🚀 HYPE Engine Fueling Hyperliquid: Can $1.2B Buybacks Propel Price to $100?

The Hyperliquid ecosystem is roaring back—$1.2 billion in buybacks just lit the fuse. But can the HYPE engine actually deliver a moonshot to triple digits?

### The Buyback Blitz

Hyperliquid’s treasury is burning cash faster than a meme coin rug pull. With $1.2B deployed to soak up supply, the math looks bullish—if you ignore the fact that buybacks are Wall Street’s favorite placebo.

### The $100 Question

Market mechanics suggest scarcity could drive price discovery. Then again, crypto has a PhD in defying logic. Either way, traders are strapping in for volatility.

### The Cynic’s Corner

Let’s be real—buybacks are the financial equivalent of a sugar rush. Sustainable growth? That takes actual adoption. But hey, when has rationality ever stopped a crypto pump?

Hyperliquid Pushes For DeFi Dominance With 97% Revenue Buybacks

Hyperliquid revealed the HYPE Engine, a new capital formation primitive designed to systematically outperform spot holdings by capturing protocol revenues and on-chain yields.

Built atop the network’s Assistance Fund (AF), the system creates a structural, permanent, and deflationary bid. It commits 97% of protocol revenue to open-market HYPE purchases.

According to the project, the Assistance Fund has acquired over $1.2 billion in HYPE since its inception, with a 140% return. Annual purchase volumes are projected to exceed $1.5 billion soon.

Crypto analyst McKenna, managing partner at Arete Capital, noted the AF now owns 5.62% of the circulating supply.

Based on the revenue generated from depressed volumes it would take the Hyperliquid Assistance fund 4.93 years to purchase the entire Hyperliquid circulating supply.

Right now HAF owns 5.62% of the circulating supply and purchasing around 140k HYPE every single day.

Food for… pic.twitter.com/BrZVQ8CxKr

The HYPE Engine extends this model by unlocking the token’s on-chain productivity. It will deploy capital into validator infrastructure, DeFi strategies, and Hyperliquid’s Nest DEX, potentially generating $40 million in annualized fees from $100 million liquidity, roughly half of which will accrue back to the Engine.

The project likens its approach to MicroStrategy’s Leveraged Bitcoin strategy. However, it is trustless, autonomous, and accessible to any MEGAHYPE token holder.

Meanwhile, Hyperliquid has become the dominant decentralized derivatives venue, commanding over 80% of on-chain derivatives volume and more than 25% of Binance’s open interest.

As BeInCrypto reported, July saw record trading volumes of $319 billion, with the platform capturing 35% of all blockchain revenue that month.

The upcoming HIP-3 upgrade aims to grow Hyperliquid from an exchange into a full Web3 infrastructure LAYER for DeFi apps and smart derivatives. Such an expansion could further strengthen HYPE’s position as ecosystem collateral.

“Perp volumes have trended upwards consistently, meaning buybacks are now $99 million per month. This means there will be 1.2 billion worth of annual buybacks into a 3.87 billion market cap token. Demand greatly exceeds supply here,” wrote Arthur, a Hyperliquid community member.

Buying a Dollar for 46 Cents? Bulls See HYPE’s Next Leg Higher

Meanwhile, speculators are eyeing higher valuations. Trader Degen APE says the cool-off mode is over, and the road to $100 is now entering easy mode. This perception sprouts from a structural supply squeeze paired with expanding revenue streams.

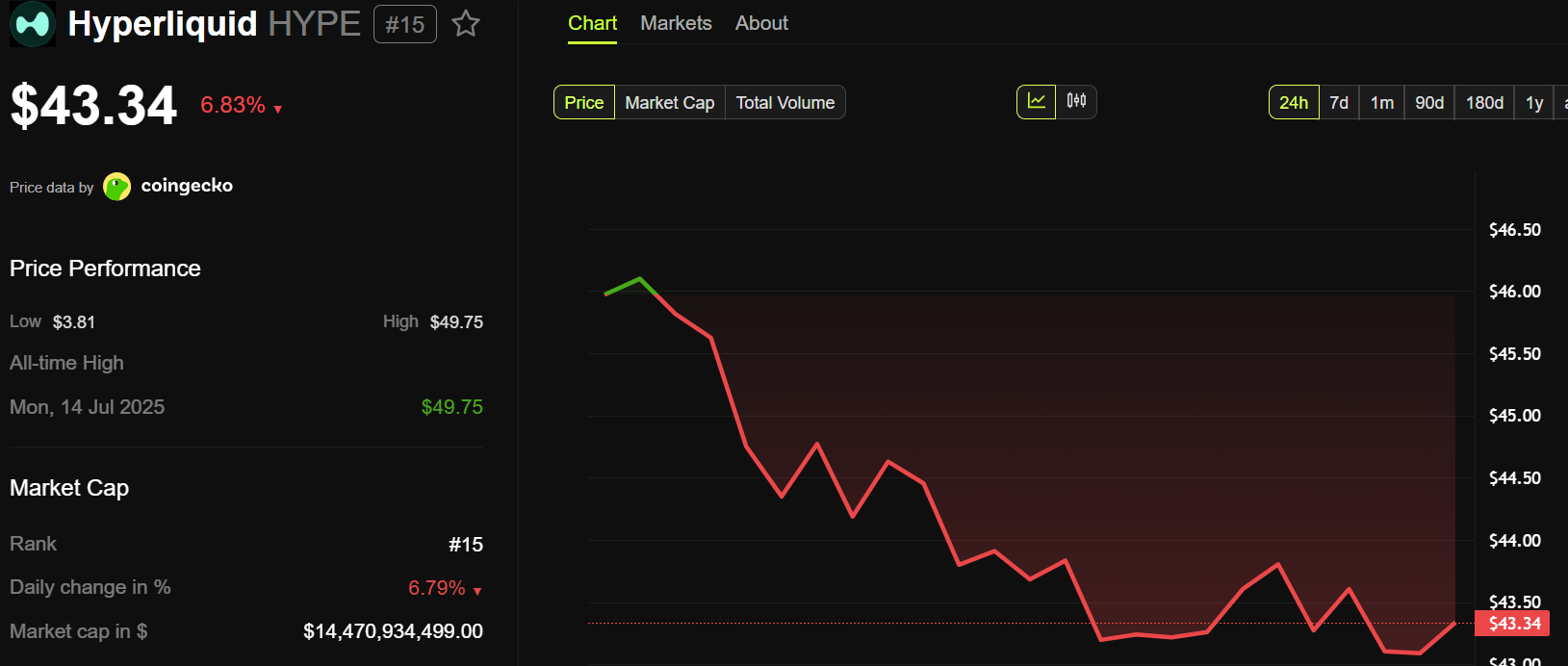

HYPE was trading for $43.34 as of this writing, up by nearly 7% in the last 24 hours.

Hyperliquid maxi, who goes by the HYPEconomist pseudonym, highlighted that Hyperliquid generated $4.6 million in fees on a casual Monday. Based on this, the trader questions why prediction markets still only assign a 46% chance of an $8 million fee day.

“This is like buying a dollar for 46 cents,” they wrote.

With whales adding millions in HYPE and buybacks accelerating, the HYPE Engine could redefine decentralized treasury management and provide a blueprint for tokenomics in the next wave of DeFi growth.

If projections hold, the model’s 16–46% total yields could justify valuations far beyond current levels.

For now, Hyperliquid appears intent on proving that decentralized infrastructure can rival centralized exchanges like Binance and outperform traditional financial (TradFi) treasuries by leveraging token buybacks.