional payment network. The fees? Fractions of a cent compared to traditional payment processors.

This isn't just about tipping - it's about Elon Musk's vision of transforming X into a WeChat-like super app where financial services blend seamlessly with social networking. Lightspark CEO David Marcus (formerly of PayPal) describes it as "building the financial rails for the internet age." When you combine this with Bitcoin's recent inclusion in traditional finance through 401(k) plans, you get a cryptocurrency that's simultaneously becoming both money and infrastructure.

Are There Any Bearish Counterarguments to Consider?

Not everyone shares Bernstein's optimism. Cyber Capital founder Justin Bons has warned that Bitcoin's security model could collapse within 7-11 years as block rewards diminish. His analysis suggests that when rewards fall to 0.39 BTC (approximately $2.3 billion annually at current prices), the network may become vulnerable to attacks given its trillion-dollar valuation.

There's also the technical reality that Bitcoin remains below its 20-day moving average with bearish MACD momentum. Some traders see this as a warning sign, especially with September historically being Bitcoin's worst performing month. The recent 6.22% pullback from August's $124,128 high shows that even in a bull market, volatility remains ever-present.

What Do the On-Chain Metrics Reveal?

Glassnode's data paints an intriguing picture of market dynamics:

- Conviction Buyers increased 10.1% (933K to 1.03M BTC)

- Loss Sellers spiked 37.8% - the largest divergence from diamond hands since January

- First-time buyers accumulated 50,000 BTC during the recent dip

- Profit-taking hit a 2024 high at 1.83M BTC

This tension between new entrants and veteran profit-taking creates what analysts call a "healthy consolidation." Exchange order books show concentrated bids between $110,000-$113,000, suggesting algorithmic buyers are building invisible support. Meanwhile, whales have accumulated over 20,000 BTC since August 13, often a precursor to upward moves.

Is Bitcoin a Good Investment in August 2025?

The current setup presents both opportunity and risk. At $113,223, Bitcoin trades below key resistance levels but above strong support. The BTCC research team notes that while technicals show short-term weakness, the fundamental case has never been stronger. Their analysis suggests:

| Metric | Current Value | Implication |

|---|---|---|

| Price | $113,223 | Below 20-day MA |

| 20-day MA | $116,595 | Key Resistance |

| MACD | -1,207.72 | Bearish Momentum |

| Bollinger Lower | $111,478 | Support Level |

For investors with a 2-3 year horizon, current levels could represent an attractive entry point before potential Fed rate cuts and continued institutional adoption provide tailwinds. However, the short-term technical picture suggests we might see more consolidation or even a test of lower support levels before the next leg up.

Frequently Asked Questions

What is Bitcoin's price prediction for 2025?

Analysts at Bernstein predict Bitcoin could reach $150,000-$200,000 within 6-12 months (by mid-2026), representing a potential 76% upside from current levels around $113,000. Their projection is based on institutional adoption, regulatory clarity, and Bitcoin's fixed supply schedule.

Is Bitcoin a good investment right now?

Bitcoin presents both opportunity and risk in August 2025. While technical indicators show short-term bearish momentum, the fundamental case remains strong with growing institutional adoption. Investors with a multi-year horizon may find current levels attractive, though short-term volatility should be expected.

Why are institutions buying Bitcoin?

Corporations like MicroStrategy and KindlyMD are accumulating Bitcoin as a hedge against inflation and fiat currency devaluation. Bitcoin's fixed supply of 21 million makes it attractive as treasury reserve asset, especially as governments continue expansive monetary policies.

What are the risks of investing in Bitcoin?

Key risks include price volatility, regulatory uncertainty, technological risks (like potential security model concerns raised by Cyber Capital), and competition from other cryptocurrencies. Bitcoin's price can experience 20%+ corrections even during bull markets.

How does the Lightning Network help Bitcoin?

The Lightning Network enables fast, low-cost Bitcoin transactions by creating payment channels off the main blockchain. Its integration on X platform demonstrates Bitcoin's potential as a payment network, not just a store of value.

What's the best way to buy Bitcoin?

Bitcoin can be purchased through regulated cryptocurrency exchanges like BTCC, brokerage accounts offering crypto exposure, or Bitcoin-specific investment products like ETFs. Always ensure you're using a reputable platform with proper security measures.