Crypto Whales Are Loading Up on These Assets Before US CPI Data Drops

Crypto's big players aren't waiting for the inflation numbers to settle—they're front-running the market with strategic buys. Here's where the smart money's flowing before the economic storm hits.

Whale Watching: The Pre-CPI Accumulation Game

While retail traders obsess over Fed statements, institutional crypto holders are quietly building positions. These aren't your grandma's safe-haven plays—they're high-conviction bets on assets that could moon or crash based on tomorrow's inflation print.

Market Movers: The Assets Getting Whale Attention

From Bitcoin's institutional appeal to altcoins with leveraged upside, the whales are diversifying their plays. Some are even doubling down on decentralized derivatives—because nothing says 'hedge against inflation' like highly volatile crypto derivatives (Wall Street would be proud).

The CPI Countdown: Why Timing Matters

With inflation data acting as crypto's temporary puppet master, whales are positioning for either a risk-on rally or a defensive crouch. Their moves suggest they know something the charts don't—or they've just got deeper pockets to gamble with.

Post-CPI Playbook: Follow the Money or Fade the Pump?

Once the numbers drop, watch where these whales exit—that's when we'll see if this was genius positioning or just another case of rich guys playing with funny money. After all, in crypto, even the 'smart money' often ends up being exit liquidity for smarter money.

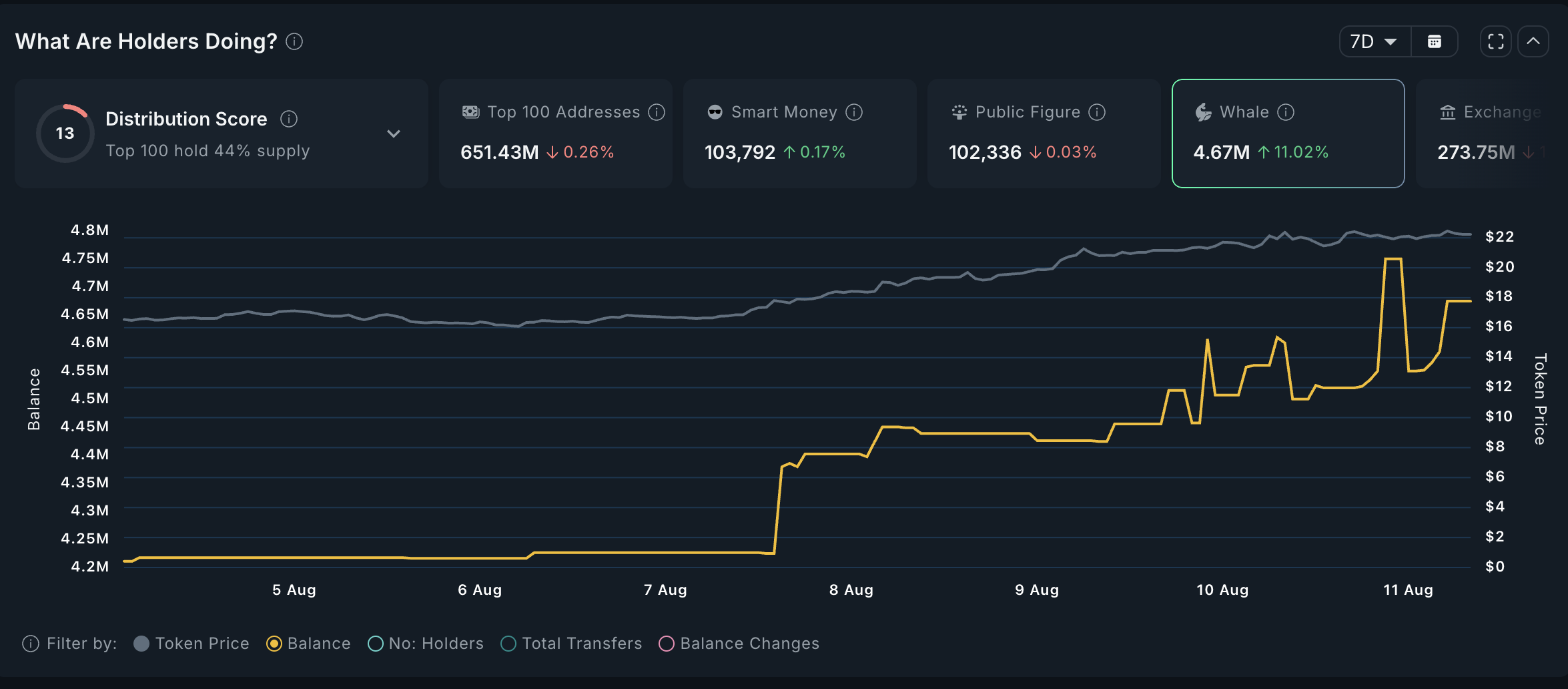

Chainlink (LINK)

LINK, the native token of leading oracle network provider Chainlink, is witnessing a surge in whale demand ahead of the US CPI Release

According to Nansen data, wallet addresses holding more than $1 million worth of LINK have increased their holdings by 11% over the past seven days.

This uptick in accumulation and improving sentiment in the broader crypto market has propelled LINK’s price more than 30% higher in the past week. This indicates renewed investor confidence and bullish momentum around the asset.

If the rally persists, LINLK’s price could extend its gains toward $25.55.

On the other hand, if demand stalls, LINK could reverse its uptrend and fall to $19.51.

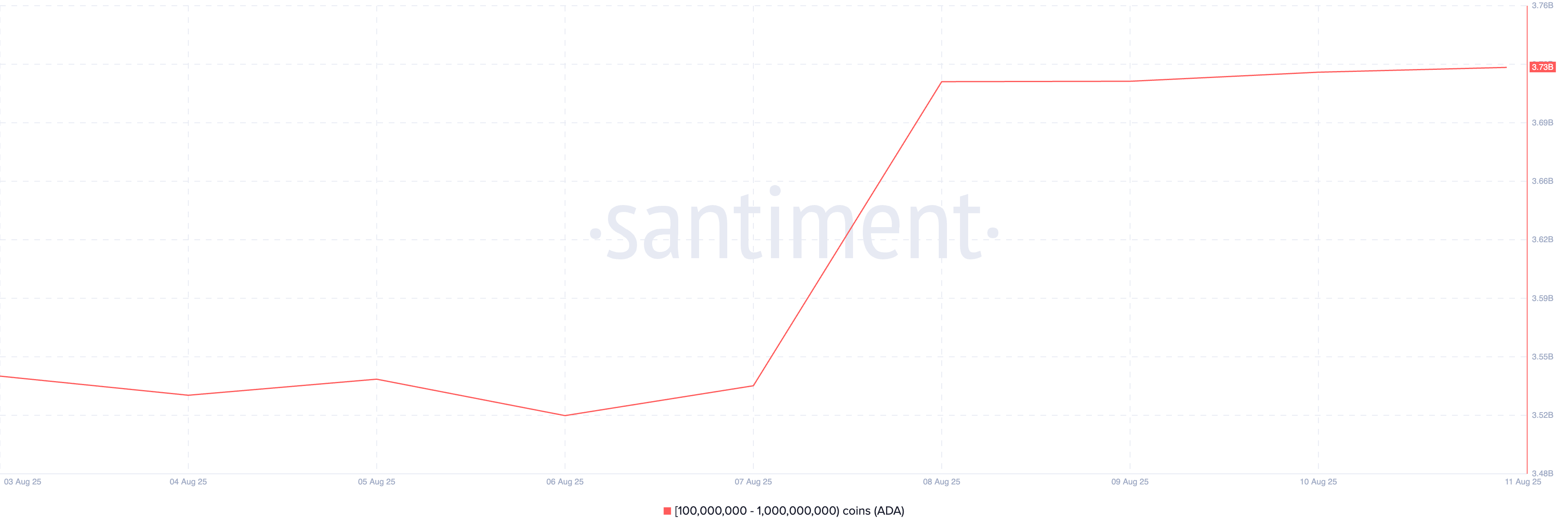

Cardano (ADA)

Layer-1 (L1) coin ADA is another asset that large investors are buying ahead of tomorrow’s US CPI release. According to Santiment, whale addresses holding between 100 million and 1 billion coins have collectively accumulated 190 million ADA in the past seven days.

This surge in whale buying appears to have energized retail traders as well, helping push ADA’s price to a 14-day high of $0.82 at press time.

If the rally continues, ADA could climb above $0.84 and potentially attempt to cross the $0.92 resistance level.

However, if demand weakens, the price may retrace to around $0.76.

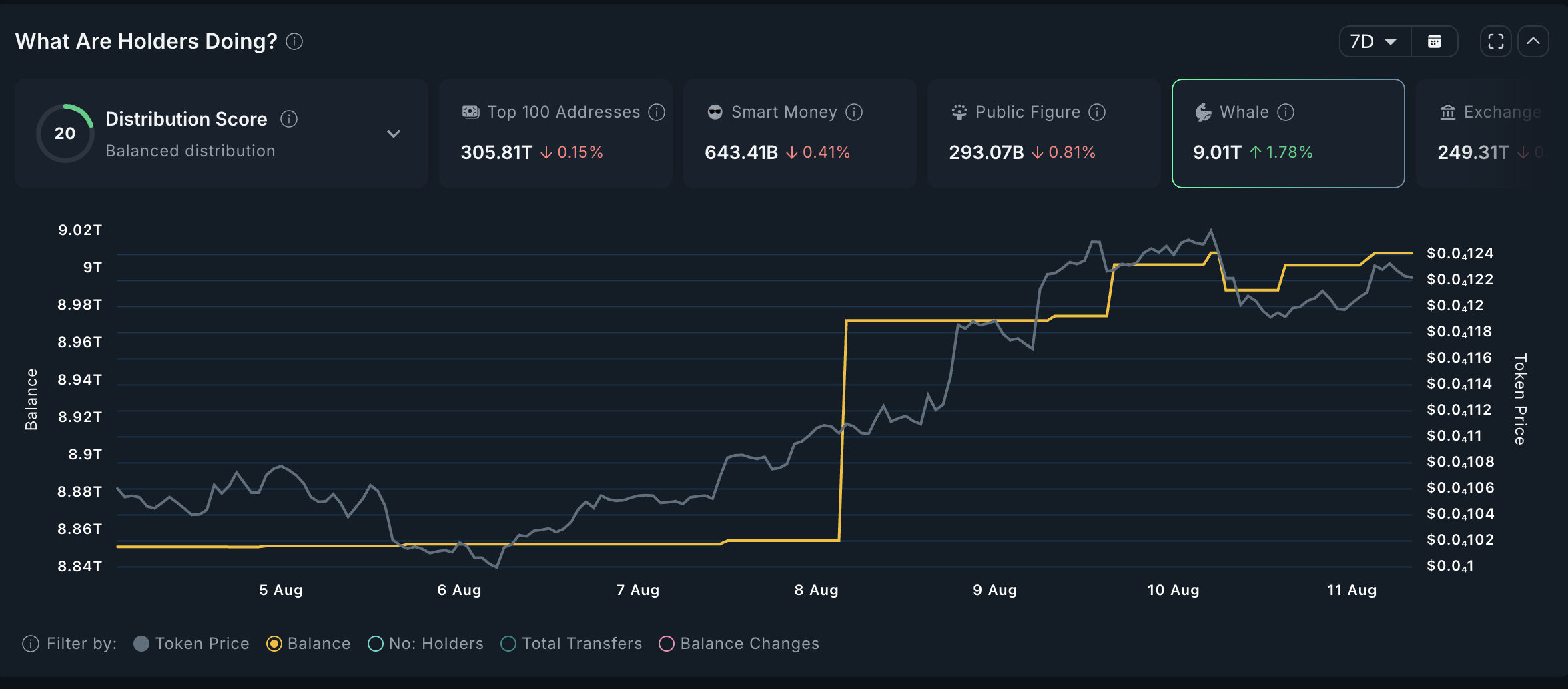

PEPE

The Solana-based frog-themed meme coin PEPE has also enjoyed some attention from crypto whales over the past week.

During that period, holders of tokens worth more than $1 million have increased their Pepe investments by 2%. As of this writing, this cohort of investors holds 9.01 trillion tokens.

PEPE trades at $0.00001207 at press time, up 17% in the past seven days. With growing bullish momentum across the crypto market, the meme coin could maintain its rally if whale demand holds.

In this scenario, PEPE could trade at $0.00001315.

Converesly, if buying activity decreases, PEPE risks plunging to $0.000001070.