Pi Coin Exodus Accelerates as Bitcoin Correlation Craters – What’s Next for Holders?

Pi Coin’s loyalty crisis deepens as holders flee—divergence from Bitcoin hits record levels. Is this the end of the 'easy mining' dream?

Once hailed as Bitcoin’s grassroots cousin, Pi Coin now faces a brutal reality check. The token’s correlation with BTC has nosedived, triggering a sell-off that’s turning into a stampede.

The great decoupling

Pi’s 30-day correlation coefficient with Bitcoin now sits at laughable levels—so much for ‘digital gold lite.’ Traders are voting with their wallets, dumping the asset faster than a hot Satoshi.

Exit strategy or exit scam?

With mainnet delays becoming a running joke and zero exchanges offering real liquidity, Pi holders are discovering the hard truth: mining tokens on your phone doesn’t magically create value. Who could’ve guessed?

The project’s cheerleaders point to ‘upcoming partnerships’—the crypto equivalent of a kid promising to clean their room tomorrow. Meanwhile, Bitcoin keeps eating the market’s lunch while altcoins like Pi play musical chairs.

Final thought: In crypto, correlation trades work until they don’t. And when the music stops, the ‘free token’ brigade always gets left holding empty bags.

Pi Coin Investors Back Away

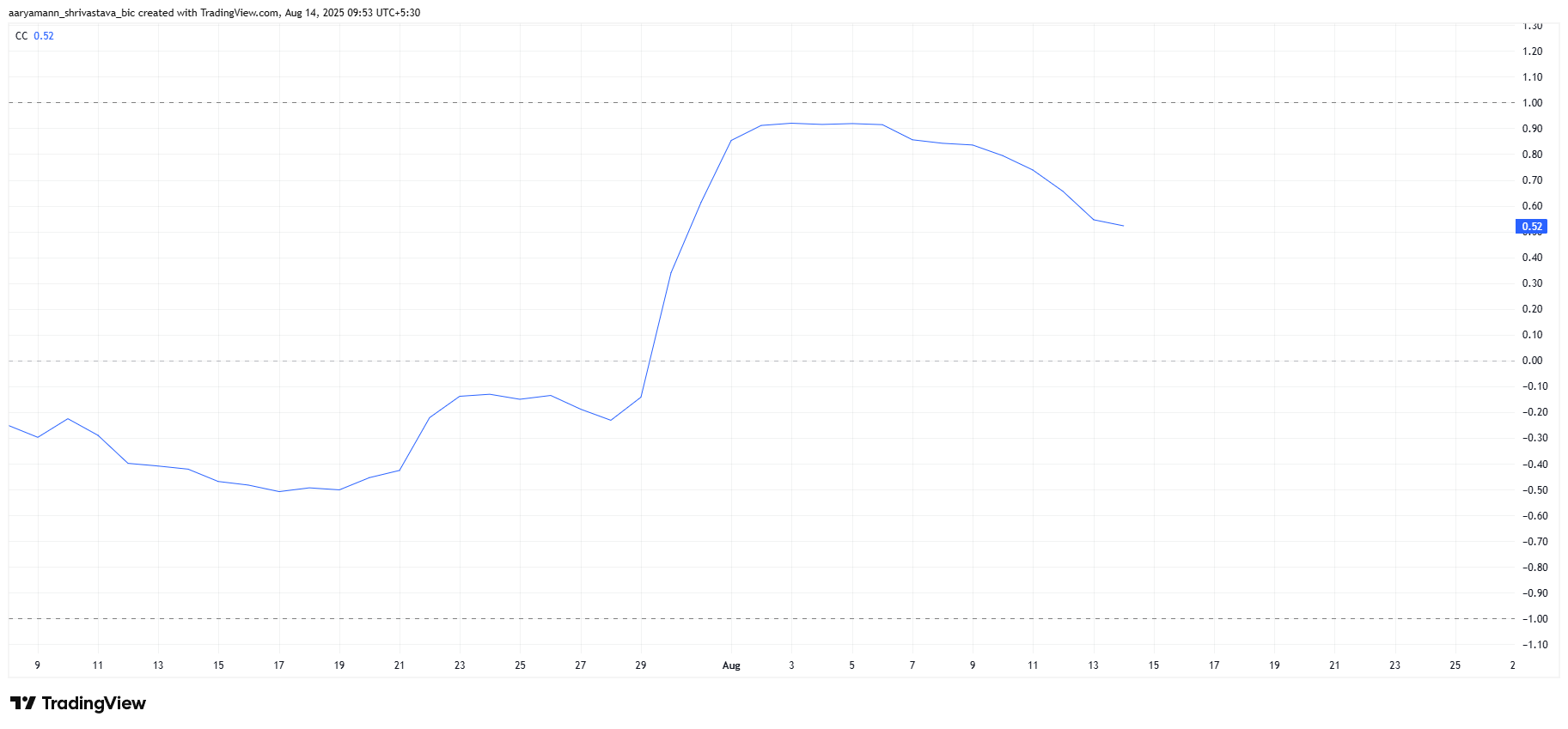

Pi Coin’s correlation with Bitcoin has been declining, now standing at just 0.52. This reduction in correlation is especially troubling given Bitcoin’s recent surge, which saw the cryptocurrency form a new all-time high (ATH) within the last 24 hours.

The weakening correlation between Pi Coin and Bitcoin means the altcoin is struggling to find direction. As Bitcoin’s price soars, Pi Coin’s failure to align with its movements signals that investor confidence may be waning. With Bitcoin in a strong bullish phase, Pi Coin’s detachment from this trend casts doubt on its short-term recovery prospects.

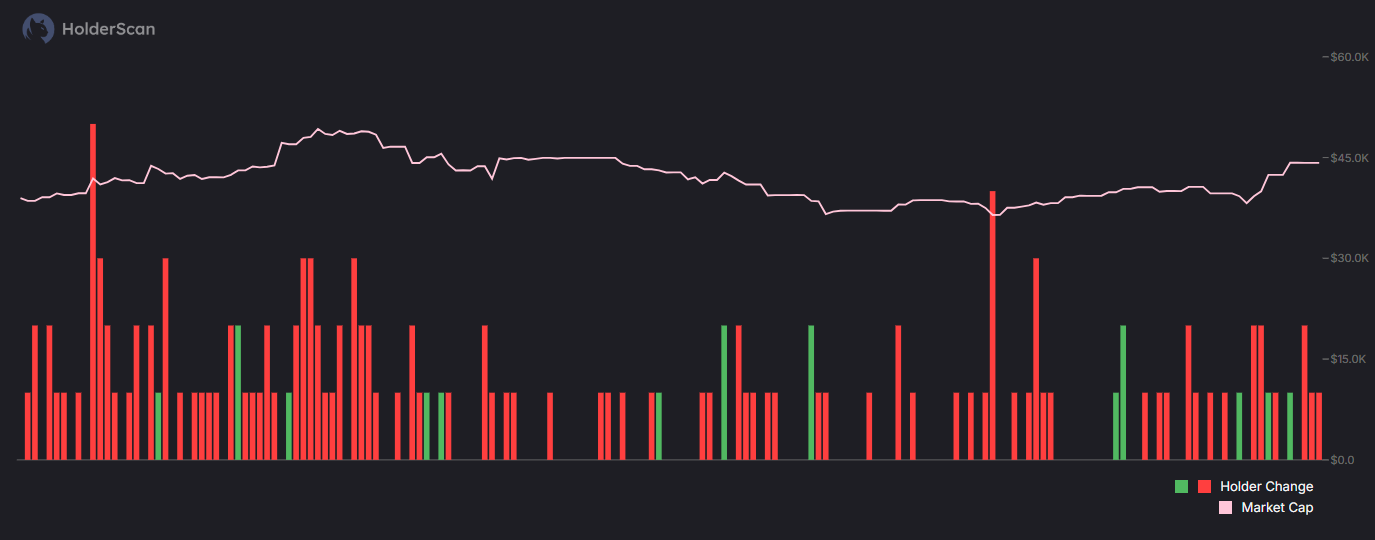

Investor sentiment surrounding Pi Coin has turned increasingly negative, with a noticeable trend of exits from the network over the past few days. As Pi Coin nears its ATL, many investors are losing faith in the altcoin’s future potential. This behavior is contributing to the overall decline, further driving the price down.

The ongoing investor exits are a sign of growing pessimism, as holders are losing interest. PI Coin’s proximity to its ATL is intensifying the bearish outlook. With such a significant loss of confidence, Pi Coin faces an uphill battle to regain investor trust and reverse its current trend.

PI Price May Not Escape

At present, Pi Coin is priced at $0.40, attempting to hold above this level as support. While the price is distancing itself from its ATL, it remains trapped in a persistent downtrend. Unless there is a significant shift in investor sentiment, Pi Coin may struggle to break free from this ongoing decline.

Given the continued bearish behavior from investors, Pi Coin’s price may drop further towards the next support level at $0.36. If this support level fails to hold, Pi Coin could head back toward its ATL of $0.32, erasing recent gains and possibly setting the stage for further losses.

However, if Pi Coin can successfully bounce off the $0.40 support, there may be a chance for a rebound. A rise above this level could break the downtrend and push Pi Coin toward $0.44. This move WOULD be crucial for Pi Coin’s recovery, but it would require significant investor confidence and buying pressure to materialize.