$1B+ Crypto Bloodbath: PPI Shockwave Triggers Mass Liquidations

Crypto markets got steamrolled today—another 'transitory' inflation surprise sent traders scrambling. The PPI gut-punch vaporized over $1 billion in leveraged positions before lunch.

Longs got rekt (again)

Another 'hedge against inflation' narrative dies screaming as crypto proves it'll drop faster than a Wall Street banker's moral compass during earnings season. BTC led the plunge, dragging altcoins through algorithmic stop-loss hell.

Silver lining? At least the Fed can't blame 'speculative crypto froth' this time—traditional markets tanked harder. Maybe Powell will finally admit his printer went brrr too long.

Crypto Market Sees Over $1 Billion in Liquidations After PPI Report Fallout

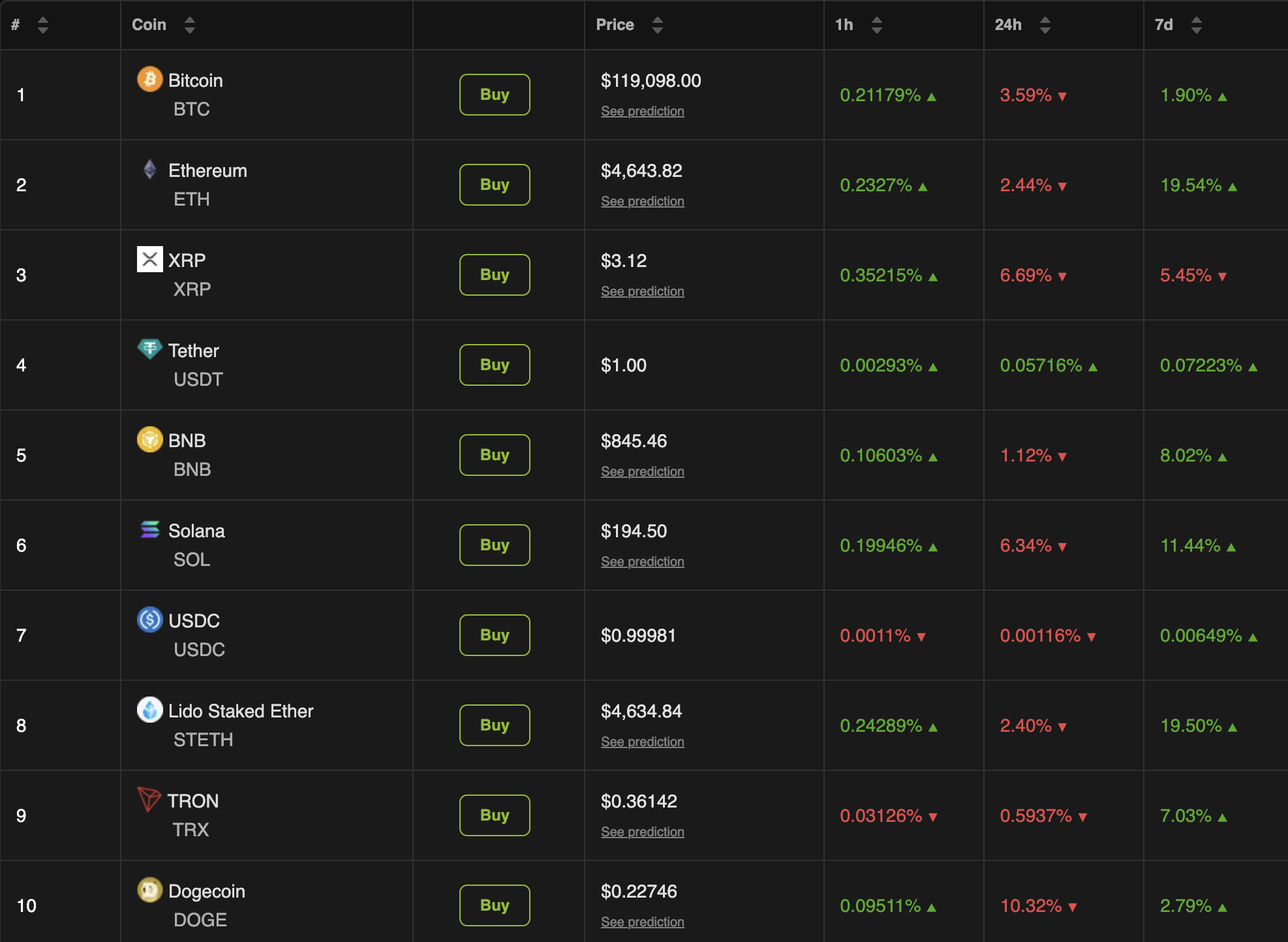

BeInCrypto Markets data showed that the market fell by 3.9% over the past day. All top ten coins except Tether (USDT) saw losses.

Bitcoin (BTC) slipped to $119,098 at press time, after hitting a new all-time high of over $123,700 yesterday.

Ethereum (ETH) also dipped to a low of $4,452 yesterday, before adjusting to a press time value of $4,643. Still, it was down 2.4% over the past day.

Furthermore, Dogecoin (DOGE) experienced the biggest loss among the top ten coins. Its value declined 10.3%. This market downturn triggered massive liquidations.

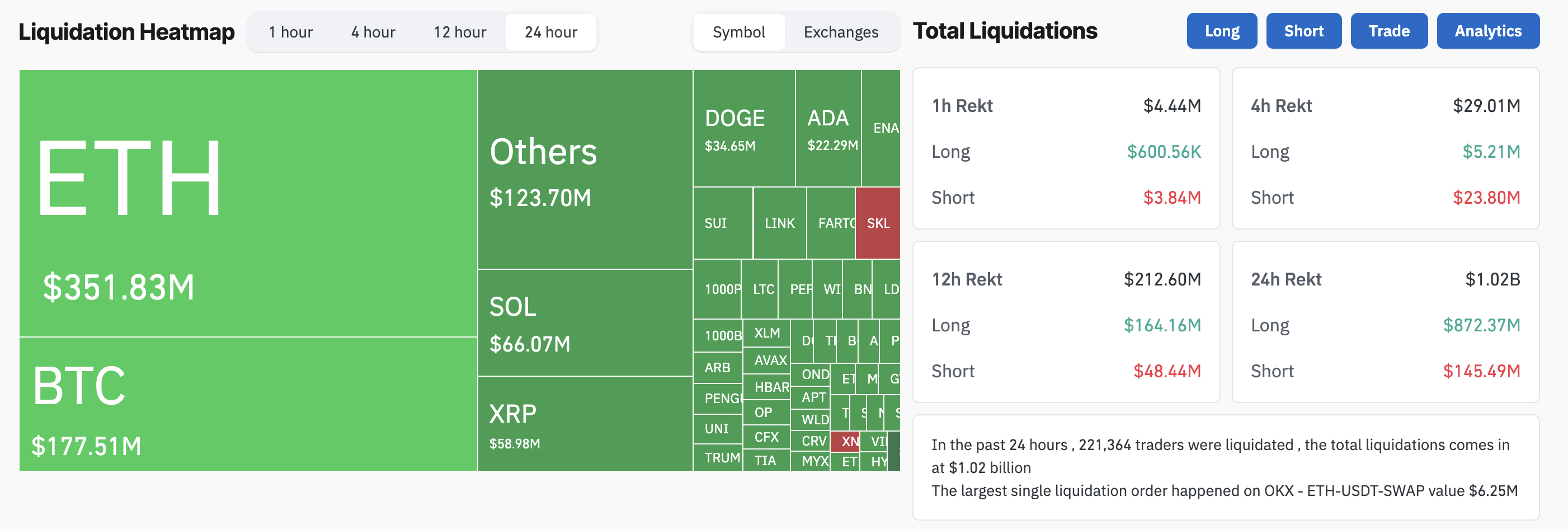

According to Coinglass data, $1.02 billion in crypto positions were liquidated within 24 hours, affecting 221,364 traders. Long positions accounted for the lion’s share of the losses, with $872.37 million liquidated.

Meanwhile, short positions saw $145.49 million in liquidations. This suggested that the market moved against those who anticipated price increases.

Ethereum recorded the highest liquidations, amounting to $351.8 million. This included $272.47 million from long positions and $79.36 million from short positions.

But what set off this rapid market collapse and liquidation spree? According to prominent crypto expert Michaël van de Poppe, it’s the PPI data.

“There’s always ‘whatever news’ causing the markets to drop. The ‘whatever news’ is PPI. It’s just liquidations after liquidations on long positions on altcoins, that’s why the correction is vital and steep,” he posted.

The Bureau of Labor Statistics published the July PPI report on August 14. The PPI index jumped 0.9%. This exceeded economists’ expectations of a 0.2% rise. Furthermore, the PPI climbed 3.3% year over year.

“On an unadjusted basis, the index for final demand advanced 3.3 percent for the 12 months ended in July, the largest 12-month increase since rising 3.4 percent in February 2025,” the report read.

![]() PPI RISES TO 3.3%

PPI RISES TO 3.3%

HIGHER THAN EXPECTATIONS.

BEARISH FOR MARKETS. pic.twitter.com/j0FSOafK4d

This hotter-than-expected data is bearish for crypto because it signals strong inflationary pressures. This, in turn, can lead to tighter monetary policy and higher interest rates.

This reduces liquidity, making traditional investments more attractive and potentially causing a pullback from riskier assets like cryptocurrencies. Structural factors further exacerbated the market’s fragility.

A recent Glassnode post highlighted that open interest in altcoins had reached an all-time high, making the market particularly vulnerable.

“This concentration of leverage elevates reflexivity, amplifying both upside and downside price reactions and increasing fragility in market structure,” Glassnode wrote.

In addition, comments from US Treasury Secretary Scott Bessent could also be a factor contributing to the bearish sentiment. Bessent recently stated that the US Strategic Bitcoin Reserve will only be funded with seized assets and not through new purchases.

Thus, the confluence of a high PPI index, vulnerabilities in the crypto market, and policymakers’ signals created a perfect storm for the crypto liquidations. Now, the broader market remains on edge, with investors closely monitoring upcoming economic data and Federal Reserve actions for further clues on monetary policy direction.