Shiba Inu Holders Bail Faster Than Ever—Is This the Start of a Death Spiral?

Dogecoin’s fiercest rival is bleeding loyalty—fast. Shiba Inu’s average holding time just got slashed in half, sending the meme token tumbling toward uncharted lows. Here’s why the ‘diamond hands’ are crumbling.

### The Great SHIB Sell-Off

Traders are dumping Shiba Inu like last season’s NFT profile pics. With holding periods collapsing from weeks to days, the token’s price is buckling under relentless sell pressure. No one’s HODLing anymore—just ask the charts.

### Meme Coin or Sinking Ship?

Once hyped as the ‘Dogecoin killer,’ SHIB’s volatility now resembles a distressed crypto hedge fund. Retail investors are fleeing, whales are circling, and the so-called ‘Shiba Army’ looks more like a disorganized retreat. Pro tip: When the holding time halves, the fun’s usually over.

### The Bottom Line

Shiba Inu’s latest plunge proves even meme coins face gravity—especially when the ‘community’ treats tokens like hot potatoes. Maybe they’ll rebound when crypto bros find another animal to shill. Until then? Enjoy the dip—or the dumpster fire.

SHIB Investors Shift to Short-Term Profits

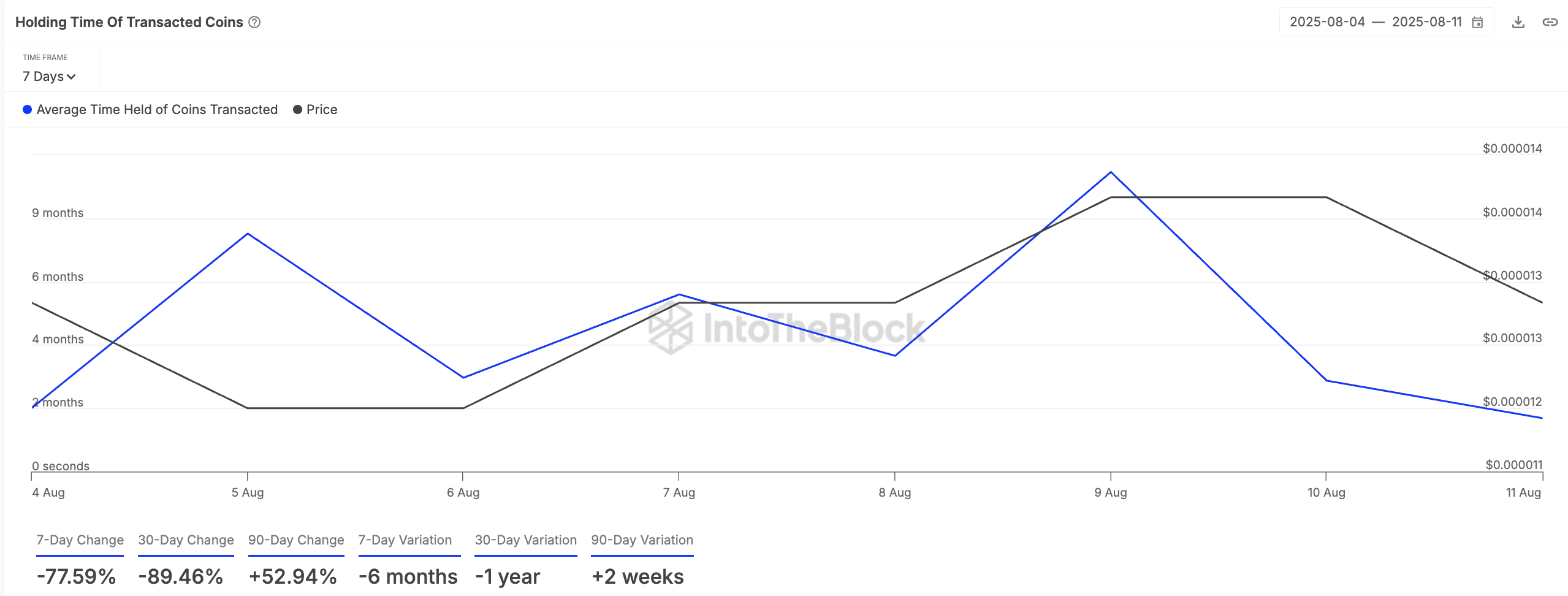

SHIB investors have reduced their holding time, a clear signal that bearish sentiment around the meme coin is growing. Data from IntoTheBlock shows that the average holding time for transacted SHIB tokens has plunged by 78% over the past seven days.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

This sharp decline suggests that holders are increasingly opting to sell or MOVE their SHIB tokens quickly to lock in recent gains rather than holding on for longer-term profit.

When an asset’s holding time falls, its investors are less confident about its future value and are more focused on short-term profits or minimizing losses.

In SHIB’s case, the trend confirms that many holders are reacting to recent price volatility by cashing out sooner, contributing to increased selling pressure in the market.

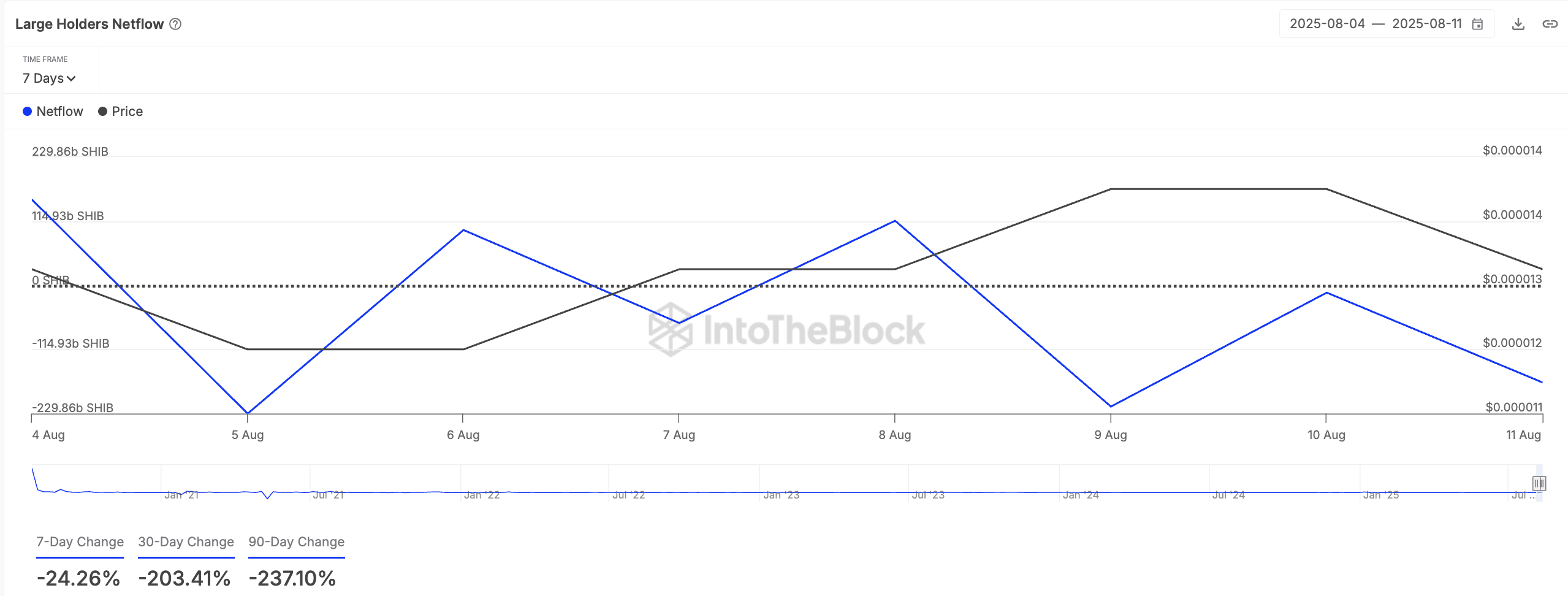

Further, the decline in SHIB whale activity during the review period compounds this bearish outlook. Per IntoTheBlock, the meme coin’s large holders’ netflow has plummeted 24% over the past seven days.

Large holders are whale addresses that hold more than 1% of an asset’s circulating supply. Their netflow measures the difference between the amount of assets they buy and sell over a specified period.

When this grows, these large holders are accumulating the asset by buying more than they are selling.

Conversely, when whale net FLOW is negative, these holders are offloading their positions by selling more tokens than they are buying. Such behavior reduces the upward buying momentum that whales typically provide, leaving SHIB more exposed to market volatility and bearish trends.

SHIB Risks Sliding Toward $0.00001167

The falling support from SHIB key holders and the shorter holding times by average investors hint at a potential continuation of SHIB’s downward price movement. In this case, the meme coin risks falling under $0.00001295 to reach $0.00001167.

However, if new demand re-emerges, SHIB could reverse its decline and climb to $0.00001385.