Bitcoin’s New Investors Dig In as Bulls Target $122K—Is This the Next Leg Up?

Bitcoin’s fresh hodlers aren’t blinking—even as the king crypto flirts with a potential moonshot to $122,000. Here’s why the smart money’s betting on a breakout.

The Diamond-Hand Brigade

Retail FOMO meets institutional muscle as Bitcoin’s latest wave of buyers refuses to sell. Meanwhile, whales are quietly accumulating—because nothing says ‘trust the process’ like nine-figure bets in a market that still can’t decide if it’s a commodity or a tech stock.

Technical Tailwinds or Wishful Thinking?

On-chain metrics scream accumulation, but let’s be real—since when did fundamentals ever stop crypto from a 30% nosedive before breakfast? Still, the $122K target isn’t just hopium: it’s the 1.618 Fib extension from the 2024 lows, and traders love a good Fibonacci fairy tale.

The Cynic’s Corner

Sure, the ‘number go up’ thesis works until it doesn’t. Remember 2022? Neither do the hedge funds now piling in—their risk models run on ‘vibes’ this cycle anyway.

Short-Term Holders Could Be Fuel for Bitcoin’s Next Rally

BTC STHs (investors who have held their coins for 155 days or less) have reduced their selloffs and gradually fallen into an accumulation pattern even as the market’s volatility climbs.

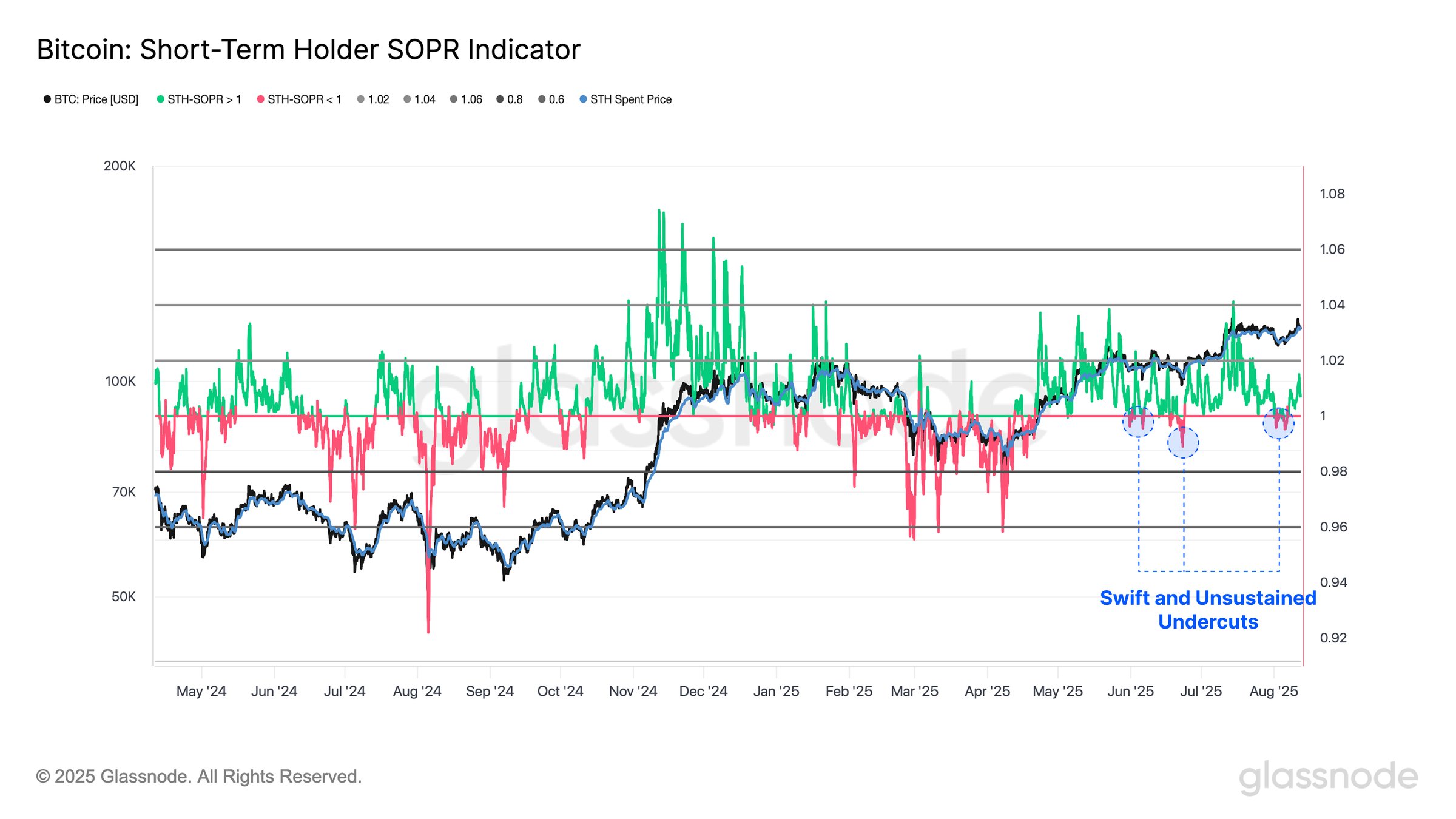

This is reflected by the coin’s STH Spent Output Profit Ratio (STH-SOPR) metric, which briefly dipped below the neutral line but has rebounded, per Glassnode.

The STH-SOPR metric measures whether coins moved by STHs are being sold at a profit or a loss. When it stays above the neutral one level, STHs sell at a profit, signaling strong market sentiment. On the other hand, when it drops below one, these investors are distributing their coins at a loss.

The movement of BTC’s STH-SOPR above the neutral line is noteworthy because STHs are among the most influential participants in BTC’s price movements. With their cost bases often close to the current market price, STHs are usually the first to react to swings. They worsen selloffs during downturns or improve rallies when they hold or accumulate.

Therefore, their decision to revert to a holding pattern, despite sharp price fluctuations, reflects a degree of conviction that can help stabilize the market.

Bitcoin’s Aggressive Buyers Absorb Sell Pressure

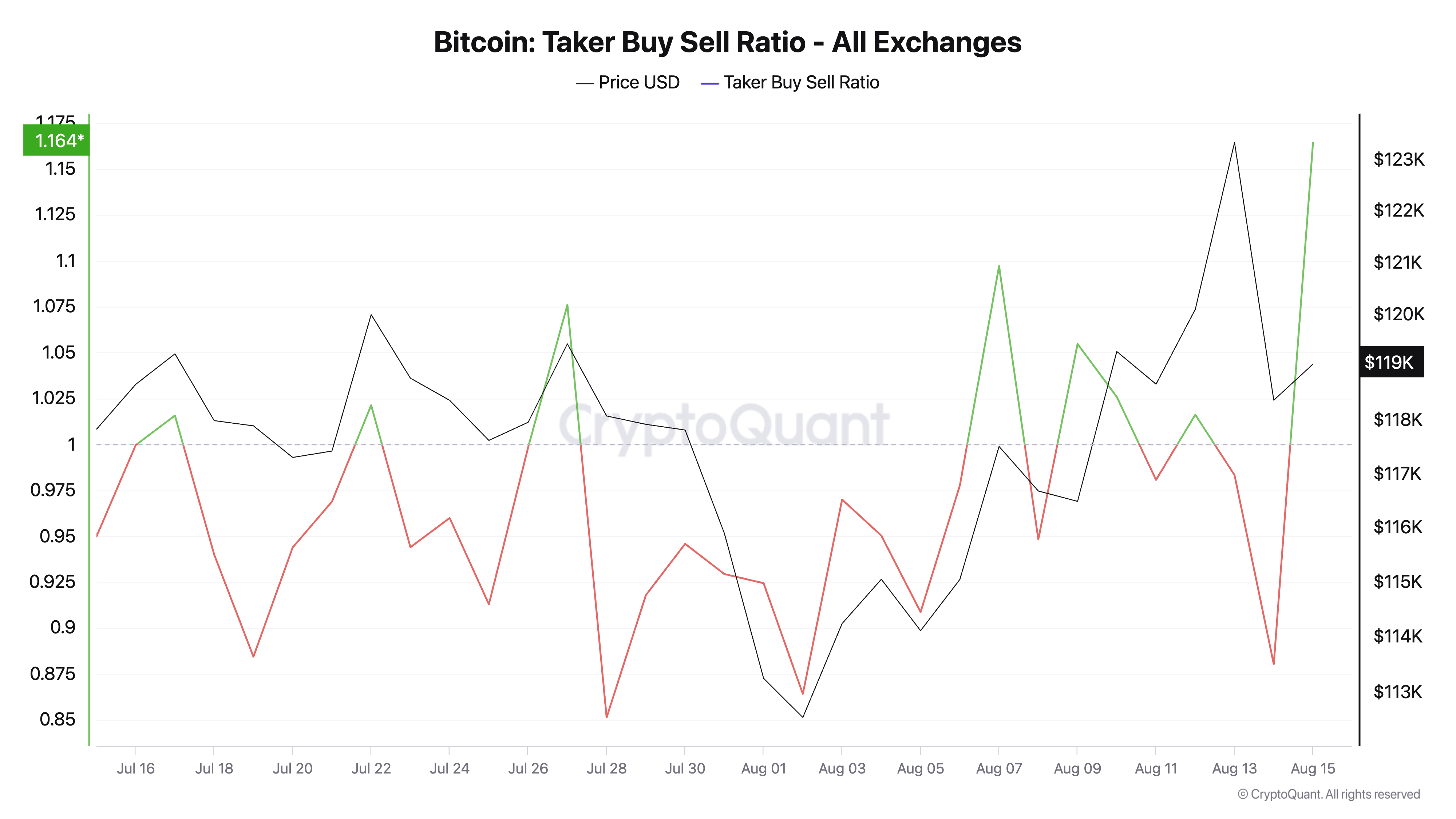

Bitcoin’s taker-buy/sell ratio has climbed to a monthly high of 1.16, confirming the bullish tilt in sentiment among derivatives traders.

The ratio measures the balance between market buy orders and sell orders on futures and perpetual contracts. A value above one means that more trades are executed at the ask price (market buys) than at the bid price (market sells), signaling stronger buyer aggression.

BTC’s current taker-buy/sell ratio means buyers in its derivatives market are actively absorbing sell-side liquidity. This shows growing demand and highlights strengthening conviction, which could drive a rebound.

$122,000 Breakout or Drop to $115,000?

If these trends persist, the king coin BTC could be back on track to retest the $122,000 level in the NEAR term. A breach of the resistance at $122,190 could trigger a rebound toward its all-time high of $123,731.

However, if volatility strengthens and bullish conviction weakens, sell-side pressure could increase, causing a price drop to $115,892.