🚀 Crypto Inflows Explode to $578M as Trump’s 401(k) Move Puts Bitcoin on Ethereum’s Tail

Wall Street’s latest love affair with crypto just hit a fever pitch—$578 million flooded in last week after Trump’s 401(k) bombshell. Bitcoin’s suddenly close enough to ETH to smell the gas fees.

The Trump Effect: Retirement Accounts Go Full Degen

When traditional finance titans start treating 401(k)s like degenerate gamblers at a roulette table, you know we’ve crossed a rubicon. Suddenly every wealth manager’s PowerPoint has a ‘digital assets’ slide—right between municipal bonds and that REIT nobody wants.

Bitcoin vs Ethereum: The Institutional Cage Match

BTC’s institutional inflows aren’t just growing—they’re morphing into a liquidity tsunami. Ethereum’s lead? Shrinking faster than a trader’s margin after leverage liquidations. The smart money’s betting this isn’t just a fluke—it’s the new pecking order.

The Cynic’s Corner

Of course Wall Street only embraced crypto after exhausting every other way to repackage subprime debt. Now they’ll ‘democratize finance’ with the same vigor they brought to… well, every other asset class they’ve ruined.

How Trump Ignited Mid-Week Recovery for Crypto Inflows

In the week ending August 2, crypto inflows reached $223 million, marking a notable contraction after the $2 billion seen in the week before.

However, Trump’s recent MOVE to allow crypto into US 401(k) inspired a sentiment reversal, pushing inflows to $578 million.

“Insanely bullish for crypto!” said crypto analyst Lark Davis on X.

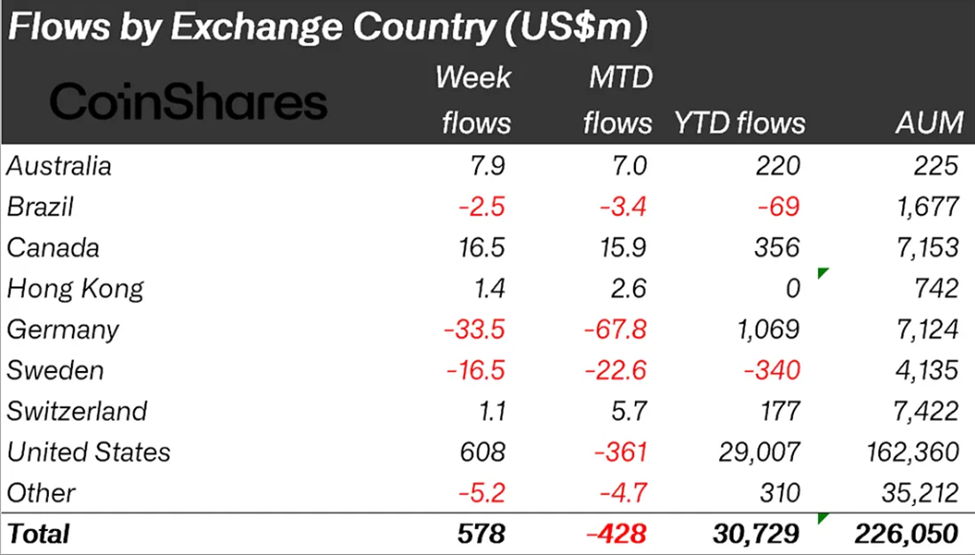

This points to HYPE around the inclusion outweighing negative sentiment from FOMC and macroeconomic woes. The US was a frontrunner, accounting for majority of crypto inflows last week.

“After early-week outflows of US$1bn on weak US payroll data, inflows rebounded to $1.57 billion following the government’s 401(k) crypto approval, bringing net weekly inflows to $578 million, read an excerpt in the latest CoinShares report.

Notably, Trump’s directive reversed crypto outflows, which had reached $1 billion midweek amid concerns from negative US economic signals.

CoinShares’ head of research, James Butterfill, explains that crypto markets recorded $1.57 billion of positive flows in the latter half of the week after the government’s announcement permitting digital assets in 401(k) retirement plans.

However, volumes in crypto ETFs (exchange-traded funds) remained 23% lower than the previous month, likely due to the quieter summer months.

Bitcoin Creeps Up on Ethereum’s Lead

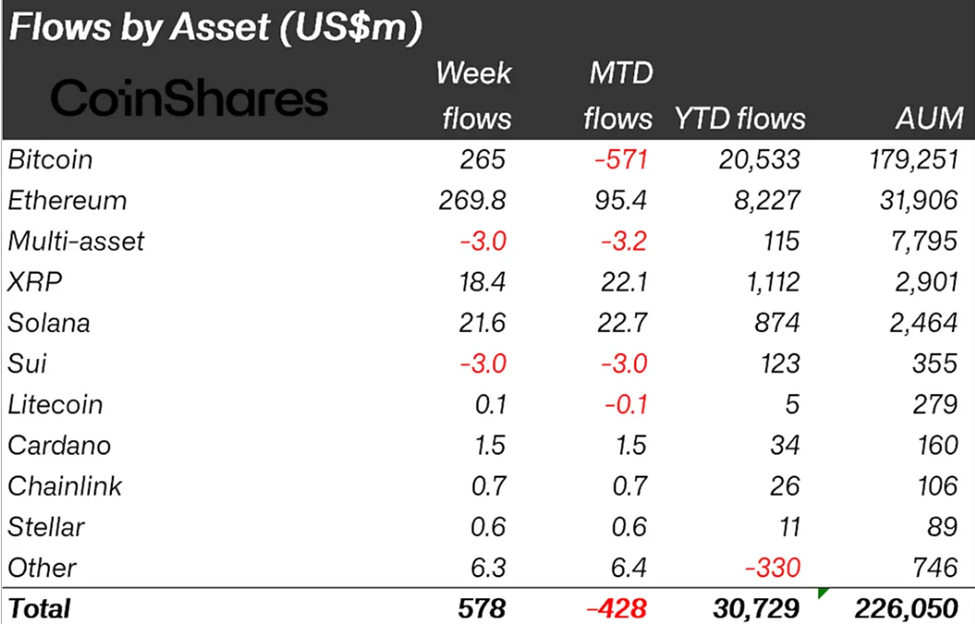

Meanwhile, ethereum has maintained a significant lead over Bitcoin over the past several weeks amid an altcoin-led rally. As BeInCrypto reported, Ethereum recently propelled crypto inflows to a record $4.39 billion weekly high.

However, amid Trump’s crypto push, Bitcoin is catching up. While Ethereum-related crypto inflows reached $269.8 million, Bitcoin was a close second with $265 million.

This is a significant shift from $133.9 million positive flows to Ethereum and $404 million outflows from Bitcoin investment products the week before.

“Bitcoin saw a recovery following two consecutive weeks of outflows,” Butterfill wrote.

Against this backdrop, Samson Mow, CEO of Jan3, says most ETH holders possess a lot of bitcoin acquired during the initial coin offering (ICO) or through insider allocations.

The Jan3 executive says these ICO investors are converting this into Ethereum to push the price up, riding the Ethereum Treasury companies narrative.

According to Mow, these investors will return their funds to Bitcoin if the ethereum price exceeds a certain level.

Aligning with Mow’s perspective, Bitcoin pioneer Davinci Jeremie, who told his followers to spare just a dollar to buy Bitcoin, urges investors not to sell their Bitcoin for Ethereum.