XRP’s Silent Storm: On-Chain Whispers Signal Imminent Explosion

Sleeping giant or ticking time bomb? XRP's eerie calm hides seismic on-chain activity.

Beneath the surface

While traders yawn at sideways price action, blockchain sleuths spot unusual accumulation patterns—the kind that typically precede violent moves. Whale wallets are filling faster than a hedge fund's offshore account.

The breakout equation

Liquidity pools show thinning resistance levels. Exchange reserves hit 18-month lows—fewer coins available to sell means sharper rallies when demand returns. Technicals scream 'compression' while fundamentals whisper 'partnership pipeline.'

Bankers hate this one trick

XRP's institutional adoption play bypasses Wall Street's usual gatekeepers. Swift executives reportedly popping antacids as Ripple's cross-border solution gains traction (but don't expect them to admit it).

Whether this ends in a 30% pump or another 'buy the rumor' disappointment, one truth remains: in crypto, quiet never lasts.

Selling Pressure Eases on XRP

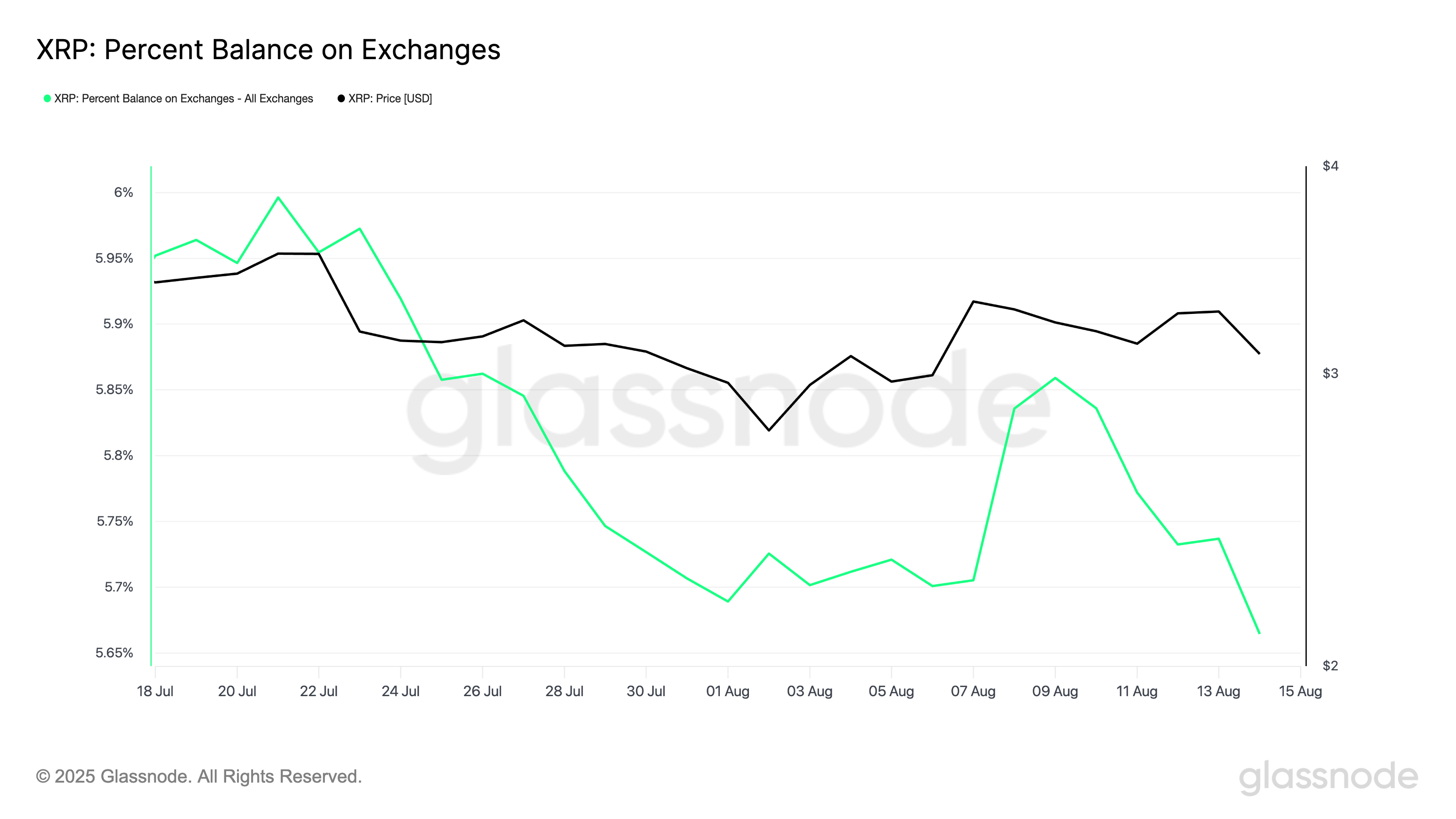

According to Glassnode, the percentage of XRP’s circulating supply held on centralized exchanges has fallen in recent days. Now at a monthly low of 5.66%, it has dropped by 3% since August 9.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

When the percentage of an asset’s circulating supply on centralized exchanges declines, fewer tokens are readily available for immediate selling. This reduction in exchange balances signals that investors are moving their holdings to long-term storage, reflecting increased confidence in the asset’s future price performance.

For XRP, the drop to a monthly low suggests that selling pressure is easing. This is significant given the token’s current sideways trend, as diminished sell-side liquidity may provide the conditions for a near-term breakout.

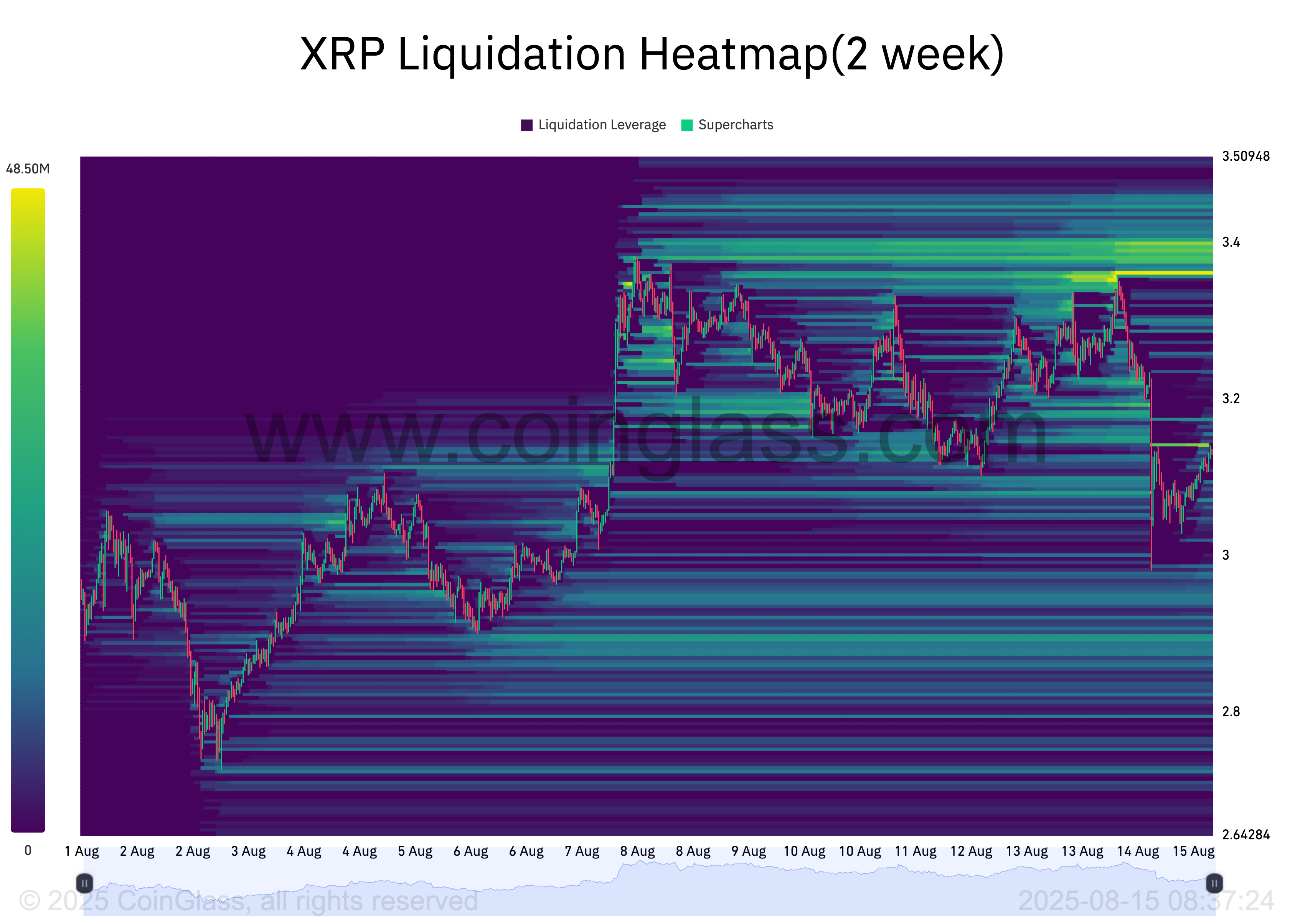

Further, XRP’s liquidity heatmap shows a dense concentration of capital just above its current price level, at $3.4.

Liquidation heatmaps identify price zones where clusters of Leveraged positions are likely to be liquidated. Historically, these capital clusters attract short-term bullish momentum as traders look to exploit these liquidity zones.

Therefore, this could act as a price magnet, drawing XRP higher to trigger liquidations and fill these orders.

XRP Eyes Upside to $3.66 as Market Faces Pullback Pressure

Today’s broader market decline has pushed XRP to trade NEAR support at $3.11. Strengthening bullish bias could drive an uptrend toward $3.34. A successful breach of this barrier could open the door for extended gains to $3.66.

On the other hand, if the support floor holding XRP’s consolidation fails and the token falls below the channel, bearish momentum could take over.

In such a scenario, XRP’s price could fall below the key $3 psychological level. It may even test $2.98 before finding some balance.