Polkadot Primed for Breakout: Why This Staked & Undervalued Altcoin Is Outpacing the Market

Polkadot’s ecosystem is heating up—just as the altcoin market hits a boiling point. With staking rewards stacking up and network activity surging, DOT’s fundamentals scream undervalued. Yet Wall Street still hasn’t caught on. Typical.

Here’s why smart money is betting on Polkadot while traditional finance snoozes.

The Staking Advantage

Polkadot’s proof-of-stake model isn’t just secure—it’s lucrative. Validators and nominators are raking in yields that leave legacy savings accounts in the dust. Meanwhile, ETH 2.0 stakers are still waiting for their payday.

Parachains: The Silent Growth Engine

Auction after auction, Polkadot’s parachain slots fill with projects shipping real utility. No vaporware here—just developers building at hyperspeed while other chains drown in memecoin mania.

The Price Paradox

Despite network growth outpacing most Layer 1s, DOT’s valuation lags behind its peers. Either the market’s asleep at the wheel—or this is the last chance to buy before the herd arrives. (Spoiler: It’s both.)

Polkadot isn’t just another altcoin. It’s a staking cash machine with a multi-chain future—trading at a Black Friday discount while bankers pile into overpriced ‘safe’ assets. Their loss.

Is DOT The Market’s Dark Horse in This Cycle?

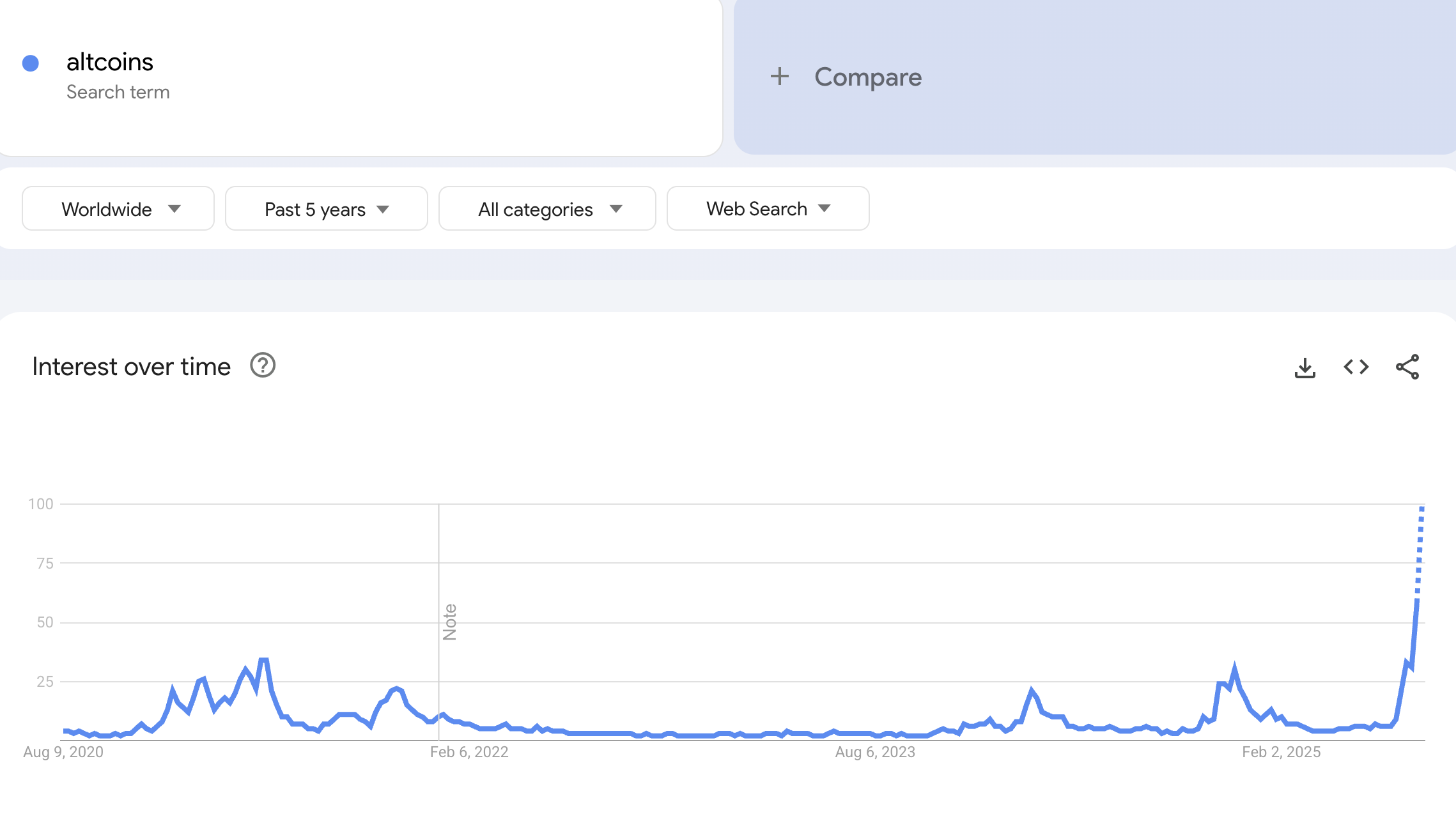

At present, altcoins are capturing the market’s attention. Searches for “altcoin” on Google Trends have hit a record high.

Against this backdrop, Polkadot (DOT) appears to be overlooked in the current bullish cycle. DOT is trading around $4.15, over 92% below its all-time high in 2021. This deep decline has led many investors to doubt the project’s potential.

In addition, a user on X highlighted lingering issues in the project’s tokenomics. DOT experiences a high inflation rate and relatively large internal staking rewards. However, weak demand drivers outside staking indicate that pressure from new token issuance persists.

Nevertheless, recent analyses suggest that DOT is well-positioned for an upswing, supported by an expanding ecosystem and bullish technical indicators.

Data shows the network remains active and stable, with over half of DOT’s total supply locked in staking. This is a key factor in reducing sell pressure and creating conditions for price recovery.

Analysts Eye $10 by September 2025

From a technical standpoint, the short-term outlook appears promising. After breaking through the $4.30 resistance level and forming a higher low, DOT has confirmed the potential continuation of its uptrend. Analysis from LennaertSnyder projects the next reasonable target at the $5.30 peak.

Meanwhile, Joao Wedson believes the market may have already accumulated enough tokens. He suggests that prices are now simply waiting for a positive catalyst to trigger a strong rally that could wipe out short sellers. Such a catalyst could be the approval of a DOT ETF.

“DOT (Polkadot) has all the chances to be the next altcoin to liquidate the bears. Market makers have probably accumulated enough, and I believe some news will soon emerge to explain the effect. But the cause has already been set!” Joao commented.

Some analysts, such as CryptonautX, are even eyeing a breakout toward $10 by September 2025 if the current bullish momentum holds. Achieving this WOULD require a combination of factors: improved real-world demand for DOT, fresh capital inflows, and major announcements from the project.

In the long run, Polkadot must prove that its parachain ecosystem and cross-chain connectivity technology can attract more users, developers, and liquidity to ensure DOT’s value is not solely reliant on staking activity.