Metaplanet’s Bold Bitcoin Bet: 518 BTC Purchase Pushes Holdings Past 18,000 Milestone

Another day, another corporate treasury diving headfirst into Bitcoin—this time it's Metaplanet making waves. The Japanese investment firm just snapped up 518 BTC, pushing its total stash beyond the 18,000 BTC mark. Who needs diversified portfolios when you've got digital gold, right?

The Numbers Don't Lie

At a time when traditional finance still clutches its pearls over crypto volatility, Metaplanet's latest buy-in screams conviction. The purchase—executed with the subtlety of a bull in a china shop—brings their total holdings to a staggering 18,000+ BTC. That's enough to make even MicroStrategy raise an eyebrow.

Why This Matters

While Wall Street debates ETFs and rate cuts, Asia's crypto whales are quietly stacking sats. Metaplanet's move signals deepening institutional confidence in Bitcoin as a treasury reserve asset—or at least a brilliant PR stunt disguised as one. Either way, it's a middle finger to fiat fragility.

The Cynic's Corner

Because nothing says 'financial prudence' like betting the company balance sheet on an asset that once crashed 80% in a month. But hey—when the music stops, at least they'll have the blockchain receipts.

Metaplanet Acquires Additional BTC

In August 2025, Metaplanet’s acquisition of 518 bitcoin for roughly 9.1 billion yen marked a notable leap. This latest move raised its total to 18,113 BTC. As outlined in the official disclosure, the company is now firmly among the most prominent corporate Bitcoin treasury holders globally. Its aggregate purchase cost totals 270.364 billion yen ($1.85 billion), averaging about 14.9 million yen ($100,000) per Bitcoin.

*Metaplanet Acquires Additional 518 $BTC, Total Holdings Reach 18,113 BTC* pic.twitter.com/rKT2l2oTRj

— Metaplanet Inc. (@Metaplanet_JP) August 12, 2025Metaplanet’s announcement also introduced innovation in performance tracking. Instead of emphasizing only traditional metrics, the company deploys a unique KPI called “BTC Yield,” which measures total Bitcoin holdings relative to fully diluted shares over time. According to filings, BTC Yield soared to 309.8% in Q4 2024, recorded 129.4% in Q2 2025, and registered 26.5% between July and August 2025.

“BTC Yield is a key performance indicator (KPI) that reflects the percentage change in the ratio of Total Bitcoin Holdings to Fully Diluted Shares Outstanding over a given period. The Company uses BTC Yield to assess the performance of its Bitcoin acquisition strategy, which is intended to be accretive to shareholders,” Metaplanet stated.

This method reflects Metaplanet’s intensified focus—since December 2024, Bitcoin treasury operations have become a central business activity, and the pace of acquisition has accelerated.

Metaplanet Maintains Its 6th Position

Metaplanet funds its multi-billion-yen Bitcoin purchases primarily through capital markets. The company raises cash by issuing shares and bonds, a strategy detailed in financial reports and benchmark equity research. Official presentations chart Metaplanet’s journey from holding zero Bitcoin at the start of 2024 to 1,762 by fiscal year-end.

Furthermore, equity research traces Metaplanet’s escalation from 141 BTC in mid-2024 to 12,345 by June 2025, culminating at 18,113 in August. The report details more ambitious targets, including the goal of reaching 100,000 BTC by the close of 2025. Public statements and official filings highlight clear, goal-oriented messaging.

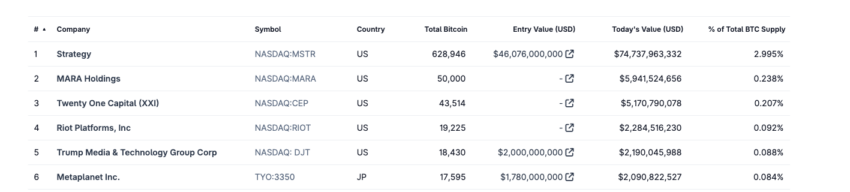

After the current purchase, Metaplanet still maintains its position as the sixth-largest publicly traded Bitcoin holding company. There is a very narrow gap between TRUMP Media & Technology Group Corp and Metaplanet for the 5th position.

Bitcoin Holdings by Public Companies. Source: CoinGecko

Strategy (MicroStrategy) maintains its top position with 628,946 BTC, which are worth $74 billion, based on the current market price. On Monday, Michael Saylor announced the purchase of 155 new BTC for roughly $18 million.