HBAR Fights for Survival as Capital Flees: Can the Hedera Token Turn the Tide?

HBAR's liquidity crisis deepens as investors pull the plug—leaving the Hedera network's native token gasping for air.

Blood in the water: Whale-sized sell orders hammer HBAR's price action, with no buy-side cavalry in sight. The 'enterprise-grade blockchain' narrative isn't paying the bills this quarter.

Technical breakdown: The 200-day moving average just turned into a ceiling. Every dead-cat bounce gets smothered by another wave of panic exits. (Pro tip: When VCs unload bags faster than a crypto conference buffet, retail always loses.)

Silver lining? The staking APY just hit double digits—desperate times call for yield farming measures. But with DeFi TVL evaporating, even yield junkies are staying clear.

Final verdict: HBAR either needs a nine-figure enterprise partnership tomorrow... or it'll become another cautionary tale about betting against Ethereum's gravity. Tick-tock.

HBAR Faces Mounting Downside Risk

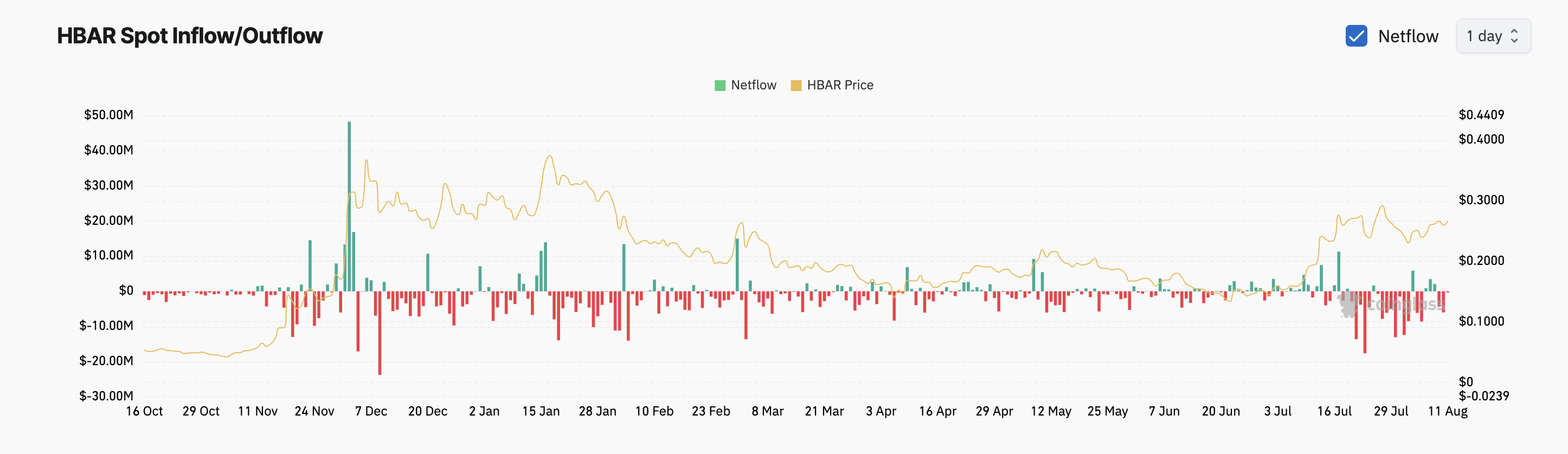

The steady capital outflow from HBAR’s spot market has weighed heavily on its price action. According to Coinglass, HBAR’s spot outflows have totaled $6.42 million over the past three days, showing the growing bearish bias against the altcoin.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

These outflows occur when the holders of an asset remove their capital from its spot markets, typically by selling their coins and moving funds elsewhere. It signals weakening demand for the asset and is a trend known to drive lower asset prices.

The daily outflows from HBAR’s spot markets over the past three days confirm the growing uncertainty surrounding the token, which has caused its price to trend sideways. This pattern also reflects a gradual shift in market sentiment, as traders increasingly look to exit their positions.

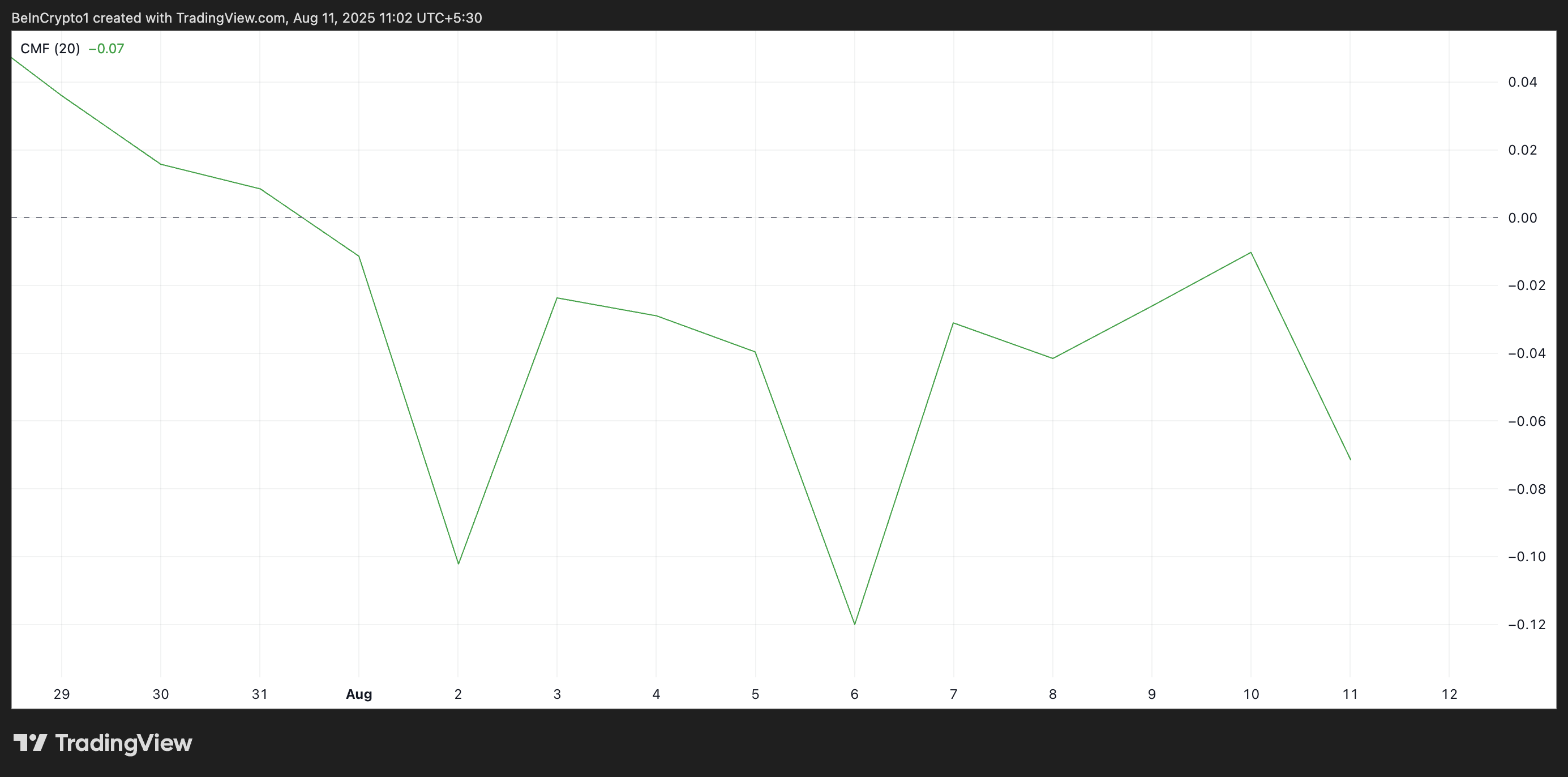

Furthermore, the negative readings from HBAR’s Chaikin Money FLOW (CMF) on the daily chart confirm its struggle to attract buying interest. As of this writing, the momentum indicator is at -0.07 and continues to trend downward.

The CMF measures an asset’s buying and selling pressure over a specified period by analyzing price and volume data. It helps identify whether money is flowing into or out of the asset.

When the CMF is positive, buying pressure is strong, with more money flowing into the asset. Conversely, when its value is negative, selling pressure dominates.

For HBAR, its negative CMF means more money is flowing out of the asset as traders exit their positions. This worsens the downward pressure on its price and could trigger a break below the lower line of its current range.

Bears Eye $0.2591 Support and Lower

At press time, HBAR trades at $0.2663, holding below the upper line of the horizontal channel, which forms resistance at $0.2667.

With growing sell-side pressure, HBAR risks falling toward the $0.2591 support floor.

However, if the bulls regain control, they could drive the token’s value past the resistance wall and toward $0.2905.