🚀 OKB Explodes 163% as OKX Drops Game-Changing News – Here’s Why Traders Are FOMOing

Hold onto your ledgers—OKX just pulled the trigger on a historic announcement, and OKB’s price is moonshotting past 163%. No, your portfolio isn’t hallucinating.

The Catalyst:

While Wall Street snoozes on legacy assets, OKX’s bombshell (details under NDA, naturally) sent the exchange token into orbit. Suddenly, that "utility token" label feels quaint.

Market Frenzy:

Trading volumes went vertical faster than a degens’ leverage position. Pro tip: When CEX tokens pump this hard, someone’s either printing money or lining up exit liquidity—place your bets.

The Punchline:

Another day, another crypto asset defying gravity while traditional finance nerds argue about P/E ratios. Wake us when the SEC tries to classify this rally as a security.

OKX Announces Token Burn and X Layer Upgrade: All You Need to Know

According to on-chain data and statements from OKX, the exchange permanently removed 65,256,712.097 OKB tokens, worth billions of dollars, from circulation in a single transaction.

The burned tokens came from historical buybacks and treasury reserves. As is typical of token burns, they were sent to a “black hole” address, making them irretrievable.

In a break from past practice, OKX exchange confirmed it will end all manual burns. Further, the exchange will adopt an automatic smart contract burn mechanism instead.

This permanently fixes OKB’s total supply at 21 million, mirroring Bitcoin’s scarcity model. Once the smart contract upgrade is completed, both minting and manual burning will be disabled.

Strategic X Layer Overhaul

The announcement was part of a broader “PP Upgrade” to OKX’s X Layer, a public chain built with Polygon’s zkEVM technology.

The upgrade boosts transaction throughput to 5,000 TPS, slashes gas costs to negligible levels, and enhances compatibility with Ethereum.

OKX outlined a clear focus on DeFi, global payments, and real-world asset (RWA) tokenization, backed by ecosystem funds, liquidity incentives, and infrastructure upgrades such as improved cross-chain bridges and compliance services.

Further, OKX will also phase out its OKTChain due to its overlap with the X Layer. Trading in OKT will halt on August 13, 2025. The exchange automatically converts OKT to OKB based on the average closing prices between July 13 and August 12, 2025.

“OKTChain will fully shut down by January 1, 2026,” an excerpt in the announcement alluded.

Nevertheless, OKB will remain the sole gas token for X Layer. The ethereum Layer-1 (L1) version of OKB will be phased out in favor of the X Layer version.

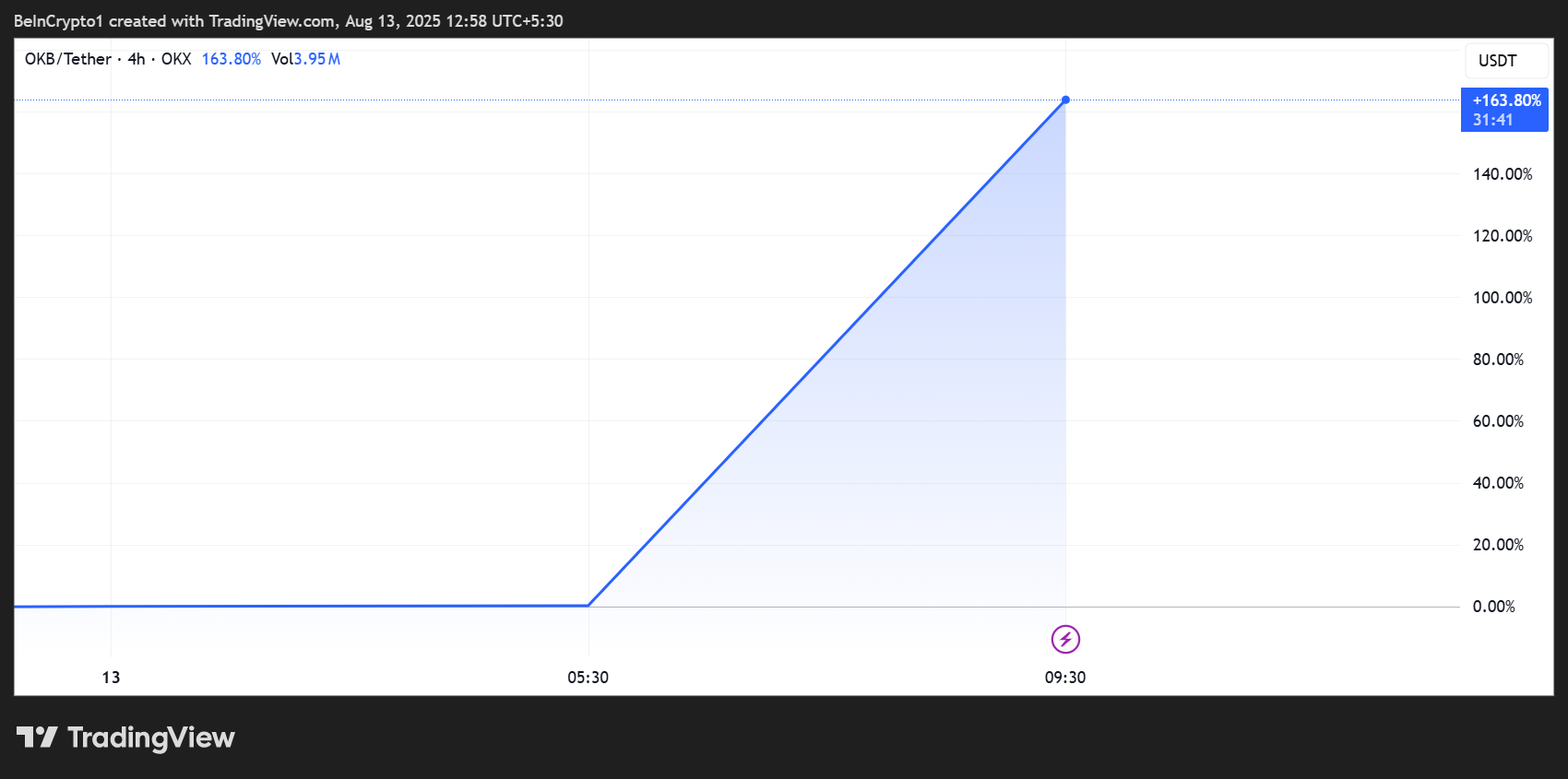

OKX Rallies 163% Amid Positive Market Reaction

Crypto trader Henry hailed the burn, crediting OKX CEO Star Xu for the bold supply-cut decision. Extreme scarcity, technological upgrades, and ecosystem expansion ignited frenzied buying, pushing OKB into record territory.

“As expected of you, Star, Boss Xu, with a technical background, it feels like this MOVE was probably your suggestion,” Henry remarked.

Following the announcement, OKB Price rallied 163% to establish a new ATH of $142.88. The explosive rally comes as token burns reduce supply, thereby bolstering demand.

The token retraced slightly from its new peak, as traders rushed to book early profits. Still, analysts note that a fixed 21 million cap combined with growing utility in DeFi, payments, and RWA markets could provide a strong foundation for sustained price momentum.

Meanwhile, it is worth mentioning that such parabolic moves often invite volatility. Also, whether OKB can hold onto its new valuation will depend on how quickly developers and users adopt X Layer’s expanded capabilities.

With the X LAYER upgrade now live and the largest OKB burn in history complete, OKX appears to be positioning its ecosystem as a major player in high-throughput, low-cost blockchain infrastructure.