JD.com Shakes Up Crypto: China’s E-Commerce Titan Dives Headfirst Into DeFi

Move over, Wall Street—JD.com just crashed the DeFi party. China's $100B e-commerce behemoth is making a power play for decentralized finance dominance, and traditional banks are sweating.

The retail giant's blockchain division dropped the bombshell today, confirming rumors of a full-scale DeFi suite launch by Q4 2025. No half-measures here—we're talking cross-chain swaps, yield vaults, and a tokenized loyalty program that could make airline miles obsolete.

Why now? Insiders point to China's 'blockchain-not-Bitcoin' policy creating the perfect sandbox. While Western regulators drag their feet, JD's leveraging its 550M-strong user base to onboard normies to DeFi—with the CCP's blessing.

The kicker? Their native token JDT will collateralize everything. Because nothing says 'trustless finance' like a centralized corporation issuing its own stablecoin (wink). Early testnets show transaction speeds blowing Ethereum out the water—12,000 TPS versus ETH's paltry 30. Take that, gas fees.

Bankers dismiss it as 'play money.' Meanwhile, JD's quietly poaching Goldman's quant team. Game recognizes game.

Leveraging PayFi for Supply Chain Finance

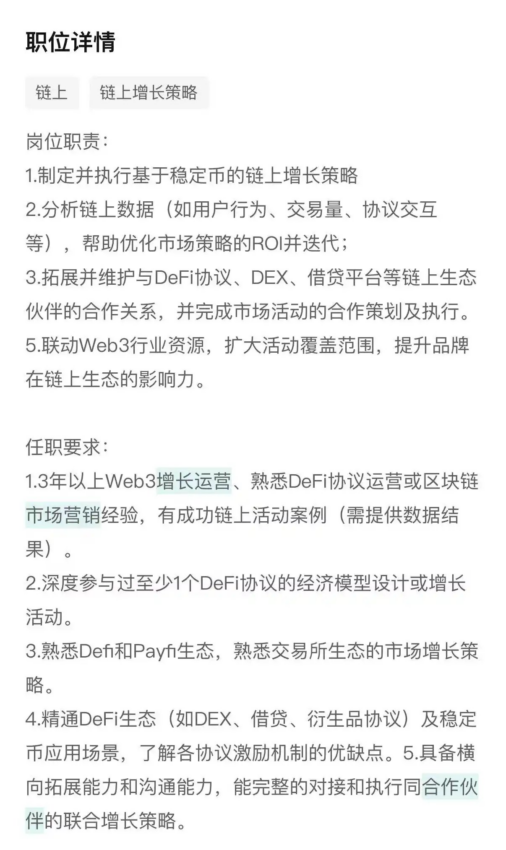

Beyond stablecoins, JD’s job description hints at a bigger vision: PayFi, or Payment Finance. This model uses smart contracts to merge payments with programmable financial services.

In practice, a supplier could receive an on-chain receivable token immediately after JD confirms delivery. That token could be collateralized in DeFi for instant liquidity or split into smaller units. It could also be used directly to pay upstream vendors. JD can tokenize real-world assets such as receivables, warehouse receipts, and logistics orders. This unlocks massive value across its trillion-dollar supply chain.

JD’s approach contrasts with other Chinese tech giants. While competitors like ANT Group focus on compliance tools and Tencent stays policy-safe, JD differs. JD is taking a two-pronged path.

Domestically, its “Zhizhen Chain” (智臻链) continues serving regulated industrial blockchain applications such as anti-counterfeiting and e-CNY integration. Offshore, JD aims to become a direct Web3 player—issuing stablecoins, building DeFi ecosystems, and exploring tokenized finance. This balance of compliance at home and innovation abroad could give JD a unique competitive edge.

From E-Commerce Giant to Onchain Economy

JD’s entry into DeFi reflects growing convergence between Web2 and Web3 companies. The e-commerce giant is leveraging its scale and capital to integrate blockchain finance into business operations.

Regulatory hurdles and user adoption remain significant challenges, but JD’s dual-track approach could provide competitive advantages if executed successfully.